If you are a financial advisor, you understand that software programs can make many of your day-to-day tasks significantly more efficient. You can eliminate repetitive clerical work, allowing you to focus on the individual needs of your clients.

At the same time, there are a lot of options available. How can you choose the right financial planning software to meet your needs?

Take a look at a few key points below, and consider signing up for a free trial of a few programs before you decide which one is right for your needs.

What Is the Best Financial Planning Software?

Financial planning software is a computer program or application designed to help individuals or businesses manage their financial resources more effectively. It typically includes tools for budgeting, tracking expenses, investment planning, retirement planning, tax planning, and other related financial activities. Financial planning software can be used to analyze financial data, create financial plans, and make informed decisions about money management. It may be used by individuals, financial advisors, or institutions to help users achieve their financial goals and objectives.

Factors a Financial Advisor Should Consider: Evaluating Your Options For Best financial planning software packages

If you are trying to find the right financial planning software program, there are a lot of factors you should consider. Some of the most important criteria you need to think about as you evaluate financial planning software companies include:

Start by understanding your client’s needs

A good financial plan software will simplify work and improve your clients’ financial needs. To find the most appropriate financial management tool for a specific business, begin to understand your clients’ need for financial information to be tracked. Are people planning on saving for the retirement? Ideally you will need these details in advance. This helps your advisors plan a comprehensive financial plan that will benefit them and will be in line with both short and long term financial goals.

As you look for comprehensive financial planning software, you need to think about your clients. Do you think your clients are mostly older? Or, do you work with younger clients?

Remember that your clients might need to interact with financial planning software programs from time to time, so you need to find financial planning tools that are appropriate for your audience.

When your clients think about their personal finance and retirement planning needs, will they be able to understand your software program? Great financial planning software should be great not only for you but also for your clients.

Your Communication

If you are trying to find the top financial planning software program, you also need to think about your communication methods. There are plenty of financial planning tools out there, but will they make it easier for you to communicate with your clients?

Do you and your clients prefer to use digital tools to communicate with one another? Or, do you take a hands-on approach when you are discussing cash flow, financial data, and personal finances?

Professional financial advisors need to communicate with their clients, so make sure you find financial planning software tools that make it easier for you to communicate with your clients.

The Program’s Security

When you are choosing financial planning software, you also need to think about the security measures provided by the program.

When your clients use financial planning services, they will be sharing a lot of confidential information about their financial accounts. This includes their retirement income, tax planning strategies, and other information about their personal capital.

The best financial planning software program should keep information about their wealth management plans secure. You do not want confidential information about your clients’ bank accounts being distributed on the web.

Customizability

The best financial planning software program should also be customizable. Your financial planning solution will probably come with a lot of features, but what happens if you don’t need to use all of them?

For example, you might not always need notifications about specific types of account data, and you might not always need access to advanced debt tracking tools.

Even though you want the complete financial picture, you need to stay focused on the financial goals of your clients. Make sure your financial management solution gives you the ability to turn on and off certain features.

The Scalability

The best financial planning program should also be scalable. What this means is that your money management planning tools should grow and expand with your firm.

If you find the right cash flow-based software, you should attract more clients in the future. An easy-to-use platform is usually better.

As a result, you may need to expand the role of the program. Can the program handle this type of demand? If you have multi-advisor firms, will the technology tools be able to keep up? You need to find software packages that can grow and expand with your business.

Ease of Use

Financial professionals also want a program that is easy to use. Ideally, the program should have a very generous learning curve. Of course, you need to find a program that can help with various aspects of the financial planning process. This includes helping clients pay bills, handle college savings, and save money for retirement.

At the same time, if the program is too complicated, you might not get exactly what you want out of it. Think about who will be using the program, and make sure the program is relatively easy to figure out.

A Free Trial

Finally, as you are looking for advanced financial planning tools, you need to find programs that have a free trial available. While there might not necessarily be a free version, you need access to this trial because you should be able to play around with the tools before you decide if they are right for you.

For example, you may want to see if the program has tools for tax planning. You may also want to play around with monthly budget creation tools. Always see if the program offers a trial for free before you make a final decision.

These are a few of the most important factors you should consider when you are looking for a money management and budgeting tool you can use to help your clients. What are a few of the top programs you should consider?

The Top 5 Financial Planning Software Programs Available For Financial Advisors

There are plenty of options that you should consider if you are looking for financial planning software programs, but some of the top options include:

MoneyGuidePro

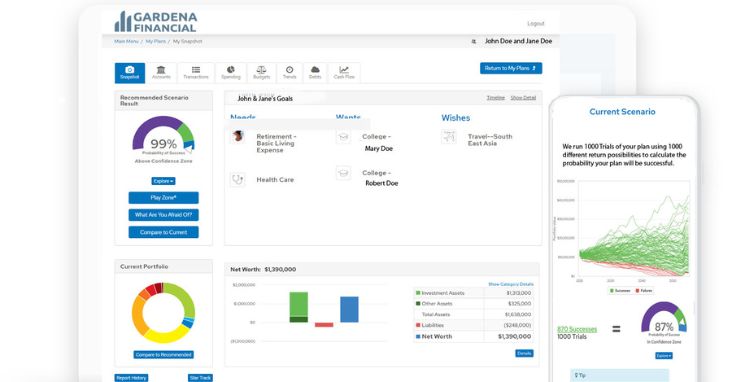

One of the most popular programs available today is called MoneyGuidePro. It is a visually engaging program that comes with a variety of user-friendly features that contribute to a relatively short learning curve.

The entry portal will immediately grab your attention, and there are customizable features that allow you to play around with hypothetical scenarios as you want to help your clients grow their wealth.

The product has multiple tiers, allowing you to customize your experience to meet your needs. For example, the lowest here might be appropriate for people who are just starting out their financial journeys, but the top level is better for clients who have very complicated financial plans.

This customizability is important, and it allows the financial advisor to conveniently explain various aspects of the financial planning process to their clients.

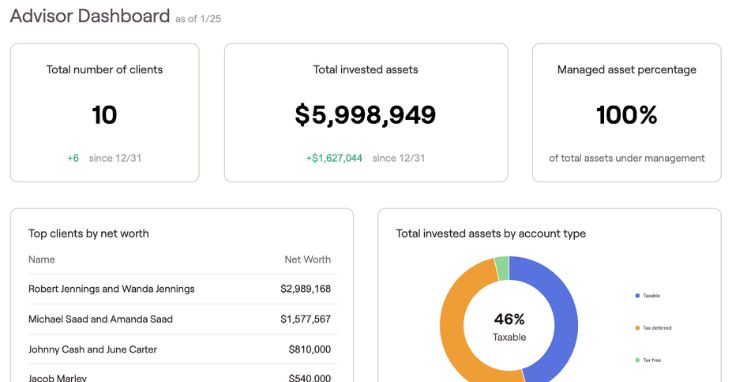

RightCapital

When compared to other programs on the list, RightCapital is relatively new, but it contains plenty of features that allow it to compete with some of the best programs on the market today.

This is a great option for financial advisors who have a lot of younger clients who need help with budgeting. Furthermore, this program comes with a lot of advanced debt management tools that can make it easier for users to figure out how to divide their money every month.

Another major feature of this program is that it comes with a wide variety of integrations. When clients already use a variety of software programs, this one should be able to integrate with them, saving people from having to manually enter information multiple times.

For financial advisors, this program also comes with an integrated billing system. This makes it easier when financial advisors need to send invoices to clients. With a variety of reporting solutions and analytical features, this program could be a strong option for clients and advisors who are tech-savvy.

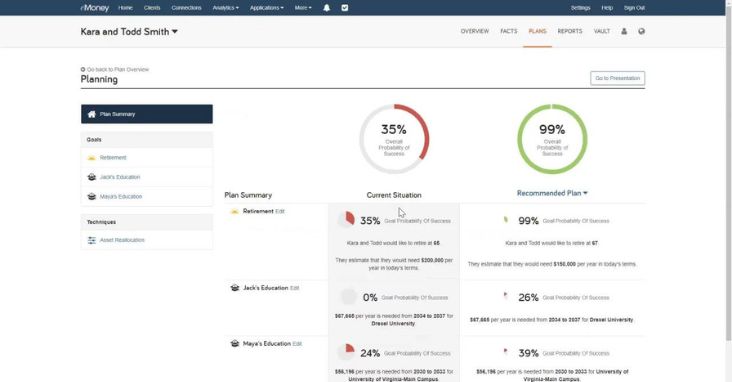

eMoney Pro

Another strong program you may want to consider is called eMoney Pro. This is a detailed program that has become popular among financial advisors who are looking to explain various aspects of cash flows to their clients.

One of the biggest traits of this program is that it provides real-time information and news alerts regarding the markets. This makes it easier for financial advisors to stay on top of everything that is happening in the financial world. In addition, the client portal allows clients to access a detailed printout of their financial situations at just about any time.

It has a long list of positive reviews, and it is easy for financial advisors to use. Even though this program may have a relatively steep learning curve for clients, it is perfect for anyone who likes to maintain total control over every aspect of their finances.

Empower

Empower is another strong financial planning software program. There is a free version of this program available, and it contains everything that people need to integrate their financial plan with their investment style.

This program allows people to link all of their financial accounts, including retirement accounts and investment accounts, in one place. That way, they have a complete picture of their financial health. This program also comes with a unique “net worth” tracker for clients who like to watch their money grow over time.

Another unique feature of this program is that it provides a tool that allows people to track the amount of money they spend on hidden fees. This could include commissions that they need to pay when they execute a trade through a brokerage account.

Of course, users can also take advantage of goal trackers that make it easier for them to hold themselves accountable for their spending and saving targets. This is particularly beneficial when saving for things like a new house, a college fund, and retirement.

Quicken

Many people are familiar with Quicken because it helps people do their taxes. Now, there are financial planning solutions available, and there are multiple packages available that people can customize to meet their needs. For example, some people may be saving for themselves, while other people may also have a business to run.

The exact tools that come with this program depend on the package that someone purchases, but these programs have been designed to help people budget, track their spending, categorize various purchases, and manage their bills. Users also get access to ratings for various mutual funds from Morningstar along with tools that can automatically pay the bills.

Quicken also provides users with access to investment tax planning tools and various market comparison features that can help people decide how they want to invest their money.

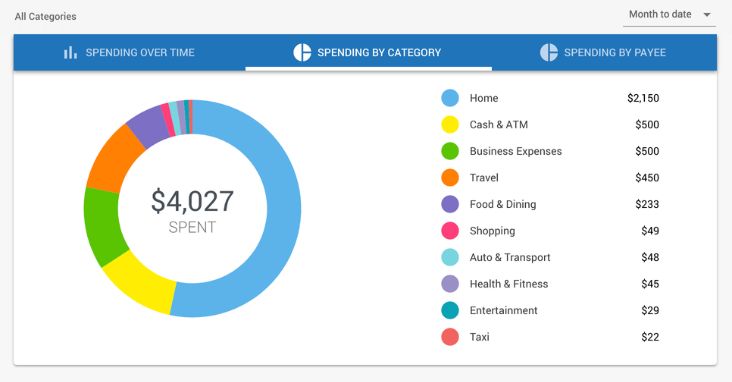

Intuit Mint

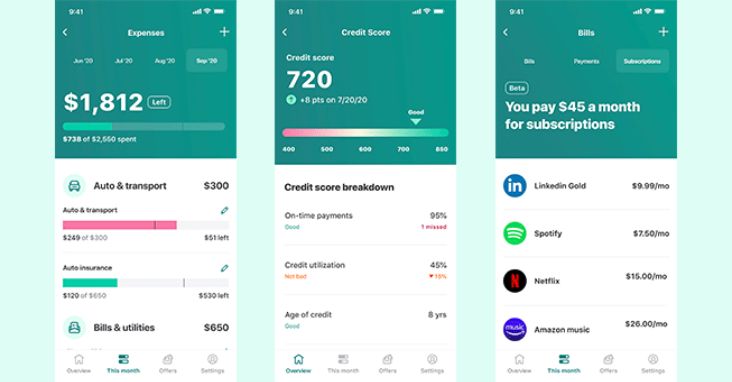

Many people are looking for a free tool, and Intuit Mint could be the best option for existing Intuit customers. It is one of the most popular free financial planning tools on the market, and it allows people to see all of their bank and credit card accounts in one place.

This program also makes it easier for people to set a monthly budget, track their expenses, and categorize them to see where their money is going. Intuit Mint also makes it easy for people to monitor their credit score, which is particularly important when someone is interested in applying for a loan for a car or a house.

Intuit Mint also provides users with tools that allow them to track their investments and watch them grow over time. Users can also take a look at how their investments compare to the market as a whole.

Finally, this program can also help users set up reminders to pay their bills, ensuring that nothing ever gets overlooked.

Conclusion

In the end, these are just a few of the many programs that are available that can help financial advisors and users take care of their financial health by creating budgets, handling bill pay issues, and establishing saving goals with personalized advice.

It is critical to have a comprehensive financial plan when thinking about the future, and with access to the right tools, users and financial advisors can stay one step ahead of the rest of the market by thinking about what if scenarios ahead of time.

Keep in mind that the right financial planning program for one person is not necessarily going to be the right software program for someone else. It is always beneficial to take advantage of a free trial before deciding which program is the best option.