Today, the economy is more turbulent than ever before, and financial advisors can help clients preserve and build their wealth even in a difficult economic environment. For financial advisors to be successful, they must be able to expand their client base even as they develop long-lasting relationships with their existing clients. One of the most important tools is a customer relationship management system, usually shortened to CRM.

The best CRM should allow financial advisors to expand their efforts, maximize their resources, and identify new opportunities for success. CRM systems are usually driven by data, giving advisors access to all of their information in one convenient database.

There are plenty of CRM options available, but what is the best CRM for financial advisors?

What Do CRM Systems for Financial Advisors Usually Include?

Every financial CRM software program for wealth management is a bit different. The right financial advisor CRM software for wealth management is not necessarily the right financial services CRM for someone else.

At the same time, there are several financial planning tools you should look for when you are trying to find the right financial CRM software solutions to meet your needs. Some of the most common features of financial services CRM programs for traditional and independent advisors include:

Strong Contact Management

As you look for wealth management CRM solutions, one of the key features is strong contact management workflows. Managing client relationships is an important part of being a successful financial advisor.

You will have clients at different stages of the wealth management process. You might be interacting with some people for the first time, and others might be established clients. Sales pipeline management and lead management are critical parts of managing your contacts, and your financial advisor CRM should help you with clerical work related to contact management.

A few examples include managing emails, scheduling appointments, and following up on previous conversations. Make sure you have a litany of tools that can help you get the most out of each client relationship.

Marketing Automation Features

If you want to expand your client base, you need to have a strong marketing arm. At the same time, you have a lot to do on a daily basis. You are constantly talking to your current clients while keeping an eye on the markets to ensure you put your clients in the best position possible to grow and expand their wealth.

You might not have time to develop a marketing campaign on your own, but that is where your CRM program can help you. For example, your client relationship management program might be able to generate email marketing campaigns, handle social media marketing, and provide you with analytics that you can use to figure out what is working and what is not.

Make sure you find a CRM program that can help you with your marketing campaign.

Time Management Tools Are Essential

As a financial advisor, it is easy to lose track of time. You get caught up speaking to a client, and you might not even realize what time it is. You might even realize that you have scheduled overlapping meetings, and you need to figure out how to address the issue.

Your CRM program should come with a variety of time management tools. You can prioritize your time appropriately, schedule various meetings and activities, and even automate recurring obligations that take place daily, weekly, or monthly.

You might want to find a CRM program that can help you with your time management needs.

Document Management and Data Management Tools Are Essential

Just as accounting software helps you with data management needs, a CRM program should do the same. Every client relationship has a slew of files, attachments, and notes that you have to keep track of. If you want to make sure you get the most out of your asset management practices, you need to be able to retrieve these documents quickly.

Ensure the CRM program makes it as easy as possible for you to retrieve files and attachments when you need them. You might want to see if you can take advantage of a free trial that lets you try out the CRM program and see for yourself how easy it is to keep your documents organized.

You may also want to take a look at a few reviews and ratings to see what other people have to say about the document management features.

Access To Detailed Analytics

Usually, a CRM program will provide you with detailed analytics. For example, you might want information related to individual client targets. Or, you might be curious about analytics as they relate to lead management and lead closure.

These analytical insights can help you figure out what is working, what is not, and what you need to improve. You might even be able to automatically convert these analytics into reports if you have a meeting with a boss or supervisor.

Take a look at the analytics provided by the CRM program, and make sure you get access to the information you need.

A Slew of Integrations

Your time is your most valuable resource, and you do not want to spend your time entering information into multiple software programs by hand. That is why most financial CRM software programs will provide you with a slew of integrations.

For example, you might be interested in a CRM program that integrates with investment management tools that you use on a daily basis. Or, you might be looking for CRM solutions that will automatically pull data from other databases.

If there are other software programs that you love, you might want to find a CRM program that will integrate with them automatically.

The Key Benefits of Customer Relationship Management Software in the Financial Services Industry

As you take a look at various CRM programs for financial advisors, you might be wondering what some of the top benefits are.

Some of the key advantages you will enjoy if you select the right customer relationship management program include:

1. Improved Business Insights

If you want to be a successful financial advisor, you need to generate solid returns for your clients. With a strong CRM program, you can take advantage of numerous business insights that allow you to do exactly that.

A financial CRM software program can provide you with invaluable data related to trading histories, planning activities, and client goals. You will get access to a wealth of financial information that you can share with your clients, and you can leverage this type of data into actionable insights.

Of course, this type of customer service can help you attract new clients.

2. Better Lead Nurturing

Not everyone is going to sign up for your services as soon as they talk to you for the first time. Instead, you need to be able to nurture your leads as they move down the sales pipeline.

A CRM program should provide you with several key features that can help you nurture your leads. This might include personal notes related to each lead, a strong engagement history, and even reminders that will let you know to reach out to certain people after a certain amount of time.

With access to an extensive history related to every client’s needs, you can increase your conversion rate.

3. Improved Marketing

If you want to attract new clients, you need to have a strong marketing campaign. You need to get your name out there as much as possible, and a CRM program can help you handle tasks related to email marketing, social media marketing, and even event management.

You might even have a sales partner that you work with, and you can coordinate your activities with them to ensure you are maximizing your conversion rates.

4. More Genuine Customer Experiences

Ultimately, you are in the service industry, and customer service must be important. CRM programs can help you deliver better customer service by fostering meaningful relationships with your customers and clients.

CRM programs can help you provide customer support, handling issues related to your clients as quickly as possible. Some of them might be questions about their portfolios, and others might be related to technical support. Not everything is going to go as planned, but your clients should be able to count on you to be there for them when they have questions and concerns.

5. Maximized Revenue Growth

Finally, your bottom line is probably what you care about the most, and the right financial CRM software can help you maximize your revenue growth. Your success is inextricably tied to your clients, and if you grow your clients’ financial portfolios, your bottom line will improve as well.

These types of tools can help you grow your bottom line by automating various types of task management. You don’t have to worry about handling clerical work every day, and it will free up your time to focus on financial research and client relationships.

These tools can automate scheduling, document management, and planning needs, allowing you to stay on top of everything that is happening.

What To Look For in Financial CRM Software

If you are trying to find the right software program for your CRM needs, there are several factors you should consider. They include:

Number of Contacts Handled

How many clients do you have today? How many clients do you think you will have in the future? You must make sure you find a CRM program that can handle all of your clients. If you think your client base is going to expand in the future, you must find a CRM program that will work well not only today but also down the road.

Ease of Use and Learning Curve

Who else is going to be using this CRM program? How comfortable are you with different types of technology? You should make sure the CRM program you choose is relatively easy to use. You do not want the learning curve to be too steep. Otherwise, you might find that you end up falling behind on your daily schedule.

Data Security

As a financial advisor, you are going to deal with a tremendous amount of confidential information. You must make sure that the CRM program you choose provides you with robust cybersecurity features. You should also make sure that the program automatically updates itself from time to time. That way, you know you always have access to the latest in cybersecurity.

Customizability

Finally, the program should provide you with a vast array of customizable features. Every financial advisor is different, and you might not want your dashboard cluttered with information, tools, and buttons that you do not use every day. You should be able to turn these features on and off at will.

Communication Tools

Communication is critical when you are looking for a financial CRM program. This includes communicating not only with your clients but also with your colleagues and your tech support team. How easy is it for you to keep everyone in the loop? The more communication tools you have, the stronger your financial CRM program should be.

By considering these factors above, you should be able to narrow down your options relatively quickly. What are a few of the top options for financial advisors looking for CRM programs?

The Top Options for Financial Advisor CRM Software

If you are looking for the best CRM program for financial advisors, there are a few choices to consider. They include:

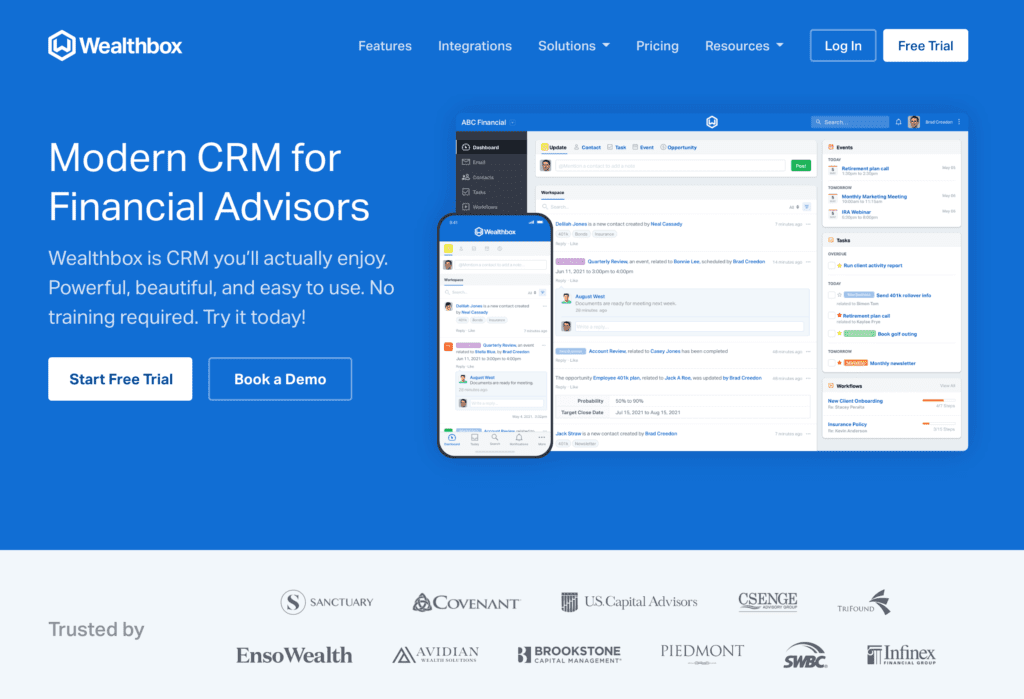

1. Wealthbox

As the name suggests, Wealthbox is a CRM program that has been specifically designed for financial advisors. It is very easy to use, can help you streamline your workflow, and is a great choice for not only independent advisors but small firms as well.

While it might not be the best option for enterprise corporations, it remains one of the most popular CRM programs for financial advisors. It is reliable, comes with customizable features, and can help you save time when you are interacting with clients and managing multiple portfolios.

Top Features

- Comes with a mobile app

- Can integrate with your social media profiles

- Has numerous tools for contact management, allowing you to keep track of interactions

- Has exceptional sales pipeline and document management capabilities

2. UGRU Financial

If you are on a tight budget, you may want to go with UGRU Financial, which has a relatively low price for the base package. This is a great option for small firms that are just starting out because it provides you with all of the essential features. They include lead management, contact management, and workflow management tools.

There are dozens of pre-designed workflows that you can use to customize your interactions with your clients. You can also take advantage of email functionality, document storage features, and marketing tools. There are multiple plans available, and you can select the best one to meet your needs.

Top Features

- Provide you with safe and secure options for data and document storage

- Features numerous email marketing tools that can help you keep in touch with your clients

- Gives you access to numerous workflows that you can use to stay on track

- Has a variety of plans that allows you to control what you pay for

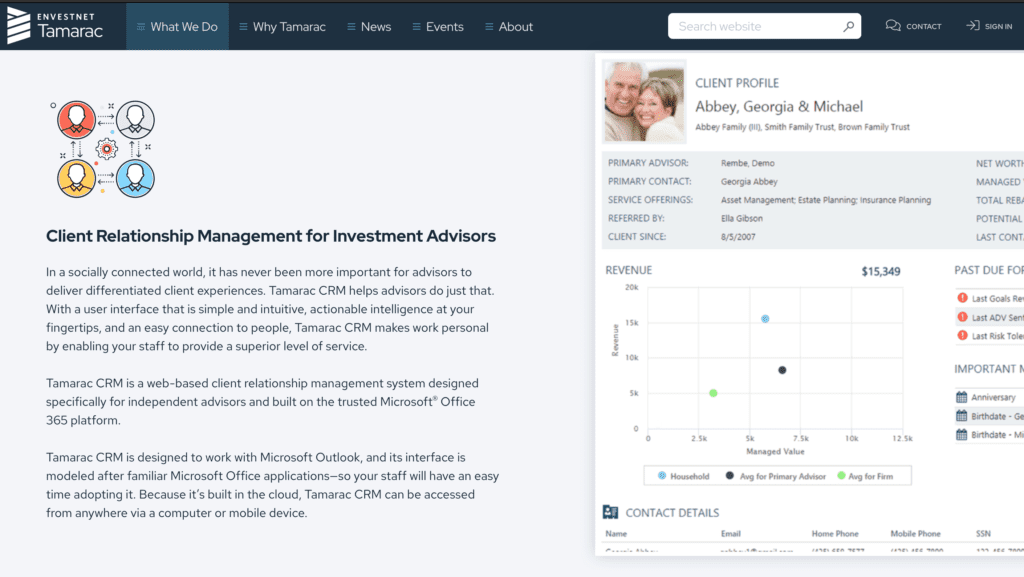

3. Envestnet Tamarac

Envestnet Tamarac is one of the oldest financial advisor CRMs on the market, but there is a reason why it is still popular. It has just about every feature you could possibly need, ranging from portfolio management and analytics to reporting features and wealth management integrations.

The goal of this tool is to help you provide your clients with personalized, customizable investing experiences. You can automatically draw data from dozens of sources thanks to numerous integrations, and it provides you with flexible, customizable reporting features.

Top Features

- Comes with a mobile app for clients and advisors

- Provides you with automatic, detailed reports

- Integrates with numerous software programs that many financial advisors use

- Can give you access to a mountain of information that will open the door to deeper market insights

4. Junxure

Junxure is a CRM program made specifically for financial advisors. It comes with a variety of business process automation tools that allow you to save time. You can also take advantage of different activity-tracking features that can help you build stronger relationships with your clients.

This is even a CRM program that will provide you with real-time tips specifically for financial advisors. That way, you understand exactly what is going on with different financial markets, and you can make sure your clients are in a position to take advantage of the current environment. It will also provide you with basic reminders related to task management.

Top Features

- Has a variety of templates for various financial advisor workflows

- Can help you handle email marketing and social media posts

- Provides you with tools that make it easier for you to segment your clients and manage your relationships during each stage of the sales pipeline

- Gives you real-time tips related to financial markets

5. DebtPayPro

As a financial advisor, every client is going to be different, and some of your clients might come to you for help with not only investments but also debt management. People have various sources of debt, including mortgages, student loans, car loans, and credit card debt. DebtPayPro can help you with not only investment management but also debt management.

This is a CRM program that is popular among both individual advisors and small firms. You can take advantage of tools related to contact management and document management in addition to features related to credit repair and loan consolidation. The goal of this interface is to be as simple as possible while helping you with both sales and marketing needs.

Top Features

- Intuitive user interface means you don’t have to make nearly as many clicks to complete tasks

- Provides you with different tools for contact management and file management

- Gives you access to analytics and insights related to both debt management and portfolio management

6. NexJ Systems

If you are looking for a CRM program for enterprise financial advisor firms, NexJ Systems could be the best option. This is a platform that can help you rapidly expand your client base, boost your revenue, and take advantage of analytics and insights related to financial markets.

This innovative CRM program also comes with a variety of AI tools that can help you automate workflows and streamline your daily operations. You can segment your client list, give individual advisors an opportunity to customize their dashboards, and access a dedicated customer support team that is always able to answer your concerns.

Top Features

- Numerous tools allow you to track revenue growth for your clients and your firms

- Onboarding tools and modules make it easy to explore various features

- A myriad of collaborative tools are available for financial advisors to communicate with one another

- Customizable dashboard tools make it easy to manage your relationships with different clients

Find the Right CRM for Financial Advisors for Your Needs

As a financial advisor, your time is valuable, and you must make sure you get as much out of it as possible. A strong CRM program can help you stay up-to-date with various clients and keep them in the loop as it relates to their portfolio. By ensuring you communicate with your clients on time, you can build customer loyalty while moving new leads down the pipeline.

You need to think about what you need, not only today but also in the future. What do you think your client base is going to look like down the road? You must make sure your CRM program makes it as easy as possible for you to access the information you need to manage your relationships with your clients and colleagues.

Think carefully about workflow automation as you look at different financial CRM systems, and consider the benefits of various CRMs for financial advisors before you decide what is right for your needs.