Are you struggling to manage your business’s cash flow effectively? You’re not alone. Many businesses, both small and large, find it challenging to maintain a healthy cash flow. In this blog post, we’ll explore the best cash flow software solutions to help you take control of your financial management. By using the right software, you can make informed decisions, optimize your cash flow, and ensure the long-term success of your business.

Best CashFlow Software List

What is CashFlow Software?

Cashflow software is a financial management tool that helps businesses monitor, manage, and analyze their various cash flows, inflows and outflows. It enables organizations to create cash flow forecasts, identify potential cash flow issues, and make informed decisions to optimize their financial performance. Cash flow software typically integrates with accounting software and other financial tools, allowing for seamless data synchronization and comprehensive financial management.

Benefits of CashFlow Software

Improved Financial Visibility

Cash flow software provides a clear, real-time view of your organization’s financial health, helping you make informed decisions and plan for the future. By having an accurate and up-to-date picture of your cash flow, you can better manage your resources and prioritize investments.

Accurate Forecasting

Cash flow software enables businesses to create reliable cash flow forecasts, allowing you to anticipate future financial challenges and opportunities. With accurate cash forecasting now, you can make better-informed decisions, such as whether to expand your business, invest in new projects, or reduce expenses.

Time Savings

Manual cash flow management can be time-consuming and prone to errors. Cash flow software automates many tasks, such as data entry and analysis, freeing up valuable time for you and your team to focus on more strategic initiatives.

Enhanced Decision-Making

Cash flow software provides insightful reports and visualizations, making it easier for you to identify trends, spot potential problems, and make informed decisions. By leveraging the power of cash flow data, you can optimize your cash flow and make decisions that drive your business forward.

Cash Flow Software Key Features

Integration with Accounting Software

A crucial feature of cash flow software is its ability to integrate with accounting software, such as QuickBooks or Xero. This integration ensures seamless data synchronization and eliminates the need for manual data entry, reducing the risk of errors.

Cash Flow Forecasting

Cash flow software should offer robust forecasting capabilities, allowing you to create accurate and reliable future cash- flow projections. With these forecasts, you can anticipate future financial challenges and make well-informed decisions.

Scenario Planning

Scenario planning is an essential feature that allows you to model various financial scenarios and assess their impact on your future cash flow. By exploring different scenarios, you can make more informed decisions and develop contingency plans for potential risks.

Customizable Reporting

Cash flow software should provide customizable reporting options, allowing you to generate insightful reports that align with your organization’s specific needs. These reports can help you identify trends, spot potential issues, and track your progress toward financial goals.

Factors to Consider When Choosing Cash Flow Software

Ease of Use

Choose cash flow software that is user-friendly and easy to learn. This will ensure a smooth transition for your team and minimize the time required for training and onboarding.

Scalability

As your business grows, your cash flow management needs may change. Select software that can scale with your organization and accommodate your evolving financial management requirements.

Customization

Look for cash flow software that offers customization options, allowing you to tailor the tool to your specific needs. This can include custom reports, dashboards spreadsheets, and scenario planning to ensure the software is aligned with your business’s unique financial management goals.

Integration Capabilities

Integration with your existing financial tools, such as accounting software and payment processors, is essential for seamless data synchronization and comprehensive financial management. Make sure the first cash management and flow software you choose can easily integrate with your current systems.

Cost

Consider the pricing structure of the cash flow software and ensure it aligns with your budget. Factor in any additional costs, such as training, support, or upgrades, when evaluating the total cost of ownership.

Cash Flow Software Use Case Examples

Small Business: A small business owner can use cash flow software to track income and expenses, create cash flow forecasts, and identify potential financial issues before they become critical. The software can also help them evaluate the impact of various decisions, such as hiring additional staff or purchasing new equipment.

Non-Profit Organization: Non-profit organizations can use cash flow software to manage their donations and expenses, ensuring they have adequate funds to fulfill their mission. The software can also help them create accurate cash flow forecasts to plan for future fundraising efforts and program expenses.

Freelancer: Freelancers can use cash flow software to track their income, manage expenses, and create cash flow projections to ensure they have enough money to cover their bills and invest in their business. The software can also help freelancers understand the impact of different payment terms or project delays on their cash flow.

Retail Business: A retail business can use cash flow software to monitor sales revenue, manage inventory, and track expenses. The software can help them create cash flow forecasts to plan for seasonal fluctuations and evaluate the impact of various decisions, such as opening a new store location or launching a new product line.

Manufacturing Company: Manufacturing companies can use cash flow software to manage their production costs, sales revenue, and expenses. The software can help them create accurate cash flow forecasts to plan for production changes and evaluate the impact of various decisions, such as investing in new equipment or expanding their product offerings.

Potential Cash Flow Software Problems

Inaccurate data input can lead to unreliable forecasts and incorrect financial analysis, impacting decision-making.

Limited integration with existing financial systems can result in manual data entry, increasing the risk of errors and inefficiencies.

Over-reliance on software without proper understanding of cash flow management principles can lead to poor financial decisions.

Cash Flow Software Costs

Cash flow software costs can vary depending on the provider, features, and pricing model. Typical costs include subscription fees, which can range from a few dollars per month for basic plans to several hundred dollars for more advanced solutions. Additional costs may include training, support, and upgrades. It’s crucial to consider the total cost of ownership when evaluating cash flow software options.

Current Cash Flow Software Trends

Current trends in cash flow software include artificial intelligence and machine learning capabilities to improve forecasting accuracy, increased focus on real-time data analysis, and enhanced integration with other financial tools and services.

How We Choose The Best Cash Flow Software

Selecting the right cash flow software for your organization can significantly impact your financial management and overall business success. With a variety of options available in the market, it can be challenging to choose the best one for your needs.

To simplify the decision-making process, we’ve conducted extensive research and analysis to identify the top cash-flow software companies in the industry.

Our methodology for selecting the best cash flow software vendors is based on several key factors. First, we considered the functionality and features offered by each software, including cash flow forecasting, scenario planning, reporting, and integration capabilities.

Second, we evaluated the user interface and ease of use, as well as the level of customization and integration with other business systems such as accounting, payment processing, and productivity tools.

We analyzed customer reviews and feedback on Serchen, as well as G2, and Trustpilot, to gauge user satisfaction and the level of support provided by each vendor. Additionally, we took into account the pricing and affordability of each solution, as well as the level of customer service and support offered.

By considering these factors, we’ve identified the top cash flow software vendors that offer the most comprehensive, user-friendly, and cost-effective cash flow tool solutions for organizations looking to optimize their financial management and drive business success.

Top 5 Cash Flow Software Providers

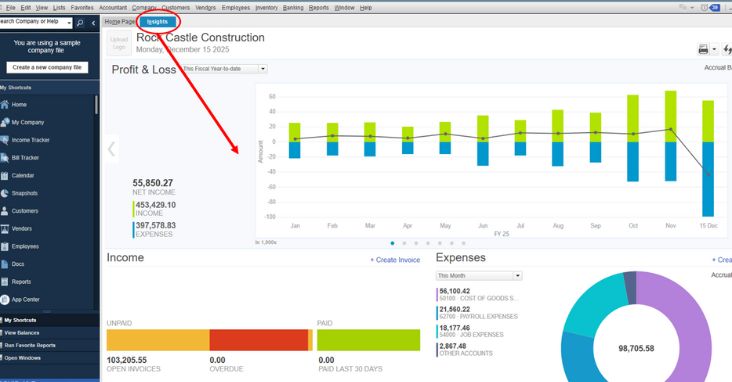

QuickBooks

Founded in 1983, QuickBooks is a comprehensive accounting and financial management platform that offers robust cash flow management features.

Features:

Cash flow forecasting

Integration with accounting software

Customizable reporting

Scenario planning

Pros:

User-friendly interface

Extensive integration options

Reliable forecasting capabilities

Cons:

May have a learning curve for some users

Some features may require additional fees

Support Available:

Online support

Phone support

Community forums

Knowledge base

Best suited to:

Small to medium-sized businesses

Freelancers

Pricing from: $25/month

Ave Rating on: (Serchen, G2, Capterra, Trustpilot): 4.4/5

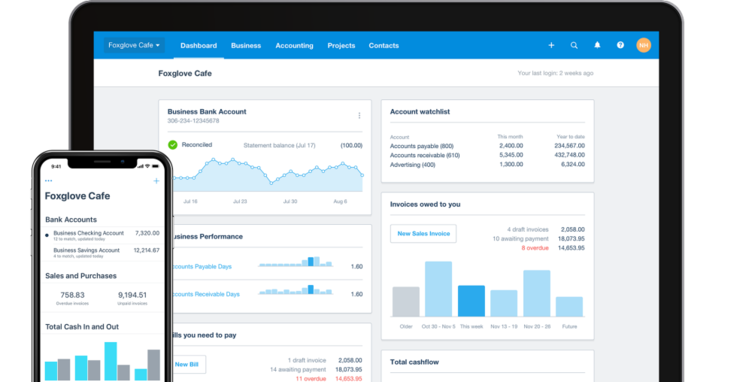

Xero

Founded in 2006, Xero is a cloud-based accounting platform with powerful cash flow management features designed for small to medium-sized businesses.

Features:

Cash flow forecasting

Integration with accounting software

Customizable reporting

Scenario planning

Pros:

Intuitive interface

Wide range of integrations

Scalable solution

Cons:

Limited customization options

May lack advanced features for larger businesses

Support Available:

Online support

Phone support

Community forums

Knowledge base

Best suited to:

Small to medium-sized businesses

Non-profit organizations

Pricing from: $12/month

Ave Rating on: (Serchen, G2, Capterra, Trustpilot): 4.3/5

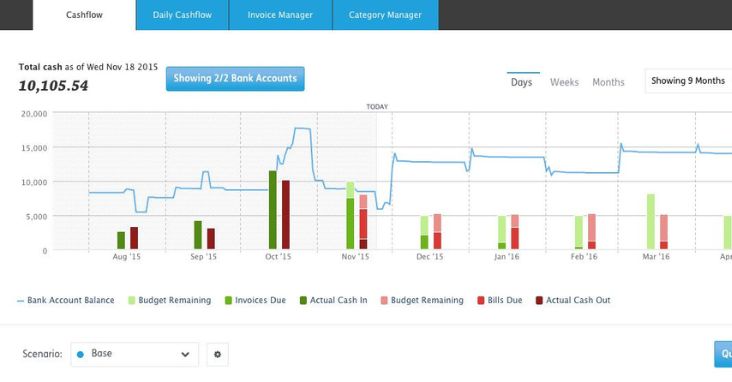

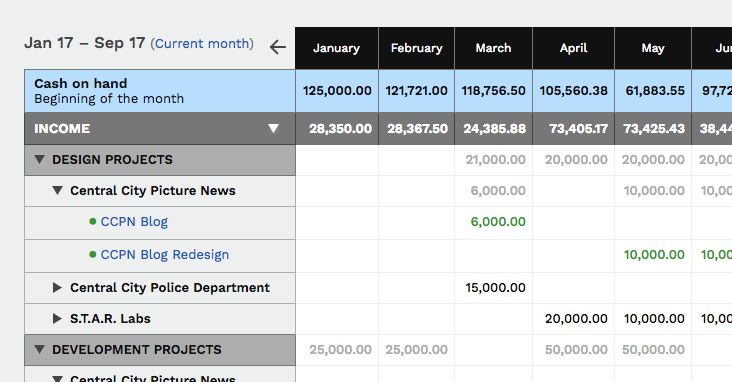

Float

Founded in 2012, Float is a dedicated, cash flow forecast and management software that integrates with popular accounting platforms to provide businesses with accurate cash flow forecasts and scenario planning.

Features:

Cash flow forecasting

Integration with accounting software

Customizable reporting

Scenario planning

Pros:

User-friendly interface

Real-time cash flow updates

Advanced scenario planning capabilities

Cons:

Limited integrations compared to other options

May require manual input for some data

Support Available:

Online support

Knowledge base

Video tutorials

Best suited to:

Small to medium-sized businesses

Agencies

Pricing from: $69/month

Ave Rating on: (Serchen, G2, Capterra, Trustpilot): 4.5/5

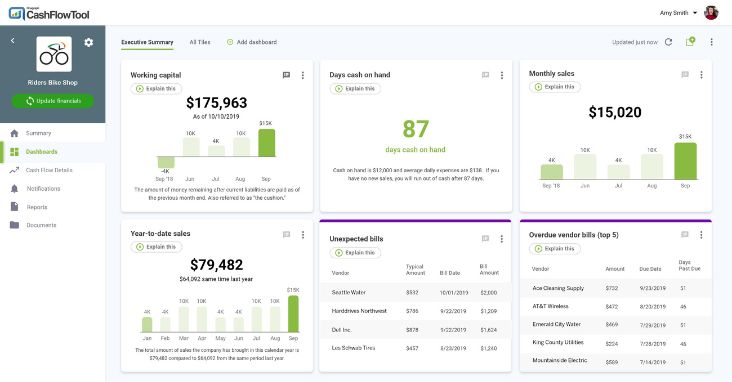

CashFlowTool

Founded in 2018, CashFlowTool is a comprehensive cash flow management software that offers businesses powerful cash flow forecasting software,, analytics, and reporting features.

Features:

Cash flow forecasting

Integration with accounting software

Customizable reporting

Scenario planning

Pros:

Intuitive interface

In-depth cash flow analysis

Real-time data updates

Cons:

May require manual input for some data

Limited customization options

Support Available:

Online support

Phone support

Knowledge base

Best suited to:

Small to medium-sized businesses

Manufacturing companies

Pricing from: $49/month

Ave Rating on: (Serchen, G2, Capterra, Trustpilot): 4.6/5

Pulse

Founded in 2007, Pulse is a cash flow management software designed for small businesses that offers simple cash flow forecasting, budgeting, and reporting features.

Features:

Cash flow forecasting

Integration with accounting software

Customizable reporting

Scenario planning

Pros:

Easy to use

Straightforward forecasting capabilities

Affordable pricing

Cons:

Limited advanced features

Fewer integrations compared to other options

Support Available:

Online support

Knowledge base

Best suited to:

Small businesses

Freelancers

Pricing from: $14/month

Ave Rating on: (Serchen, G2, Capterra, Trustpilot): 4.2/5

Cash Flow Software FAQ

What is cash flow software?

Cash flow software is a tool designed to help businesses monitor, analyze, and forecast their cash flow, ensuring they have adequate funds to cover expenses, invest in growth opportunities, and maintain financial stability.

How does cash flow software work?

Cash flow software works by collecting and analyzing financial data from various sources, such as accounting software, payment processors, and bank accounts. It uses this data to create cash flow forecasts, show cash flow frog identify trends, and generate reports, helping businesses make informed financial decisions.

What are the benefits of using cash flow software?

Using cash flow software can help businesses better see future cash flows, understand their financial health, identify potential cash flow issues, create accurate cash flow forecasts, and make informed decisions about investing, spending, and borrowing.

Who should use cash flow software?

Cash flow software is suitable for businesses of all sizes and industries, including small businesses, freelancers, non-profit organizations, retail companies, and manufacturing firms.

How much does cash flow software cost?

The cost of cash flow software can vary depending on the provider, features, and pricing model. Typical costs include subscription fees, which can range from just a few clicks dollars per month for basic plans to several hundred dollars for more advanced solutions. Additional costs may include training, support, and upgrades.

Can cash flow software integrate with other financial tools?

Yes, most cash flow software can integrate with popular accounting platforms, payment processors, and other financial tools, enabling secure and seamless data synchronization and comprehensive financial management.

How accurate are cash flow forecasts generated by cash flow software?

The accuracy of cash flow forecasts generated by cash flow software depends on the quality of the input data and the software’s forecasting capabilities. Advanced cash flow forecasting software solutions that utilize artificial intelligence and machine learning can provide highly accurate forecasts.

Can cash flow software help with budgeting and financial planning?

Yes, cash flow software can help with budgeting and financial planning by providing businesses with accurate cash flow forecasts, scenario planning capabilities, and customizable reporting.

Is cash flow software easy to use?

Most cash flow software solutions are designed to be user-friendly and intuitive. However, some solutions may have a learning curve, especially for users who are not familiar with financial management concepts.

What support options are available for cash flow software?

Support options for cash flow software may include online support, phone support, community forums, knowledge bases, and video tutorials. The availability and quality of support can vary depending on the provider.

Honorable Mentions

While our top five cash flow software solutions offer a range of features and benefits, there are other options worth considering. Here are five more alternatives to our top picks:

PlanGuru (https://www.planguru.com/)

Fathom (https://www.fathomhq.com/)

Cashculator (https://www.apparentsoft.com/cashculator)

Dryrun (https://dryrun.com/)

CashFlowMapper (https://www.cashflowmapper.com/)

For even more choices, visit the cash flow software category page on Serchen.

Conclusion

Efficient cash flow management is crucial for the success of any business, and the right cash flow software can make a significant difference in ensuring financial stability. By carefully considering the features, benefits, and costs of different cash flow software solutions, you can find the best fit for your organization’s needs.

In addition to cash flow software, businesses may also benefit from other financial management tools, such as invoicing software and expense management solutions. These can be found on serchen.com.

Bonus Content: Cash Flow Software Tips and Practices

To get the most out of your cash flow software, follow these tips and best practices:

Keep your financial data up-to-date to ensure accurate cash flow forecasts and reporting.

Regularly review your cash flow forecasts and make adjustments as needed based on actual financial performance.

Utilize scenario planning features to explore the potential impact of different business decisions on your cash flow.

Integrate your cash flow software with other financial tools for seamless data synchronization and comprehensive financial management.

Train your team on how to use the cash flow software effectively and encourage them to actively participate in cash flow management.