How to calculate operating income? Operating income is calculated by subtracting operating expenses and cost of goods sold (COGS) from total revenue. It reflects the profit made from a business’s core operations, excluding expenses and incomes from investments, taxes, and other non-operational activities.

Calculating operating income is a crucial aspect of determining the profitability of a business. It is a measure of the company’s earnings before interest and taxes (EBIT) and provides insight into the company’s core operations. Operating income is a key metric for investors, analysts, and managers, as it helps in evaluating the company’s financial health and making informed decisions.

Understanding operating income requires an understanding of the income statement, which is a financial statement that summarizes a company’s revenues and expenses over a specific period. The income statement is divided into three sections: revenue, cost of goods sold, and operating expenses. Operating expenses include selling, general, and administrative expenses, depreciation, and amortization. By subtracting the operating expenses from the revenue, we arrive at the operating income.

To calculate operating income, one must have a clear understanding of the components of operating income. It is important to identify and isolate the expenses that are directly related to the company’s core operations. Non-operating expenses, such as interest expenses and gains or losses from the sale of assets, should be excluded from the calculation. By doing so, we can arrive at an accurate measure of the company’s profitability from its core operations.

Key Takeaways

- Operating income is a measure of a company’s earnings before interest and taxes (EBIT) and provides insight into the company’s core operations.

- Operating income is calculated by subtracting the operating expenses from the revenue.

- Non-operating expenses should be excluded from the calculation to arrive at an accurate measure of the company’s profitability from its core operations.

Understanding Operating Income

Definition of Operating Income

Operating income, also known as operating profit or earnings before interest and taxes (EBIT), is a financial metric that measures a company’s core profitability from its business operations. It is calculated by subtracting operating expenses from total revenue. Operating expenses include costs related to production, sales, and administration, but exclude interest and taxes.

Operating income is an important financial metric for investors as it provides a clear picture of a company’s ability to generate profits from its core business operations. A high operating income indicates that a company is able to generate profits without relying on external factors such as investments or financing.

Importance of Operating Income for Investors

Investors use operating income as a key indicator of a company’s financial health and profitability. It is a useful metric for comparing the performance of different companies within the same industry. By comparing the operating income of two companies, investors can determine which one is more efficient in generating profits from its business operations.

Operating income is also useful for identifying trends in a company’s financial performance. A consistent increase in operating income over time indicates that a company is growing and becoming more profitable. On the other hand, a decline in operating income may indicate that a company is facing challenges in its business operations.

In conclusion, understanding operating income is crucial for investors who want to make informed decisions about investing in a company. By analyzing a company’s operating income, investors can gain insights into its core profitability and financial health. To learn more about how to calculate operating income, check out this resource from Investopedia.

Components of Operating Income

Operating income is a crucial metric for any business as it indicates the profitability of the company’s core operations. Operating income is calculated by subtracting cost of goods sold (COGS) and operating expenses from revenue. In this section, we will discuss the three main components of operating income: revenue and net sales, cost of goods sold (COGS), and operating expenses breakdown.

Revenue and Net Sales

Revenue is the total amount of money a company earns from its primary business activities, including sales of goods or services. Net sales, on the other hand, are the revenue earned by a company after deducting any discounts, returns, and allowances. It is important to note that revenue and net sales are not the same, and it is essential to calculate net sales to get an accurate picture of a company’s financial performance.

Cost of Goods Sold (COGS)

COGS is the direct cost incurred by a company to produce the goods or services it sells. It includes the cost of raw materials, labor, and manufacturing overhead. Calculating COGS is crucial as it helps determine the gross profit margin, which is the difference between revenue and COGS.

Operating Expenses Breakdown

Operating expenses are the indirect costs incurred by a company to run its business operations. It includes expenses such as wages, rent, utilities, depreciation, amortization, insurance, office supplies, marketing, and inventory. It is important to note that operating expenses are not included in COGS as they are not directly related to the production of goods or services.

To calculate operating income, subtract COGS and operating expenses from revenue. A positive operating income indicates that a company’s core operations are profitable, while a negative operating income indicates that a company’s core operations are not profitable.

For more information on calculating operating income, check out this resource from Investopedia, a highly authoritative source on financial topics.

Calculating Operating Income

Calculating operating income is an essential step in determining a company’s profitability. It is a crucial accounting figure that shows how much profit a company generates from its core operations. By subtracting operating expenses from gross income, we can arrive at the operating income.

Operating Income Formula

The formula for calculating operating income is straightforward. It is the difference between gross income and operating expenses.

Operating Income = Gross Income – Operating Expenses

Gross income is the revenue generated from sales, while operating expenses are the costs incurred in running the business, such as salaries, rent, and utilities.

Step-by-Step Calculation Process

To calculate operating income, follow these simple steps:

- Determine the gross income: This is the total revenue generated by the company from sales.

- Determine the operating expenses: These are the costs incurred in running the business, such as salaries, rent, and utilities.

- Subtract the operating expenses from the gross income: This will give you the operating income.

Adjustments for Depreciation and Amortization

Depreciation and amortization are non-cash expenses that can affect the calculation of operating income. They are accounting methods used to spread the cost of an asset over its useful life.

To adjust for these expenses, the company needs to add them back to the operating income. This will give us the earnings before interest, taxes, depreciation, and amortization (EBITDA).

In conclusion, calculating operating income is a crucial step in determining a company’s profitability. By subtracting operating expenses from gross income, we can arrive at the operating income. It is important to adjust for non-cash expenses such as depreciation and amortization to get an accurate picture of the company’s financial health. For more information on calculating operating income, visit Investopedia.

Analyzing Operating Income

Operating income is a crucial metric for assessing a company’s financial health. It represents the profit generated from a company’s core business operations, excluding any non-operating expenses or income. Analyzing operating income can provide valuable insights into a company’s profitability and efficiency.

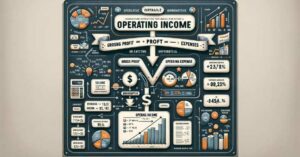

Operating Margin and Efficiency

One important metric to consider when analyzing operating income is the operating margin. This is calculated by dividing operating income by net revenue, and it represents the percentage of revenue that is left over after deducting operating expenses. A high operating margin indicates that a company is generating significant profits from its operations, while a low operating margin may suggest that a company is struggling to control its expenses.

Another important aspect of operating income is efficiency. This refers to a company’s ability to generate revenue with its available resources. A company with high operating efficiency is able to generate more revenue with the same amount of resources as a less efficient company. Analyzing operating efficiency can help investors identify companies that are able to maximize their profits and minimize their expenses.

Comparing Operating Income Across Companies

Comparing operating income across companies can provide valuable insights into a company’s financial health and competitive position. When comparing operating income, it is important to consider the size and industry of the companies being compared. For example, a small tech startup may have a lower operating income than a large established company like Apple Inc., but this does not necessarily mean that the startup is less profitable or less efficient.

Operating Income vs. Net Income

It is also important to distinguish between operating income and net income. Net income represents the bottom line profit of a company after all expenses and income have been accounted for. Operating income is a measure of recurring profit generated from a company’s core business operations. While net income can be influenced by one-time events such as asset sales or write-offs, operating income provides a more accurate picture of a company’s ongoing profitability.

To learn more about how to calculate operating income and analyze a company’s financial health, investors can consult resources such as Investopedia’s guide to financial analysis.

Investopedia’s guide to financial analysis

Non-Operating Items Impact

Operating income is a crucial measure of a company’s profitability. It is calculated by subtracting operating expenses from operating revenues. However, non-operating items can also impact a company’s operating income. Non-operating items refer to revenue and expenses that are not related to the core business operations of a company. In this section, we will discuss the impact of non-operating items on operating income.

Non-Operating Expenses and Income

Non-operating expenses and income can have a significant impact on a company’s operating income. Non-operating expenses include expenses such as interest expense, which is the cost of borrowing money. On the other hand, non-operating income includes income such as gains from the sale of assets.

When a company incurs non-operating expenses, it reduces its operating income. For example, if a company has a high interest expense, it will have less money available to invest in its core business operations. Conversely, when a company has non-operating income, it increases its operating income. For example, if a company sells an asset for a gain, it will have more money available to invest in its core business operations.

Interest and Taxes Effects

Interest and taxes can also impact a company’s operating income. Interest expense is the cost of borrowing money, and it reduces a company’s operating income. Taxes are also an expense that reduces a company’s operating income.

When a company has a high interest expense, it may be an indication that the company has a lot of debt. High debt can limit a company’s financial decision-making and strategic decisions. On the other hand, when a company has a low interest expense, it may have more financial flexibility to make strategic business decisions.

In conclusion, non-operating items can have a significant impact on a company’s operating income. Understanding the impact of non-operating expenses and income, as well as interest and taxes, is crucial for making informed financial and strategic decisions. For more information on calculating operating income, refer to this resource from Investopedia.

Operating Income in Decision-Making

Operating income is a crucial metric that is used by businesses to evaluate their financial performance. It is the income generated from a company’s core business activities after deducting operating expenses. Operating income is a key metric used by decision-makers to evaluate the financial health of a company.

Role in Financial Decisions

Operating income plays a critical role in financial decisions. It is an important metric that is used to evaluate a company’s profitability. Decision-makers use operating income to assess the financial health of a company and to determine whether it is generating enough revenue to cover its operating expenses. Operating income is also used to calculate other important financial metrics such as earnings per share (EPS) and return on investment (ROI).

When making financial decisions, operating income is used to evaluate a company’s ability to meet its financial goals. Decision-makers use this metric to determine whether a company is generating enough revenue to pay its creditors and investors. Operating income is also used to evaluate a company’s ability to invest in its core business activities.

Influence on Strategic Business Decisions

Operating income also plays a crucial role in strategic business decisions. It is used by decision-makers to evaluate the profitability of a company’s core business activities. This metric is used to determine whether a company should invest in new business activities or focus on its core business.

When making strategic business decisions, operating income is used to evaluate a company’s ability to achieve its financial goals. Decision-makers use this metric to determine whether a company is generating enough revenue to invest in new business activities or to expand its existing operations. Operating income is also used to evaluate a company’s ability to compete with its competitors.

In conclusion, operating income is a critical metric used by decision-makers to evaluate a company’s financial health. It plays a crucial role in financial and strategic business decisions. By understanding the importance of operating income, decision-makers can make informed decisions that help a company achieve its financial goals and succeed in its core business activities.

Here is a link to Investopedia’s article on Operating Income, which provides more in-depth information on the topic.

Common Adjustments and Exceptions

Calculating operating income can be a complex process, as there are many factors that can affect a company’s profitability. However, by understanding some common adjustments and exceptions, one can arrive at a more accurate picture of a company’s financial health.

Handling Discounts and Returns

Discounts and returns are common in many industries, and they can have a significant impact on a company’s operating income. When calculating operating income, it is important to take into account any discounts or returns that have been issued. This can be done by subtracting the total amount of discounts and returns from the company’s gross revenue.

It is also important to note that not all discounts and returns are created equal. For example, some discounts may be given as part of a promotional campaign, while others may be given to long-term customers as a loyalty reward. Similarly, some returns may be due to a defect in the product, while others may be due to customer dissatisfaction. By categorizing discounts and returns in this way, one can get a better understanding of their impact on a company’s operating income.

Employee Wages and Commissions

Employee wages and commissions are another important factor to consider when calculating operating income. In general, wages and commissions should be subtracted from a company’s gross revenue to arrive at its operating income. However, there are some exceptions to this rule.

For example, if a company has a large sales force that is paid on commission, it may be more accurate to include these commissions as a cost of goods sold rather than as an operating expense. Similarly, if a company has a large research and development department, it may be more accurate to include these expenses as a part of its cost of goods sold rather than as an operating expense.

Overall, it is important to carefully consider the impact of employee wages and commissions when calculating operating income. By doing so, one can arrive at a more accurate picture of a company’s financial health.

For more information on how to calculate operating income, check out this resource from Investopedia.

Real-World Examples

Case Studies of Operating Income

To better understand how to calculate operating income, it can be helpful to examine some real-world examples. One such example is Apple Inc., a multinational technology company. In their annual report for the fiscal year 2023, Apple reported an income from operations of $110.1 billion. This figure represents the amount of money that Apple earned from its operational activities before deducting interest and taxes.

Another example is a small business that sells handmade crafts. Suppose this business had total revenues of $100,000 in a year and incurred $60,000 in expenses related to its operations, such as materials, labor, and rent. The business’s operating income would be $40,000, which is the difference between its revenues and expenses.

Interpreting Operating Income in Annual Reports

When examining a company’s annual report, operating income is typically listed as a line item on the income statement. It is important to note that operating income is not the same as EBITDA (earnings before interest, taxes, depreciation, and amortization), which is another common financial metric.

Interpreting a company’s operating income can provide insight into its financial health and performance. A high operating income relative to a company’s revenues indicates that it is generating a significant profit from its core business activities. On the other hand, a low or negative operating income may suggest that a company is struggling to generate profits from its operations.

To learn more about how to analyze a company’s financial statements, Investopedia provides a helpful guide on How to Read Financial Statements, which can be a valuable resource for investors and analysts alike.

Frequently Asked Questions

What are the components necessary to determine operating income?

To calculate operating income, you need to know the total revenue and total operating expenses of a business. Operating expenses include all expenses incurred in the regular course of business, such as salaries, rent, and utilities. These expenses do not include interest or taxes.

How do you derive operating income from the contribution margin?

To derive operating income from the contribution margin, subtract operating expenses from the contribution margin. The contribution margin is the amount of revenue remaining after deducting variable costs.

What is the difference between operating income and net income?

Operating income is the income earned from a company’s regular operations, while net income is the total income earned after all expenses, including interest and taxes, have been deducted. Operating income is a measure of a company’s profitability before considering non-operating expenses.

Can you provide examples of operating income calculations?

Suppose a company has total revenue of $500,000 and total operating expenses of $300,000. The operating income would be $200,000 ($500,000 – $300,000).

In what ways do operating expenses impact operating income?

Operating expenses have a direct impact on operating income. The higher the operating expenses, the lower the operating income. It is important for businesses to manage their operating expenses to maximize operating income.

How is EBIT different from operating income, and how is it calculated?

EBIT (Earnings Before Interest and Taxes) is similar to operating income but includes interest and tax expenses. To calculate EBIT, add interest and tax expenses to operating income. EBIT is a measure of a company’s profitability before considering the impact of interest and taxes.

For more information on how to calculate operating income, please visit Investopedia.

Compare hundreds of Financial Planning Software in our Software Marketplace