Capital expenditure (capex) is an important aspect of any company’s financial planning and analysis.

Capex refers to the funds that a company spends on acquiring, upgrading, or maintaining its fixed assets such as property, plant, and equipment. Capex is a crucial factor in determining a company’s financial health and growth potential, as it directly impacts the company’s cash flow, profitability, and operational efficiency.

Understanding capex requires a thorough knowledge of the components of capex, the capex calculation, and how capex is presented in financial statements. The capex formula involves identifying the cost of the asset, the expected useful life of the asset, and the salvage value of the asset. The difference between the cost and the salvage value is then divided by the expected useful life of the asset to determine the annual depreciation expense. This annual depreciation expense is then added to any other expenses related to the asset, such as maintenance and repair costs, to arrive at the total capex for the year.

Key Takeaways

- Capex is a crucial factor in determining a company’s financial health and growth potential.

- Understanding capex requires knowledge of its components, calculation, and presentation in financial statements.

- Analyzing capex can help companies make informed decisions about their operational strategy, planning, budgeting, financing, and investment.

Understanding Capex

Definition of Capital Expenditure

Capital Expenditure, commonly referred to as Capex, is an accounting term used to describe the funds a company uses to acquire, improve, or maintain fixed assets such as property, plant, and equipment. Capex can also include investments in intangible assets such as patents, software, and trademarks. These expenditures are typically made to increase the efficiency and productivity of a business.

Importance of Capex in Business Operations

Capex is a crucial aspect of a company’s financial planning and budgeting process. It helps a company to maintain and improve its assets, which in turn, helps to boost productivity and profitability. Without Capex, a company may struggle to keep up with its competitors and may face difficulties in meeting the demands of its customers.

Investing in Capex can also help a company to reduce its operating costs in the long run. For example, upgrading to more energy-efficient equipment can help to lower energy bills and reduce the company’s carbon footprint. This not only benefits the environment but also helps to improve the company’s image and reputation.

In conclusion, Capex plays a vital role in a company’s financial planning and budgeting process. It helps a company to acquire, improve, and maintain its fixed assets, which is essential for its long-term success. By investing in Capex, a company can improve its efficiency, productivity, and profitability, while also reducing its operating costs.

Components of Capex

When it comes to capital expenditures (Capex), there are several components that companies need to consider. These components include property, plant, and equipment (PP&E), physical assets, technology, and software. Each of these components plays a crucial role in determining the total Capex of a company.

Property, Plant, and Equipment (PP&E)

PP&E refers to the tangible assets that a company owns and uses in its operations. These assets include land, buildings, machinery, and vehicles. Companies need to invest in PP&E to maintain and expand their operations. The Capex for PP&E can be significant, especially for companies that operate in capital-intensive industries like manufacturing.

Physical Assets

Physical assets refer to the assets that a company uses to produce goods or services. These assets can include raw materials, inventory, and finished goods. Companies need to invest in physical assets to maintain their production capabilities and meet customer demand. The Capex for physical assets can vary depending on the industry and the type of asset.

Technology and Software

Technology and software are becoming increasingly important components of Capex for many companies. As businesses become more digital, they need to invest in technology and software to remain competitive. This can include investments in hardware, software, and infrastructure. The Capex for technology and software can be significant, especially for companies that are undergoing digital transformation.

In conclusion, companies need to carefully consider all of the components of Capex when making investment decisions. By investing in the right assets, companies can maintain and expand their operations, remain competitive, and drive long-term growth.

Capex Calculation

When it comes to calculating capital expenditures (capex), it is important to understand the formula and the factors that go into it. This section will explain the capex formula and the key components that contribute to it.

Capex Formula Explained

The capex formula is relatively straightforward: it is the sum of all investments in property, plant, and equipment (PP&E) made during a specific period. This includes any purchases of new equipment, as well as any improvements or upgrades to existing equipment.

The formula for capex can be expressed as:

Capex = PP&E at end of period - PP&E at beginning of period + Depreciation and Amortization

Depreciation and Amortization

Depreciation and amortization are key components of the capex formula. Depreciation refers to the decrease in value of an asset over time, while amortization refers to the process of spreading the cost of an intangible asset over its useful life.

Depreciation and amortization are subtracted from the change in PP&E to arrive at net capital expenditure.

Net Capital Expenditure

Net capital expenditure is the amount of money that a company has invested in PP&E during a specific period, after accounting for depreciation and amortization. This figure represents the true amount of money that a company has spent on new equipment and improvements to existing equipment.

In summary, understanding the capex formula and the factors that contribute to it is essential for any business that wants to accurately track its investments in PP&E. By calculating capex on a regular basis, businesses can gain valuable insights into their capital expenditures and make informed decisions about future investments.

Capex in Financial Statements

Capital expenditures (Capex) are an essential part of a company’s financial statements. Capex refers to the funds a company spends on acquiring, upgrading, or maintaining long-term assets such as property, plant, and equipment. Capex is a critical metric for investors and analysts to evaluate a company’s growth potential and future cash flows.

Balance Sheet Impact

Capex has a direct impact on a company’s balance sheet. When a company invests in a long-term asset, the amount spent is recorded as a capital expenditure and is shown as an asset on the balance sheet. The asset’s value is then depreciated over its useful life, and the amount of depreciation is recorded as an expense on the income statement.

Income Statement Considerations

Capex also has an indirect impact on a company’s income statement. Even though the amount spent on Capex is not recorded as an expense on the income statement, the depreciation expense resulting from the Capex is recorded as an expense. This expense reduces the company’s net income, which, in turn, reduces the amount of taxes the company has to pay.

Cash Flow Statement Analysis

Capex is also an essential metric for analyzing a company’s cash flow statement. Capex is classified as a cash outflow in the cash flow statement’s investing activities section. A company that is investing heavily in Capex will have a negative cash flow from investing activities. However, this negative cash flow can be a positive sign for investors if the Capex is expected to generate future cash flows.

In conclusion, Capex is a vital metric for evaluating a company’s growth potential and future cash flows. It has a direct impact on the balance sheet and an indirect impact on the income statement. Capex is also an essential metric for analyzing a company’s cash flow statement. By understanding Capex and its impact on a company’s financial statements, investors and analysts can make informed investment decisions.

Analyzing Capex

When analyzing capital expenditures (capex), there are several key ratios that investors and analysts may use. These ratios can help to provide insight into a company’s spending habits and financial health. In this section, we will explore three important capex ratios: the capex to depreciation ratio, the capex to revenue ratio, and free cash flow considerations.

Capex to Depreciation Ratio

The capex to depreciation ratio is a measure of how much a company is investing in new capital assets relative to the value of its existing assets. Specifically, this ratio compares a company’s capital expenditures to its depreciation expense. A high ratio suggests that the company is investing heavily in new assets, while a low ratio may indicate that the company is not investing enough in its future growth.

Capex to Revenue Ratio

The capex to revenue ratio is another important metric for analyzing a company’s spending habits. This ratio compares a company’s capital expenditures to its revenue. A high ratio suggests that the company is investing heavily in its future growth, while a low ratio may indicate that the company is not investing enough to support its revenue growth.

Free Cash Flow Considerations

Finally, it is important to consider a company’s free cash flow when analyzing its capex. Free cash flow is a measure of how much cash a company generates after accounting for all of its capital expenditures. A company with strong free cash flow may be better positioned to invest in new growth opportunities, while a company with weak free cash flow may struggle to fund new investments.

Overall, analyzing capex can provide valuable insights into a company’s financial health and growth prospects. By considering key ratios such as the capex to depreciation ratio and the capex to revenue ratio, as well as free cash flow considerations, investors and analysts can gain a better understanding of a company’s spending habits and future potential.

Capex and Operational Strategy

Capex, or capital expenditures, is a crucial aspect of any business’s operational strategy. It involves investing in long-term assets such as property, equipment, and infrastructure to improve business operations, maintain existing assets, and expand the business.

Maintenance vs. Growth Capex

One of the primary reasons for capex is to maintain and repair existing assets. This is known as maintenance capex and is essential for ensuring that assets remain in good condition and perform optimally. Growth capex, on the other hand, involves investing in new assets to expand the business and increase revenue.

Capex for Expansion and Growth

Capex can be a significant driver of business growth. By investing in new assets such as equipment and technology, businesses can increase production capacity, improve efficiency, and expand into new markets. However, it’s essential to strike a balance between growth and financial stability. Too much capex can strain a company’s finances, while too little can hinder growth.

Repair and Upgrades

Capex can also be used for repair and upgrades of existing assets. Upgrading equipment and technology can improve efficiency, reduce downtime, and increase output. Repairing assets can also extend their lifespan and improve their performance, reducing the need for costly replacements.

In conclusion, capex is a critical component of a business’s operational strategy. It allows businesses to maintain and repair existing assets, expand operations, and improve efficiency. However, it’s crucial to strike a balance between growth and financial stability and to use capex wisely to achieve long-term success.

Planning and Budgeting for Capex

When it comes to capital expenditures (capex), planning and budgeting are crucial processes that ensure a business invests in the right assets at the right time. By forecasting future capex needs and developing a capex budgeting process, a company can ensure it has the resources it needs to support future growth.

Forecasting Future Capex Needs

Forecasting future capex needs involves projecting the capital investments a company will need to make in the future. This process involves analyzing historical data, market trends, and industry forecasts to identify potential investment opportunities. By forecasting future capex needs, a company can ensure it has the resources it needs to support growth and remain competitive.

To forecast future capex needs, a company can use a variety of methods, including trend analysis, regression analysis, and scenario analysis. These methods can help identify potential investment opportunities and provide insight into the expected return on investment.

Capex Budgeting Process

Once a company has forecasted its future capex needs, it can begin the capex budgeting process. This process involves developing a budget for capital investments based on the forecasted needs. The budget should include all capital investments the company plans to make during the budget period, including new equipment, facilities, and technology.

To develop a capex budget, a company should first identify its strategic goals and objectives. This will help ensure that the budget aligns with the company’s overall strategy and priorities. The company should then identify all potential capital investments and estimate the costs associated with each investment.

The capex budget should also include a timeline for each investment, including the expected start and completion dates. This will help ensure that the investments are made in a timely manner and that the company has the resources it needs to support growth.

In conclusion, planning and budgeting for capex is a critical process that can help ensure a company has the resources it needs to support future growth. By forecasting future capex needs and developing a capex budgeting process, a company can ensure it invests in the right assets at the right time.

Capex Financing and Investment

Capex, short for capital expenditures, is the money a company spends to acquire or upgrade its fixed assets such as buildings, machinery, and equipment. Financing such expenditures is a crucial aspect of a company’s financial management. In this section, we will explore the sources of finance for capex and the relationship between investing activities and capex.

Sources of Finance for Capex

Companies have several options when it comes to financing their capex. The following are some of the common sources of finance for capex:

- Internal Financing: This refers to using the company’s own cash reserves or profits to finance the capex. This option is ideal for companies with strong cash flow and profitability.

- Debt Financing: This involves borrowing money from banks, financial institutions, or bond markets to finance the capex. Debt financing is suitable for companies that need a large amount of capital and have a good credit rating.

- Equity Financing: This involves issuing new shares or selling existing shares to raise capital for the capex. Equity financing is suitable for companies that want to avoid taking on debt or diluting their ownership.

Choosing the right source of finance depends on a company’s financial position, risk appetite, and growth objectives.

Investing Activities and Capex

Investing activities are the purchases or sales of long-term assets such as property, plant, and equipment. Capex is a subset of investing activities that involves the acquisition or upgrade of fixed assets. Investing activities and capex are closely related because capex is a major component of investing activities.

Investing activities are reported on a company’s cash flow statement, which provides information on the cash inflows and outflows related to investing activities. A company’s ability to generate cash from investing activities is an important indicator of its financial health and growth prospects.

In conclusion, capex financing and investment are critical aspects of a company’s financial management. Companies have several options when it comes to financing their capex, and the choice of source depends on their financial position and growth objectives. Investing activities and capex are closely related, and monitoring cash flows from investing activities is crucial for assessing a company’s financial health.

Capex in Different Industries

Capital expenditures (Capex) are essential for businesses to invest in their infrastructure and grow their operations. However, the amount and type of Capex required vary across different industries. In this section, we will explore Capex in the manufacturing, technology, and energy sectors.

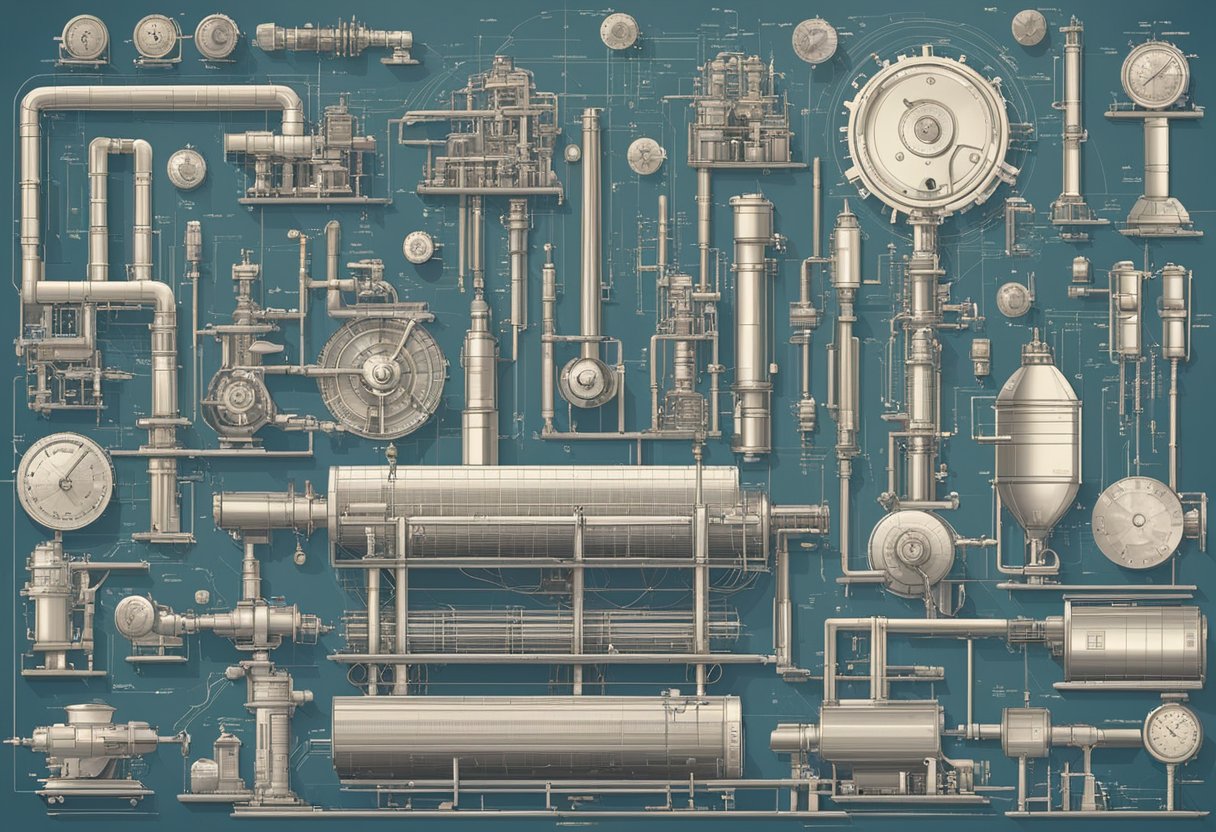

Manufacturing Sector Capex

The manufacturing industry involves the production of goods that are sold to customers. The Capex requirements in this industry are primarily related to the purchase of machinery, equipment, and facilities. The Capex investment in the manufacturing sector is crucial for maintaining production levels, improving efficiency, and reducing production costs.

In the manufacturing industry, Capex is also used to develop new products and improve existing ones. For example, a company may invest in research and development to create new products or improve the quality of existing ones. This type of Capex is critical for the long-term success of a manufacturing business.

Technology Industry Capex

The technology industry is known for its rapid pace of innovation and change. This industry requires significant Capex investment in research and development to create new products, improve existing ones, and stay ahead of the competition. The Capex investment in the technology sector is also related to the purchase of hardware, software, and other equipment necessary for the development and delivery of technology products and services.

In the technology industry, Capex is also used to invest in infrastructure, such as data centers and cloud computing services. This type of Capex is critical for providing the necessary computing power and storage capacity to support the delivery of technology products and services.

Energy Sector Capex

The energy sector involves the production and distribution of energy, including oil, gas, and electricity. The Capex requirements in this industry are primarily related to the exploration, drilling, and production of energy resources. The Capex investment in the energy sector is crucial for maintaining production levels, improving efficiency, and reducing production costs.

In the energy sector, Capex is also used to invest in infrastructure, such as pipelines, refineries, and power plants. This type of Capex is critical for the transportation, processing, and distribution of energy resources.

Overall, Capex is a critical component of business operations in various industries. The type and amount of Capex investment required vary across different sectors, but it is essential for businesses to invest in their infrastructure to remain competitive and grow their operations.

Capex Examples and Case Studies

Capex formula is a vital tool for businesses to calculate the potential return on investment from capital expenditures. Here are a few examples and case studies that demonstrate the importance of capex formula in various industries.

Example 1: Manufacturing Industry

A manufacturing company is considering purchasing new equipment to increase production efficiency. The equipment will cost $500,000, and the expected return on investment is $750,000 over five years. Using the capex formula, the company can calculate the potential return on investment by dividing the expected return by the cost of the equipment. In this case, the capex ratio is 1.5, indicating that the investment is worth pursuing.

Example 2: Retail Industry

A retail company is considering opening a new store location. The cost of the new store is $1 million, and the expected return on investment is $1.5 million over five years. Using the capex formula, the company can calculate the potential return on investment by dividing the expected return by the cost of the new store. In this case, the capex ratio is 1.5, indicating that the investment is worth pursuing.

Case Study: Amazon

Amazon is a prime example of a company that utilizes capex formula to make strategic investments. In 2019, Amazon invested $35 billion in capital expenditures, including new fulfillment centers and data centers. The company’s capex ratio has consistently been above 1, indicating that the investments are generating a positive return on investment.

In conclusion, capex formula is a valuable tool for businesses to evaluate potential investments and make strategic decisions. By using capex formula, companies can make informed decisions about capital expenditures and ensure that investments generate a positive return.

Tools for Capex Analysis

When analyzing capital expenditures (capex), having the right tools can make the process much easier and more accurate. Here are two tools that can be used for capex analysis:

Excel Templates for Capex

Excel templates are a popular tool for capex analysis. These templates can be customized to fit specific needs and can help with forecasting, budgeting, and tracking capex. Excel templates can also be used to create charts and graphs to visualize capex data.

One popular Excel template for capex analysis is the “Capital Expenditure Budget Template.” This template allows users to input their capex budget and track actual spending against the budget. It also includes sections for depreciation and amortization.

Another useful Excel template for capex analysis is the “Capex Request Form Template.” This template allows users to submit capex requests with detailed information such as the purpose of the expenditure, the expected return on investment, and the estimated cost.

DCF Models and Capex

Discounted cash flow (DCF) models are another tool that can be used for capex analysis. DCF models are used to estimate the value of an investment based on its expected future cash flows. This can be useful when evaluating capex projects that will generate cash flows over a long period of time.

When using DCF models for capex analysis, it is important to include all relevant cash flows, including the initial investment, operating cash flows, and terminal value. The terminal value represents the expected value of the investment at the end of its useful life.

DCF models can be complex and time-consuming to build, but there are many pre-built models available online that can be customized to fit specific needs. It is important to ensure that the assumptions used in the DCF model are realistic and based on accurate data.

In conclusion, Excel templates and DCF models are two tools that can be used for capex analysis. Excel templates are useful for forecasting, budgeting, and tracking capex, while DCF models are useful for estimating the value of long-term capex projects. Both tools require accurate data and assumptions to ensure accurate results.

Frequently Asked Questions

How is capital expenditure (CapEx) calculated from a company’s balance sheet?

Capital expenditures are typically found in the investing section of a company’s balance sheet. The formula for calculating CapEx is as follows:

CapEx = Ending PP&E – Beginning PP&E + Depreciation Expense

PP&E stands for property, plant, and equipment. Depreciation expense is the amount that a company has written off for the wear and tear on its assets over a given period of time.

What is an effective method for forecasting future capital expenditures?

One effective method for forecasting future capital expenditures is to use a percentage of sales approach. This involves estimating what percentage of a company’s sales will be spent on capital expenditures in the future based on historical trends and industry benchmarks.

Can you provide an example of how to compute CapEx using a financial formula?

Suppose a company has $10 million in property, plant, and equipment at the beginning of the year, and $12 million at the end of the year. The company also has $1 million in depreciation expense for the year. Using the formula above, the CapEx for the year would be:

CapEx = $12 million – $10 million + $1 million

CapEx = $3 million

What is the difference between net CapEx and gross CapEx in financial analysis?

Gross CapEx refers to the total amount of money a company spends on capital expenditures, while net CapEx takes into account any proceeds from the sale of assets. Net CapEx is calculated as follows:

Net CapEx = Gross CapEx – Proceeds from Sale of Assets

How do capital expenditures differ from operating expenditures (OpEx) in financial accounting?

Capital expenditures are investments in long-term assets, such as property, plant, and equipment, that are expected to provide benefits over a period of several years. Operating expenditures, on the other hand, are expenses incurred in the day-to-day operations of a business, such as rent, utilities, and salaries.

What are some common examples of capital expenditures in business?

Common examples of capital expenditures in business include investments in property, plant, and equipment, such as buildings, machinery, and vehicles. Other examples include investments in software, research and development, and intellectual property.