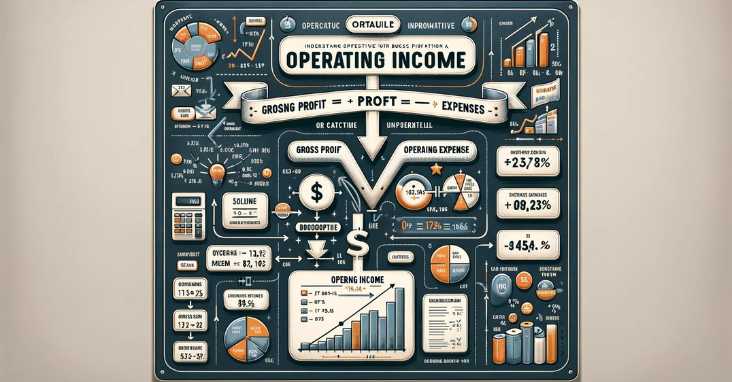

How to calculate and interpret your business’s operating income formula? Calculate Operating Income: Revenue – COGS – Operating Expenses. It shows profitability before interest and taxes, indicating financial health.

Operating income is a key metric used by businesses to evaluate their financial performance. It is a measure of the profit generated by a company’s operations after deducting operating expenses. Operating income is an important metric for investors and analysts as it provides insight into a company’s ability to generate profits from its core business activities.

Understanding Operating Income

Operating income is calculated by subtracting operating expenses from revenue. Operating expenses include costs such as salaries, rent, utilities, and depreciation. Revenue is the total amount of money earned from the sale of goods or services. Operating income is a measure of the profit generated by a company’s operations, and it does not include income from investments or financing activities.

Components of Operating Expenses

Operating expenses are the costs associated with running a business. They include costs such as salaries, rent, utilities, and depreciation. Understanding the components of operating expenses is important for calculating operating income accurately. By breaking down the various costs associated with running a business, companies can identify areas where they can reduce costs and improve profitability.

Key Takeaways

- Operating income is a measure of the profit generated by a company’s operations after deducting operating expenses.

- Operating expenses include costs such as salaries, rent, utilities, and depreciation.

- Calculating operating income is important for evaluating a company’s financial performance and identifying areas for improvement.

Understanding Operating Income

Definition of Operating Income

Operating income, also known as earnings before interest and taxes (EBIT), is a financial metric that reflects a company’s profitability from its core operations. It is calculated by subtracting the company’s operating expenses from its gross revenue. Operating income is an important indicator of a company’s financial health and is often used by investors, analysts, and creditors to evaluate its performance.

Components of Operating Income

Operating income is derived from a company’s income statement, which summarizes its revenue and expenses over a specific period. The following components are used to calculate operating income:

- Sales or Revenue: This refers to the total amount of money a company earns from the sale of its products or services. It is the starting point for calculating operating income.

- Expenses: These are the costs incurred by a company in the process of generating revenue. Examples of expenses include salaries and wages, rent, utilities, and marketing expenses.

- Operating Income: This is the difference between a company’s revenue and its operating expenses. It is calculated by subtracting the total operating expenses from the total revenue.

It is important to note that operating income does not include non-operating items such as interest income or expenses, taxes, or gains or losses from the sale of assets. These items are accounted for separately in a company’s income statement.

To learn more about how operating income is calculated and its importance in financial analysis, check out this resource from Investopedia, a trusted source for financial information.

Components of Operating Expenses

Operating expenses refer to the costs incurred by a business in its day-to-day operations. These expenses are subtracted from the revenue to calculate the operating income of a company. The components of operating expenses include direct costs, indirect costs, depreciation, and amortization.

Direct Costs

Direct costs are expenses that can be directly attributed to the production of goods or services. These costs include raw materials, labor, and other expenses incurred in the production process. Direct costs are variable costs, which means they vary with the level of production.

Indirect Costs

Indirect costs, also known as overhead costs, are expenses that cannot be directly attributed to the production of goods or services. These costs include rent, utilities, insurance, office supplies, and other expenses that are necessary for the day-to-day operations of a business. Indirect costs are fixed costs, which means they do not vary with the level of production.

Depreciation and Amortization

Depreciation and amortization are non-cash expenses that represent the decline in the value of assets over time. Depreciation applies to tangible assets such as buildings, equipment, and vehicles, while amortization applies to intangible assets such as patents and trademarks. These expenses are included in the operating expenses because they represent the cost of using these assets in the production process.

To learn more about operating income formula and its components, check out this resource from Investopedia.

Calculating Operating Income

The Operating Income Formula

Operating income is a measure of a company’s profitability and is calculated by subtracting operating expenses from gross profit. The formula for operating income is:

Operating Income = Gross Profit – Operating Expenses

Gross profit is calculated by subtracting the cost of goods sold (COGS) from revenue. Operating expenses include all expenses related to running the business, such as salaries, rent, and utilities.

Example Calculation

Let’s say that a company has a revenue of $1,000,000 and a cost of goods sold of $600,000. This gives a gross profit of $400,000. The company also has operating expenses of $200,000.

Using the operating income formula, we can calculate the operating income as follows:

Operating Income = Gross Profit – Operating Expenses

Operating Income = $400,000 – $200,000

Operating Income = $200,000

Therefore, the company’s operating income is $200,000.

It is important to note that operating income is different from net income, which takes into account all expenses, including taxes and interest. Operating income is a useful metric for evaluating a company’s efficiency in generating profits from its operations.

For more information on calculating operating income, check out this Investopedia article on the topic.

Operating Income vs. Other Profit Metrics

Operating income is a commonly used financial metric that indicates the profitability of a company’s core operations. However, it is often confused with other profit metrics such as net income and EBITDA. In this section, we will compare operating income with these two metrics and highlight their differences.

Operating Income vs. Net Income

Net income is the total amount of profit a company has after accounting for all expenses, including taxes and interest. Operating income, on the other hand, only considers the revenue and expenses directly related to a company’s operations. This means that operating income does not include non-operating income, such as investment income or gains from the sale of assets, while net income does.

While net income provides a comprehensive view of a company’s profitability, it can be influenced by factors outside of its core operations. Operating income, on the other hand, provides a more accurate picture of a company’s financial performance in terms of its core business activities.

Operating Income vs. EBITDA

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. It is a widely used financial metric that measures a company’s profitability without taking into account its capital structure or accounting practices. EBITDA is often used by investors and analysts to compare the financial performance of different companies in the same industry.

Operating income and EBITDA are similar in that they both exclude interest and taxes from their calculations. However, EBITDA also excludes depreciation and amortization, which are important expenses for many companies. Operating income, on the other hand, includes depreciation and amortization in its calculation.

While EBITDA can be a useful metric for comparing companies, it does not provide a complete picture of a company’s financial performance. Operating income, with its inclusion of depreciation and amortization, provides a more accurate view of a company’s profitability.

In conclusion, operating income is a key metric for evaluating a company’s financial performance. While it is often compared to other profit metrics such as net income and EBITDA, it provides a unique perspective that is focused on a company’s core operations. By understanding the differences between these metrics, investors and analysts can make more informed decisions about the companies they are evaluating.

Here is a resource that provides more information on operating income and its importance in financial analysis.

Factors Affecting Operating Income

Operating income is a key metric that businesses use to evaluate their financial health. It is calculated by subtracting operating expenses from gross profit. However, there are several factors that can affect operating income, which businesses must consider when analyzing their financial statements.

Efficiency and Cost Control

Efficiency and cost control are key factors that can affect operating income. By optimizing business operations, reducing waste, and improving productivity, businesses can increase their profitability. This can be achieved by investing in technology, streamlining processes, and reducing labor costs.

Pricing Strategies

Pricing strategies can also have a significant impact on operating income. By setting prices too high, businesses risk losing customers to competitors. Conversely, setting prices too low can lead to reduced profitability. Therefore, businesses must carefully consider their pricing strategies to ensure that they are maximizing their operating income.

External Factors

External factors, such as economic conditions and market trends, can also affect operating income. For example, changes in consumer demand can impact sales revenue, while fluctuations in the cost of goods sold can impact profitability. Therefore, businesses must stay informed about external factors that may impact their operating income and adjust their strategies accordingly.

Overall, businesses must take into account a variety of factors when analyzing their operating income. By optimizing efficiency, implementing effective pricing strategies, and staying informed about external factors, businesses can maximize their profitability and ensure financial success.

Here is a link to a resource with more information on operating income.

Using Operating Income in Business Analysis

Operating income is a crucial metric for businesses to evaluate their profitability and efficiency. It is calculated by subtracting operating expenses from gross income. The resulting figure represents the amount of profit generated by a company’s core business operations. This section explores how operating income can be used in business analysis from an investor perspective and in operational decision making.

Investor Perspective

Investors use operating income as a measure of a company’s profitability and financial health. A company with a high operating income indicates that it is generating significant profits from its core business operations. This is a positive sign for investors as it suggests that the company is efficient and profitable. A low operating income, on the other hand, could indicate that a company is struggling to generate profits from its core business activities.

Investors can also use operating income to compare companies within the same industry. This allows them to evaluate which companies are performing well and which ones are not. By comparing operating income figures, investors can make informed investment decisions.

Operational Decision Making

Operating income can also be used by companies to make operational decisions. By analyzing operating income, companies can identify areas where they are generating significant profits and where they are not. This information can be used to make decisions about where to allocate resources and which areas of the business to focus on.

For example, a company with a high operating income in one area of the business may choose to invest more resources in that area to further increase profitability. Alternatively, a company with a low operating income in a particular area may choose to reduce investment in that area or make changes to improve efficiency.

In conclusion, operating income is a critical metric for businesses to evaluate their profitability and efficiency. It can be used by investors to make informed investment decisions and by companies to make operational decisions. By analyzing operating income, businesses can identify areas of strength and weakness and make informed decisions to improve profitability and efficiency.

For more information on operating income and its significance in business analysis, check out this source from Investopedia.

Reporting and Legal Considerations

GAAP Compliance

When calculating operating income, it is important to ensure compliance with Generally Accepted Accounting Principles (GAAP). GAAP is a set of accounting standards that companies must follow when preparing financial statements. Failure to comply with GAAP can result in legal and financial consequences.

One of the key GAAP requirements is the proper classification of non-recurring items. Non-recurring items are one-time expenses or gains that are not expected to occur again in the future. These items should be separately disclosed in the financial statements and excluded from the calculation of operating income.

Non-Recurring Items and Adjustments

Non-recurring items and accounting adjustments can have a significant impact on the calculation of operating income. It is important to carefully review the financial statements and make appropriate adjustments to ensure accurate reporting.

Legal considerations should also be taken into account when calculating operating income. Tax expense is a major consideration, as it can have a significant impact on a company’s financial performance. Companies must ensure compliance with all applicable tax laws and regulations.

Overall, the operating income formula is an important tool for evaluating a company’s financial performance. However, it is important to carefully consider all reporting and legal considerations to ensure accurate and compliant reporting.

For more information on GAAP compliance, please refer to the Financial Accounting Standards Board (FASB).

Practical Applications and Tools

Excel Templates for Calculation

Excel templates are a useful tool for calculating operating income and margin. These templates can be easily downloaded from the internet and customized to fit the specific needs of a business. The template includes a pre-built formula that automatically calculates the operating income and margin. The user only needs to input the relevant financial data into the template to get the results.

One such template can be found at Vertex42. It includes a comprehensive income statement that calculates the operating income and margin. The template is easy to use and customizable, making it a useful tool for businesses of all sizes.

Software for Income Tracking

There are various software tools available for tracking income and expenses. These tools can be used to calculate operating income and margin. The software can automatically calculate the operating income and margin based on the financial data entered into the system.

One such software is QuickBooks. It is a popular accounting software that can be used to track income and expenses. It includes a feature that automatically calculates the operating income and margin. The software is user-friendly and can be used by businesses of all sizes.

Another useful software is Xero. It is a cloud-based accounting software that can be used to track income and expenses. It includes a feature that automatically calculates the operating income and margin. The software is easy to use and can be accessed from anywhere with an internet connection.

In conclusion, Excel templates and software tools are useful for calculating operating income and margin. They can save time and effort, and provide accurate results. Businesses should consider using these tools to streamline their financial tracking and reporting.

Frequently Asked Questions

How is operating income calculated on an income statement?

Operating income is calculated by subtracting operating expenses from gross profit. The formula for operating income is as follows:

Operating Income = Gross Profit – Operating Expenses

What items are included in the calculation of operating income?

Operating income includes all expenses directly related to the production and sale of goods or services. This includes expenses such as wages, rent, utilities, and depreciation.

How does operating income differ from net income?

Operating income is a measure of a company’s profitability before interest and taxes are taken into account. Net income, on the other hand, takes into account all expenses, including interest and taxes. In other words, net income is the profit a company earns after all expenses have been deducted.

Can you provide an example of how to compute operating income?

Suppose a company has a gross profit of $100,000 and operating expenses of $50,000. To calculate the operating income, you would subtract the operating expenses from the gross profit:

Operating Income = $100,000 – $50,000 = $50,000

How does contribution margin relate to operating income?

Contribution margin is the amount of revenue left over after variable expenses have been deducted. It is calculated by subtracting variable expenses from revenue. Operating income is calculated by subtracting all operating expenses from gross profit. Contribution margin can be used to calculate the breakeven point, while operating income is used to measure a company’s profitability.

Is EBIT the same as operating income?

EBIT (Earnings Before Interest and Taxes) is similar to operating income, but it includes non-operating income and expenses. Operating income only includes expenses directly related to the production and sale of goods or services. EBIT is often used as a measure of a company’s overall profitability, while operating income is used to measure its profitability from its core operations.

For more information on operating income and its importance in financial analysis, please visit Investopedia.

Compare hundreds of Financial Planning Software in our Software Marketplace