How to Start a Bookkeeping Business: A Step-by-Step Guide

How to start a bookkeeping business ? Get trained in bookkeeping, register your business, choose software, market services, and start managing clients’ finances. Starting a

How to start a bookkeeping business ? Get trained in bookkeeping, register your business, choose software, market services, and start managing clients’ finances. Starting a

What are ACH payment vs wire ? ACH payments are low-cost, batch-processed bank transfers. Wires are faster, secure, individual transfers but typically cost more. ACH

What is the difference between gross revenue vs net revenue? Gross revenue is total sales income without deductions. Net revenue subtracts expenses like taxes and

How much does an accountant cost? Accountant costs vary: hourly rates ($150-$400), fixed fees (depends on services), and retainers. Small biz might pay $1k-$5k/month based

How to secure funding via startup business loans with no revenue? Explore grants, pitch to angel investors, join accelerators, and consider crowdfunding to secure startup

What are convertible notes? Convertible notes are short-term debt that converts into equity, usually in the context of a future financing round, offering flexibility to

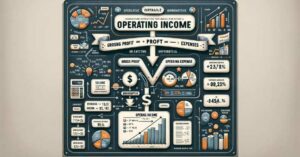

How to calculate and interpret your business’s operating income formula? Calculate Operating Income: Revenue – COGS – Operating Expenses. It shows profitability before interest and

What are the key differences between revenue vs profit? Revenue is total income from sales; profit is what remains after deducting expenses. Revenue and profit

How to calculate operating income? Operating income is calculated by subtracting operating expenses and cost of goods sold (COGS) from total revenue. It reflects the

| Cookie | Duration | Description |

|---|---|---|

| cookielawinfo-checkbox-analytics | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Analytics". |

| cookielawinfo-checkbox-functional | 11 months | The cookie is set by GDPR cookie consent to record the user consent for the cookies in the category "Functional". |

| cookielawinfo-checkbox-necessary | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookies is used to store the user consent for the cookies in the category "Necessary". |

| cookielawinfo-checkbox-others | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Other. |

| cookielawinfo-checkbox-performance | 11 months | This cookie is set by GDPR Cookie Consent plugin. The cookie is used to store the user consent for the cookies in the category "Performance". |

| viewed_cookie_policy | 11 months | The cookie is set by the GDPR Cookie Consent plugin and is used to store whether or not user has consented to the use of cookies. It does not store any personal data. |