What are the key differences between revenue vs profit? Revenue is total income from sales; profit is what remains after deducting expenses.

Revenue and profit are two of the most important concepts in the world of business. While they are often used interchangeably, they are not the same thing. Revenue refers to the total amount of money a company brings in from its sales, while profit is the amount of money a company makes after deducting all of its expenses.

Understanding the difference between revenue and profit is crucial for any business owner. Revenue is important because it represents the total amount of money a company brings in. However, it does not take into account the costs associated with running the business. Profit, on the other hand, is the amount of money a company makes after taking into account all of its expenses. This is the money that can be reinvested in the business or distributed to shareholders.

Exploring the relationship between revenue and profit is also important for understanding the financial health of a business. By analyzing a company’s financial statements, investors can gain insight into its profitability and growth potential. This can help them make informed decisions about whether to invest in the company or not.

Key Takeaways

- Revenue and profit are not the same thing. Revenue refers to the total amount of money a company brings in from its sales, while profit is the amount of money a company makes after deducting all of its expenses.

- Understanding the difference between revenue and profit is crucial for any business owner because profit is the money that can be reinvested in the business or distributed to shareholders.

- Analyzing a company’s financial statements can provide insight into its profitability and growth potential, which can help investors make informed decisions about whether to invest in the company or not.

Understanding Revenue

Revenue is the total amount of money a company earns from its sales of goods or services. It is the top line of a company’s income statement and is a key metric used to evaluate a company’s financial performance. Understanding revenue is crucial for any business owner or investor, as it provides insight into a company’s ability to generate income.

Types of Revenue

There are various types of revenue that a company can generate. The most common types of revenue are product sales, subscriptions, and services. Product sales revenue is generated from the sale of physical or digital goods, while subscription revenue is generated from recurring payments for access to a product or service. Service revenue is generated from providing services to customers.

Factors Influencing Revenue

Several factors can influence a company’s revenue. Market share, demand, pricing, and competition are some of the most significant factors. Market share refers to the percentage of total sales in a particular market that a company has. A higher market share can lead to higher revenue, as more customers are buying from the company.

Demand for a product or service can also impact revenue. If demand is high, revenue is likely to increase. Pricing is another factor that can influence revenue. If a company charges too much for its products or services, customers may choose to buy from competitors, leading to a decrease in revenue.

Finally, competition can impact revenue. If a company faces stiff competition, it may need to lower its prices to remain competitive, leading to a decrease in revenue.

Overall, understanding revenue is essential for any business owner or investor. By analyzing a company’s revenue, one can gain insight into its financial performance and make informed decisions about investing or running the business.

Here is an external resource with more information about revenue and its importance.

Exploring Profit

Profit is the amount of money a company earns after deducting all expenses from its revenue. It is an essential metric for measuring a company’s success and sustainability. There are different types of profit that a company can make, and each one has its own significance. In this section, we will explore the different types of profit and how they are calculated.

Gross Profit

Gross profit is the amount of money a company earns after deducting the cost of goods sold (COGS) from its net sales. COGS includes the cost of raw materials, labor, and manufacturing overhead. Gross profit is an important metric for companies that sell physical products. It shows how much money the company is making from selling its products. A high gross profit margin indicates that the company is efficiently managing its production costs.

Operating Profit

Operating profit is the amount of money a company earns after deducting its operating expenses from its gross profit. Operating expenses include rent, utilities, employee salaries, and other costs associated with running the business. Operating profit shows how much money the company is making from its core operations. It is a good indicator of the company’s profitability and efficiency.

Net Profit

Net profit is the amount of money a company earns after deducting all expenses, including taxes and interest, from its revenue. It is also known as the bottom line. Net profit is the most important metric for measuring a company’s overall profitability. It shows how much money the company is making after all expenses have been accounted for. A high net profit margin indicates that the company is efficiently managing its expenses and generating a healthy return on investment.

In conclusion, profit is a crucial metric for measuring a company’s success and sustainability. Gross profit, operating profit, and net profit are the three main types of profit that a company can make. Each type of profit provides different insights into the company’s financial performance. To learn more about profit and how it is calculated, check out this resource from Investopedia.

Costs and Expenses

When it comes to understanding revenue and profit, it’s important to have a clear understanding of costs and expenses. Costs and expenses are the expenditures a business incurs in order to generate revenue. In this section, we will explore the different types of costs and expenses, and how they impact a business’s bottom line.

Direct vs Indirect Costs

Direct costs are the expenses that are directly related to the production of goods or services. These costs include the cost of raw materials, labor, and any other expenses that are directly tied to the production process. Indirect costs, on the other hand, are expenses that are not directly related to the production process, but are necessary for the business to operate. Examples of indirect costs include rent, utilities, and marketing expenses.

Calculating COGS

Cost of goods sold (COGS) is a direct cost that is directly related to the production of goods. It includes the cost of raw materials, labor, and any other expenses that are directly tied to the production process. Calculating COGS is important because it allows a business to determine the gross profit margin, which is the difference between revenue and COGS. This information is important because it allows a business to determine how much profit it is making on each sale.

Understanding Operating Expenses

Operating expenses are the indirect costs that a business incurs in order to operate. These costs include rent, utilities, marketing, and employee salaries. Operating expenses are important because they impact a business’s net profit margin, which is the difference between revenue and total expenses. It’s important for a business to manage its operating expenses carefully in order to maximize its net profit margin.

In conclusion, understanding costs and expenses is critical for any business looking to maximize its revenue and profit. By carefully managing direct and indirect costs, calculating COGS, and controlling operating expenses, a business can improve its bottom line. For more information on this topic, check out this article on Investopedia.

Financial Statements Analysis

Income Statement Breakdown

The income statement is a financial statement that shows a company’s revenues and expenses over a specific period of time. It is also known as the profit and loss statement. The income statement is an essential tool for investors, as it provides insights into a company’s financial health and profitability.

The income statement is divided into three sections: revenues, expenses, and net income. Revenues are the income generated by a company from its core operations, while expenses are costs incurred in generating that revenue. The net income is the difference between revenues and expenses.

One of the most critical metrics to analyze in the income statement is gross profit. Gross profit is calculated by subtracting the cost of goods sold from revenue. It represents the profit a company makes from its core operations before deducting operating expenses.

Balance Sheet Insights

The balance sheet is a financial statement that shows a company’s assets, liabilities, and equity at a specific point in time. It provides insights into a company’s financial health and liquidity.

Assets are resources owned by a company that have economic value and are expected to provide future benefits. Liabilities are obligations that a company owes to others, such as loans or accounts payable. Equity represents the residual value of a company’s assets after deducting liabilities.

One important metric to analyze in the balance sheet is the debt-to-equity ratio. This ratio measures the amount of debt a company has compared to its equity. A high debt-to-equity ratio indicates that a company may be at risk of defaulting on its debt obligations.

Cash Flow Statement

The cash flow statement is a financial statement that shows a company’s cash inflows and outflows over a specific period of time. It provides insights into a company’s liquidity and ability to generate cash.

The cash flow statement is divided into three sections: operating activities, investment activities, and financing activities. Operating activities include cash inflows and outflows from a company’s core operations. Investment activities include cash inflows and outflows from buying or selling long-term assets. Financing activities include cash inflows and outflows from issuing or repaying debt or equity.

One important metric to analyze in the cash flow statement is free cash flow. Free cash flow represents the cash a company generates after deducting capital expenditures. It is an essential metric for investors, as it indicates a company’s ability to generate cash that can be used for dividends, share buybacks, or reinvestment in the business.

To learn more about financial statements analysis, you can visit Investopedia’s guide, which provides a comprehensive overview of the topic.

Profitability and Growth

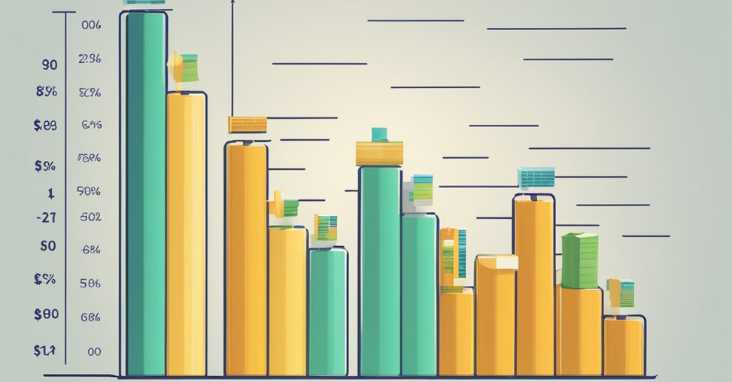

Profit Margin Analysis

Profit margin is a key metric in determining the financial health of a business. It is calculated by dividing net profit by revenue. A high profit margin indicates that a company is able to generate more profit from each dollar of revenue. This is important for startups that need to demonstrate ROI to investors.

To improve profit margins, companies can focus on reducing costs and increasing prices. However, it is important to balance these strategies with maintaining market share and product sales. It is also important to consider the impact of revenue growth on profit margins. Rapid revenue growth can lead to lower profit margins in the short term, but can also lead to increased market share and long-term profitability.

Revenue Growth Strategies

Revenue growth is an important factor in the success of a business. There are several strategies that companies can use to increase revenue, including expanding into new markets, increasing sales to existing customers, and introducing new products.

Expanding into new markets can help companies increase their market share and reach new customers. This can be done through partnerships, acquisitions, or opening new locations. Increasing sales to existing customers can be achieved through targeted marketing and sales campaigns, as well as improving customer service and support.

Introducing new products can also help companies increase revenue. This can be done through research and development, as well as strategic partnerships and acquisitions. However, it is important to ensure that new products align with the company’s overall strategy and brand.

Overall, companies must balance revenue growth with maintaining profitability and financial health. By focusing on profit margin analysis and implementing effective revenue growth strategies, companies can achieve long-term success and growth.

To learn more about profit margin analysis and revenue growth strategies, check out this article on Investopedia.

Frequently Asked Questions

What distinguishes gross profit from net profit?

Gross profit is the revenue minus the cost of goods sold, while net profit is the revenue minus all expenses, including taxes and interest. Gross profit only takes into account the cost of producing goods, while net profit gives a more comprehensive picture of a company’s profitability.

How is profit calculated from revenue?

Profit is calculated by subtracting the total expenses from revenue. The formula for profit is: Profit = Revenue – Total Expenses. This calculation gives a company an idea of how much money it is making after all expenses have been paid.

Can you provide an example that illustrates the difference between revenue and profit?

For example, a company might have revenue of $1,000,000, but after paying all expenses, including salaries, rent, and taxes, it might only have a profit of $100,000. This means that the company is generating a lot of revenue, but its expenses are high, which is reducing its profit margin.

In financial terms, how does turnover differ from revenue?

Turnover and revenue are often used interchangeably, but they have different meanings. Turnover refers to the total amount of goods or services that a company sells, while revenue refers to the money that a company earns from selling those goods or services. Turnover is a measure of the volume of sales, while revenue is a measure of the value of those sales.

What is the relationship between sales and revenue?

Sales and revenue are closely related, but they are not the same thing. Sales refer to the total amount of goods or services that a company sells, while revenue refers to the money that a company earns from selling those goods or services. Sales are a measure of the volume of sales, while revenue is a measure of the value of those sales.

Are earnings and profit considered the same in accounting?

Earnings and profit are not the same thing in accounting. Earnings refer to the total amount of money that a company earns from its operations, while profit refers to the money that a company earns after all expenses have been paid. Earnings can include revenue from non-operational sources, such as investments, while profit only takes into account the money earned from the company’s core operations.

For more information on revenue vs profit, please visit Investopedia’s article on the topic.

Compare hundreds of Financial Reporting Software in our Software Marketplace