How to write a receipt ? List date, transaction details, amounts, and parties involved. Sign to validate. Use templates for consistency and clarity.

Asking how to write a receipt may seem like a simple task, but it can be more complicated than many people realize. Whether you’re a business owner or an individual providing a service, creating a clear and accurate receipt is essential for keeping track of financial transactions. In this article, we’ll explore the key elements of a receipt and provide tips for creating and managing them effectively to learn how to write a receipt.

Understanding Receipts

Before diving into the specifics of how to write a receipt, it’s important to understand their purpose. A receipt is a written record of a financial transaction between two parties. It serves as proof of payment and can be used for tax purposes, expense tracking, and to resolve disputes or discrepancies. Different types of receipts may be required for different purposes, so it’s important to know what information should be included on each one before searching how to write a receipt.

Essential Elements of a Receipt

While the exact format of a receipt may vary depending on the type of transaction and the parties involved, there are several essential elements that should be included on every receipt. These include the date and time of the transaction, the names and contact information of both parties, a description of the goods or services provided, the total amount paid, and any applicable taxes or fees. It’s also important to clearly indicate the method of payment, such as cash, check, or credit card. By including these key elements, you can ensure that your receipts are accurate, complete, and legally compliant.

Key Takeaways

- Receipts serve as proof of payment and can be used for tax purposes, expense tracking, and dispute resolution.

- Essential elements of a receipt include the date and time of the transaction, names and contact information of both parties, description of goods or services provided, total amount paid, and method of payment.

- Creating clear and accurate receipts is essential for effective financial management.

Understanding Receipts

Definition and Purpose of Receipts

A receipt is a written or electronic document that serves as proof of a transaction. It is a crucial document that provides evidence of a purchase, sale, rent, or services rendered. The primary purpose of a receipt is to provide proof of payment and to help keep track of financial transactions.

Receipts contain important information such as the date of the transaction, the amount paid, the name of the seller or service provider, and the method of payment used. They are also used for accounting and tax purposes, as they provide a record of all financial transactions that have taken place.

Types of Receipts

There are different types of receipts, and they vary depending on the transaction being made. The most common types of receipts include:

Sales Receipts: These are receipts issued by sellers to buyers as proof of payment for goods or services purchased. They typically include details such as the name of the seller, the date of the transaction, the amount paid, and a description of the goods or services purchased.

Rent Receipts: These are receipts issued by landlords to tenants as proof of payment for rent. They typically include details such as the name of the landlord, the date of the transaction, the amount paid, and the period for which the rent is being paid.

Service Receipts: These are receipts issued by service providers to clients as proof of payment for services rendered. They typically include details such as the name of the service provider, the date of the transaction, the amount paid, and a description of the services rendered.

It is important to note that receipts should be kept in a safe place, as they can be used as proof of purchase or payment in case of disputes or refunds.

To learn more about the different types of receipts, their importance and how to write a receipt, check out this resource from Investopedia.

Essential Elements of a Receipt

When it comes to asking how to write a receipt, there are certain essential elements that must be included to ensure that it is accurate, complete, and legally compliant. These elements include the date and time of the transaction, business and customer information, transaction details, payment information, and the total amount and breakdown.

Date and Time

The date and time of the transaction should be clearly stated on the receipt. This information is important for record-keeping purposes and can also help resolve any disputes that may arise later. It is recommended to use a standard format for the date and time, such as “MM/DD/YYYY” and “HH AM/PM.”

Business and Customer Information

The receipt should include the name and contact information of the business, as well as the name of the customer. If the customer is a regular or repeat customer, their information can be saved for future transactions. It is also important to include any relevant identification numbers, such as a customer or order number.

Transaction Details

The transaction details section should include a list of the items or services purchased, along with their prices and quantities. This information should be clearly organized and easy to read, with subtotals for each item and a total for all items combined. If applicable, any discounts or taxes should also be included in this section.

Payment Information

The payment information section should include the type of payment used, such as cash, credit card, or check. If a credit card was used, the last four digits of the card number should be included. It is also important to include the authorization code and any other relevant information related to the payment.

Total Amount and Breakdown

The total amount and breakdown section should clearly state the total amount due, as well as the breakdown of how that total was calculated. This should include the subtotal, any taxes or fees, and any discounts or promotions that were applied. It is also important to include the amount paid and the grand total.

To learn more about how to write a receipt, check out this helpful guide from the National Federation of Independent Business: How to Write a Receipt.

Creating a Receipt

When it comes to how to write a receipt and creating one, there are several ways to go about it. The method you choose will depend on your preference and the tools you have at your disposal. Here are three popular ways to create a receipt:

Choosing the Right Template

One of the easiest ways to create a professional-looking receipt is to use a pre-made template. There are many receipt templates available online, and most of them are free to download. These templates come in a variety of formats, including Microsoft Word, Google Sheets, and PDF. Simply choose the template that best suits your needs and fill in the necessary information. This method is quick, easy, and requires no design skills.

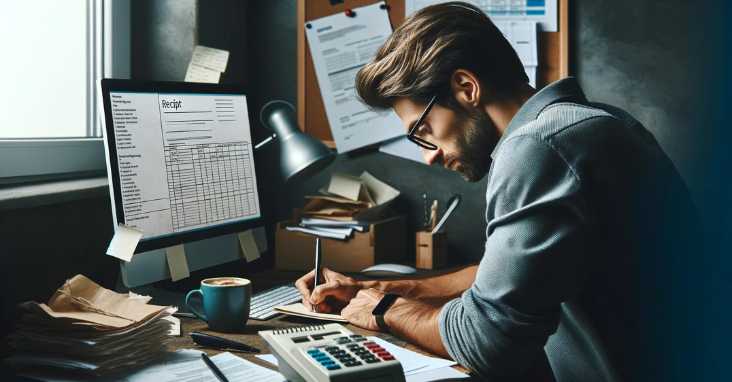

Filling Out a Receipt Manually

If you prefer a more hands-on approach, you can create a receipt manually. This method requires a bit more effort, but it allows you to customize the receipt to your liking. How to write a receipt manually ? Start by designing a basic layout on paper. Then, transfer the design to a digital format using a program like Microsoft Word or Google Docs. Finally, fill in the necessary information, such as the date, time, and items purchased.

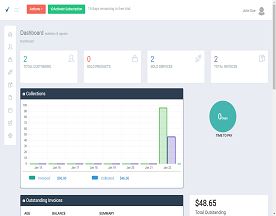

Using Digital Tools and Software

For those who prefer a more tech-savvy approach, there are several digital tools and software available for creating receipts. How to write a receipt with digital tools ? Many mobile apps offer the ability to create digital receipts that can be sent directly to a customer’s email. Additionally, there are software programs specifically designed for creating receipts, such as QuickBooks and FreshBooks. These programs allow you to create professional-looking receipts quickly and easily.

Regardless of the method you choose, creating a receipt is an essential part of any transaction. By providing a receipt to your customers, you are not only fulfilling a legal requirement, but you are also establishing trust and credibility with them. For more information on how to create a receipt, check out this helpful guide.

Legal Considerations and Compliance

When it comes to asking how to write a receipt, there are certain legal considerations and compliance requirements that must be met. This section will discuss some of the most important things to keep in mind to ensure that your receipt is legally compliant.

Tax Implications

One of the most important considerations when writing a receipt is the tax implications. It is important to ensure that your receipt includes all of the necessary information for tax purposes, such as the date of the transaction, the amount paid, and any applicable taxes. This information will be used to calculate taxes owed and may be required for tax returns.

Record Keeping Requirements

Another important consideration is record keeping requirements. It is important to keep accurate records of all transactions, including receipts. This information may be required by the IRS or other legal entities in the event of an audit or other legal proceeding. It is important to keep these records for a minimum of three years, although some states may require longer.

To ensure compliance with record keeping requirements, it is recommended that you keep digital copies of all receipts and other important documents. This will make it easier to access and organize this information, as well as ensure that it is not lost or damaged.

For more information on record keeping requirements and how to write a receipt, you can visit the IRS website or consult with a tax professional.

Overall, it is important to ensure that your receipts are legally compliant and meet all necessary requirements. By following these guidelines and keeping accurate records, you can ensure that your business is in compliance with all relevant laws and regulations.

Best Practices for Receipt Management

Organizing and Storing Receipts

Organizing and storing receipts is an essential task for any business, as it helps keep records of expenses and income. There are several best practices for organizing and storing receipts that businesses can follow to ensure that they are easily accessible and retrievable when needed.

One of the best practices is to categorize receipts based on their purpose or type. For example, a business can categorize receipts based on expenses such as rent, utilities, and office supplies. This categorization can be done using a spreadsheet or accounting software. Additionally, it is recommended to store receipts in a secure and easily accessible location. A filing cabinet or cloud-based storage system can be used to store receipts.

Another best practice is to label receipts with relevant information such as the date, purpose, and amount. This labeling helps to ensure that receipts are easily identifiable and retrievable when needed. It is also recommended to keep digital copies of receipts, as they can be easily searched and retrieved.

Preventing and Resolving Disputes

Receipts can be used as evidence in case of disputes such as audits, tax assessments, or legal proceedings. Therefore, it is important to ensure that receipts are accurate and complete. One way to prevent disputes is to ensure that receipts are legible and contain all necessary information such as the date, purpose, and amount.

If a dispute arises, businesses should have a process in place to resolve it. This process may involve providing additional documentation or information to support the accuracy of the receipt. It is also recommended to keep a record of all receipts and related documentation in case of future disputes.

In conclusion, organizing and storing receipts and preventing and resolving disputes are essential aspects of receipt management. By following best practices, businesses can ensure that they have accurate and complete records of expenses and income, which can be used for business decisions, accounting, and documentation purposes. For more information on receipt management and how to write a receipt, visit this link to the IRS website.

Advanced Receipt Handling

Itemized Receipts and Detailed Records

How to write a receipt via the itemized and detailed avenues ? Itemized receipts are a great way to provide detailed records of transactions to customers. By including a breakdown of each item purchased, customers can easily see what they paid for and how much each item cost. This can be especially useful for bookkeeping purposes, as it allows for more accurate record-keeping and easier tracking of expenses.

When creating itemized receipts, it’s important to include all relevant information, such as the date of the transaction, the name and address of the business, and a description of each item purchased. Additionally, it’s a good idea to include any applicable taxes or discounts, as well as the total amount paid.

Integrating with Accounting Systems

Integrating your receipt system with your accounting system can save you time and reduce errors. By automating the process of entering data into your accounting system, you can reduce the risk of mistakes and free up time to focus on other tasks.

There are many accounting systems available, such as QuickBooks and Xero, that can be integrated with your point of sale system or receipt generator. This allows for seamless transfer of data between systems, and can help ensure that your financial records are accurate and up-to-date.

Automating Receipt Generation

Automating the process of receipt generation can save you time and reduce errors. By using a system that automatically generates receipts, you can ensure that all necessary information is included and that receipts are consistent across all transactions.

How to write a receipt via generators ? There are many receipt generators available, such as Square and PayPal, that can be easily integrated with your point of sale system or website. These systems can also provide additional features, such as the ability to send receipts via email or text message.

By implementing these advanced receipt handling techniques, businesses can improve their record-keeping, reduce errors, and save time. For more information on receipt handling and how to write a receipt, check out this link to a high authority resource on receipt handling.

Frequently Asked Questions

What information must be included on a payment receipt?

A payment receipt should include the date of the transaction, the name of the person or business receiving the payment, the amount paid, the purpose of the payment, and the method of payment. It is also important to include a unique receipt number for record-keeping purposes.

What is the correct format for a receipt of payment?

The format of a payment receipt can vary depending on the needs of the business or individual. However, it is important to ensure that the receipt is easy to read and includes all necessary information. Many receipts include a header with the name and contact information of the business or individual, followed by a table or list of the transaction details.

How can I create a receipt template for future transactions?

Creating a receipt template can save time and ensure consistency in your record-keeping. Many word processing programs offer templates for receipts, or you can create your own by designing a table or list that includes all necessary information. It is important to ensure that your template includes space for a unique receipt number and any other information specific to your needs.

How to write a receipt by hand?

How to write a receipt by hand? Start by including the date of the transaction and the name of the person or business receiving the payment. Next, write out the amount paid and the purpose of the payment. Finally, include the method of payment and a unique receipt number. It is important to write legibly and clearly to ensure that the receipt can be easily read and understood.

How do I properly document a cash transaction with a receipt?

When documenting a cash transaction with a receipt, it is important to include all necessary information, including the date of the transaction, the name of the person or business receiving the payment, the amount paid, and the purpose of the payment. It is also important to include a unique receipt number for record-keeping purposes. Additionally, it is a good practice to have both parties sign the receipt to acknowledge the transaction.

What are the best practices for writing a receipt for services rendered?

When writing a receipt for services rendered, it is important to include the date of the transaction, the name of the person or business receiving the payment, the amount paid, and a description of the services provided. It is also important to include any relevant details, such as the duration of the service or any materials used. Finally, include a unique receipt number for record-keeping purposes.

For more information on how to write a receipt, visit The Balance Small Business.