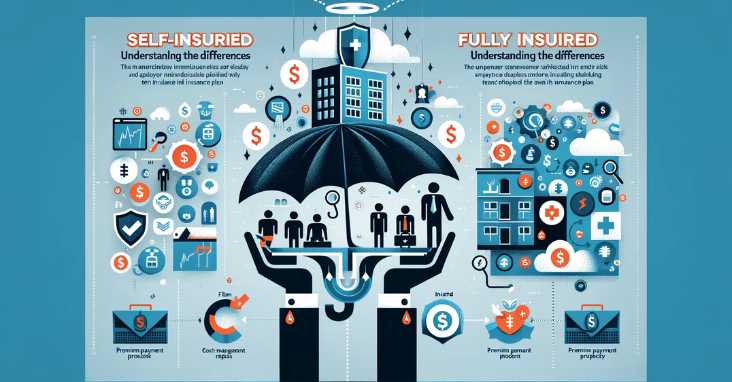

What is the difference between self-insured vs fully insured? Self insured plans involve employers paying direct healthcare costs, offering more control but higher risk. Fully insured plans transfer risk and management to an insurer, with fixed premiums but less flexibility.

When it comes to providing healthcare benefits to employees, businesses have two main options: self insured and fully insured plans. While both options offer coverage for employees, they differ in terms of financial implications, administrative responsibilities, and risk management. Understanding the differences between these types of plans is crucial for businesses looking to provide the best healthcare coverage for their employees while also managing costs.

Self insured plans, also known as self-funded plans, are plans in which the employer takes on the financial risk of providing healthcare benefits to employees. This means that the employer is responsible for paying all healthcare claims, rather than paying a premium to an insurance company. Fully insured plans, on the other hand, are plans in which the employer pays a premium to an insurance company, which then assumes the financial risk of providing healthcare benefits to employees. In this case, the insurance company is responsible for paying all healthcare claims.

Understanding the differences between self insured and fully insured plans is important for businesses looking to provide healthcare benefits to their employees. While self insured plans offer more flexibility and potential cost savings, they also come with more administrative responsibilities and financial risk. Fully insured plans offer less risk and administrative responsibilities, but may come at a higher cost. Ultimately, the decision between self insured and fully insured plans will depend on the unique needs and financial situation of each business.

Key Takeaways

- Self insured plans require the employer to assume the financial risk of providing healthcare benefits to employees, while fully insured plans transfer that risk to an insurance company.

- Self-insured plans offer more flexibility and potential cost savings, but also come with more administrative responsibilities and financial risk.

- The decision between self-insured and fully insured plans will depend on the unique needs and financial situation of each business.

Understanding Self-Insured vs Fully Insured Models

When it comes to health insurance, there are two main models: self-insured and fully-insured. Both models have their own benefits and drawbacks, and it is important to understand the differences between them in order to make an informed decision.

Definition of Self-Insured Plans

A self-insured plan is one in which the employer takes on the financial risk of providing health insurance for their employees. Instead of paying premiums to an insurance company, the employer sets aside money to pay for their employees’ medical expenses. This means that the employer has more control over the plan design and can customize it to fit the needs of their employees.

One of the main benefits of a self-insured plan is that it can be more cost-effective than a fully-insured plan. This is because the employer only pays for the medical expenses that their employees incur, rather than paying a fixed premium to an insurance company. Additionally, self-insured plans are not subject to state insurance regulations, which can result in lower costs for employers.

However, self-insured plans also come with some risks. If an employee has a serious medical condition, the employer may end up paying a large amount of money to cover their medical expenses. Additionally, self-insured plans require a significant amount of administrative work, as the employer is responsible for managing the plan and paying claims.

Definition of Fully-Insured Plans

A fully-insured plan is one in which the employer pays a fixed premium to an insurance company in exchange for coverage for their employees. The insurance company is responsible for paying the medical expenses of the employees.

One of the main benefits of a fully-insured plan is that the employer has less financial risk. The insurance company is responsible for paying the medical expenses of the employees, regardless of the amount. Additionally, fully-insured plans are typically easier to administer, as the insurance company handles most of the administrative work.

However, fully-insured plans can be more expensive than self-insured plans. This is because the employer is paying a fixed premium, regardless of the medical expenses incurred by their employees. Additionally, fully-insured plans are subject to state insurance regulations, which can result in higher costs for employers.

In conclusion, both self-insured and fully-insured plans have their own benefits and drawbacks. Employers should carefully consider their options and choose the plan that best fits the needs of their employees and their budget. For more information on self-insured and fully-insured plans, check out this resource.

Financial Implications

Self-insurance and fully-insured plans have different financial implications for businesses. This section will explore the financial considerations that businesses should take into account when deciding between self-insurance and fully-insured plans.

Premiums and Cash Flow

One of the most significant financial implications of self-insurance versus fully-insured plans is the difference in premiums and cash flow. With a fully-insured plan, the business pays a fixed premium to the insurance company, regardless of the actual cost of healthcare for its employees. In contrast, with self-insurance, the business pays for the actual cost of healthcare for its employees, which can result in lower premiums.

However, self-insurance can also result in cash flow challenges for businesses. Since the business is responsible for paying for the actual cost of healthcare, it may experience significant fluctuations in healthcare costs from year to year. To manage this risk, businesses can purchase stop-loss insurance, which limits the amount of money the business is responsible for paying.

Savings and Financial Risk

Another financial implication of self-insurance versus fully-insured plans is the potential for savings and financial risk. Self-insurance can result in significant savings for businesses, particularly if they have a healthy employee population. Since the business is responsible for paying for the actual cost of healthcare, it has an incentive to keep healthcare costs low.

However, self-insurance also exposes businesses to financial risk. If healthcare costs are higher than expected, the business may be responsible for paying more than it would with a fully-insured plan. To manage this risk, businesses can purchase stop-loss insurance, which limits the amount of money the business is responsible for paying.

Overall, businesses should carefully consider the financial implications of self-insurance versus fully-insured plans before making a decision. By weighing the costs and benefits of each option, businesses can make an informed decision that meets their financial needs.

Here is a resource that provides more information on self-insured plans.

Benefits and Coverage Details

Plan Design and Flexibility

Self-insured plans offer more flexibility in plan design compared to fully insured plans. Employers can tailor their self-insured plans to meet the specific needs of their employees, while fully insured plans have more standardized plan designs. Self-insured plans allow employers to choose the services and benefits they want to offer, which can be more cost-effective in the long run.

On the other hand, fully insured plans offer a more hands-off approach to plan design. Insurance companies offer pre-packaged plans with set benefits and services, which can be less time-consuming for employers to manage. However, this can also lead to less flexibility in coverage options.

Coverage and Dependents

Both self-insured and fully insured plans offer coverage for essential health benefits, including hospitalization, prescription drugs, and preventive care. However, self-insured plans may offer more comprehensive coverage options, such as alternative medicine and mental health services.

Employers can also choose to include coverage for dependents in their self-insured plans. This can be beneficial for employees who have family members who require medical care. Fully insured plans also offer coverage for dependents, but the cost of this coverage may be higher compared to self-insured plans.

It is important for employers to carefully consider the benefits and coverage options when deciding between self-insured and fully insured plans. Employers should consult with their insurance broker or benefits consultant to determine which plan type is most suitable for their organization.

For more information on the differences between self-insured and fully insured plans, visit healthcare.gov for a comprehensive guide.

Administrative Responsibilities

When it comes to self-insured vs fully-insured plans, one of the biggest differences is the administrative responsibilities. In a fully-insured plan, the insurance company takes on most of the administrative tasks, while in a self-insured plan, the employer is responsible for many of these tasks.

Third-Party Administrators

Employers who choose a self-insured plan often hire a third-party administrator (TPA) to handle the day-to-day administrative tasks. A TPA can handle tasks such as claims processing, network management, and provider contracting. This can help relieve the employer of many administrative burdens, but it also means that the employer must choose a reputable TPA and oversee their work.

Compliance and Regulation

Both self-insured and fully-insured plans are subject to compliance and regulation. However, self-insured plans are subject to additional regulations under ERISA (Employee Retirement Income Security Act). This means that employers who choose a self-insured plan must ensure that they are in compliance with all ERISA regulations, which can be complex and time-consuming.

Employers who choose a fully-insured plan may have fewer regulatory responsibilities, but they still need to ensure that they are in compliance with all applicable regulations. This includes regulations related to the Affordable Care Act (ACA), as well as state-specific regulations.

Overall, the administrative responsibilities of self-insured vs fully-insured plans can vary significantly. Employers who are considering self-insurance should carefully consider the administrative tasks involved and whether they have the resources to handle them. It may be beneficial to work with a reputable TPA to help manage these tasks and ensure compliance with all regulations.

Here is a helpful resource on ERISA regulations for self-insured plans.

Risk Management

When it comes to self-insured and fully insured plans, risk management is a crucial factor to consider. Self-insured plans require a company to take on a greater level of risk as they are responsible for paying medical claims out of pocket. On the other hand, fully insured plans transfer the risk to the insurance carrier who is responsible for paying all claims.

Stop-Loss Coverage

One way self-insured plans manage risk is by purchasing stop-loss coverage. Stop-loss coverage protects the company from catastrophic losses by limiting the amount they are responsible for paying out of pocket. In other words, stop-loss coverage provides a safety net for self-insured plans.

Claims Payment and Management

Claims payment and management is another important aspect of risk management for both self-insured and fully insured plans. With self-insured plans, the company is responsible for managing and paying claims. This requires a strong claims management system to ensure timely and accurate payment of claims. On the other hand, fully insured plans rely on the insurance carrier to manage and pay claims.

Overall, risk management is a critical factor to consider when deciding between self-insured and fully insured plans. Companies must carefully evaluate their risk tolerance, claims management capabilities, and financial resources before making a decision.

For more information on risk management in self-funded insurance, check out this resource from the International Foundation of Employee Benefit Plans: Risk Management for Self-Funded Health Plans.

Cost Analysis

Self-insured and fully-insured plans differ in terms of costs. A cost analysis can help employers decide which option is best for their company.

Potential for Cost Savings

One of the primary reasons employers choose self-insured plans is the potential for cost savings. Self-insured plans allow employers to pay for medical claims as they arise, instead of paying a fixed premium to an insurance company. This means that employers only pay for the actual medical costs incurred by their employees, rather than paying a fixed premium that may be higher than the actual costs.

According to a study by the Employee Benefit Research Institute, self-insured plans can save employers up to 12% in costs compared to fully-insured plans. However, it is important to note that self-insured plans also carry more financial risk for the employer if there are unexpected or high medical claims.

Fixed vs Variable Costs

Fully-insured plans have fixed premiums that employers pay to the insurance company. These premiums cover the cost of medical claims, administrative fees, and profit for the insurance company. This means that employers have a predictable, fixed cost for their employee health benefits.

On the other hand, self-insured plans have variable costs that depend on the number and cost of medical claims. Employers must set aside funds to cover these costs, which can fluctuate from year to year. However, self-insured plans offer more flexibility in plan design and can potentially save employers money in the long run.

It is important for employers to consider their financial situation and risk tolerance when deciding between self-insured and fully-insured plans. Consulting with a benefits advisor can help employers make an informed decision.

To learn more about the cost differences between self-insured and fully-insured plans, check out this resource from the Society for Human Resource Management.

Regulatory Considerations

Self-insured and fully-insured plans are subject to different regulatory considerations. It is important for employers to understand the regulatory landscape and how it affects their choice of plan.

ERISA and Federal Laws

The Employee Retirement Income Security Act (ERISA) is a federal law that sets minimum standards for most voluntarily established pension and health plans in private industry. ERISA does not require employers to offer health insurance, but it does regulate the operation of employer-sponsored health plans. Self-insured plans are subject to ERISA regulations, while fully-insured plans are not.

In addition to ERISA, self-insured plans must comply with other federal laws, such as the Affordable Care Act (ACA) and the Health Insurance Portability and Accountability Act (HIPAA). These laws impose requirements on plan design, reporting, and disclosure.

State Regulations and Taxes

States also regulate health insurance, and the regulatory environment can vary widely from state to state. Self-insured plans are generally exempt from state insurance regulations, but they may still be subject to state taxes and fees.

For example, some states impose a premium tax on self-insured plans. This tax is calculated as a percentage of the plan’s total premium, and it is usually paid by the employer. In addition, some states require self-insured plans to pay into a state-run reinsurance pool, which helps to cover high-cost claims.

Fully-insured plans, on the other hand, are subject to state insurance regulations and taxes. These regulations can affect plan design, network adequacy, and consumer protections.

Employers should consult with legal and tax advisors to understand the regulatory and tax implications of self-insured and fully-insured plans in their state. The National Association of Insurance Commissioners provides a directory of state insurance departments, which can be a helpful resource for employers.

Here is a link to the directory of state insurance departments provided by the National Association of Insurance Commissioners.

Advantages and Challenges

Self-insured and fully-insured plans each have their own set of advantages and challenges. Understanding these differences is crucial in selecting the best plan for an organization’s needs.

Control and Customization

One of the most significant advantages of self-insured plans is the level of control and customization they offer. Companies that self-insure can tailor their plans to fit their specific needs, including coverage options, cost-sharing arrangements, and wellness programs. This level of customization allows employers to design a plan that aligns with their company culture and values.

Fully-insured plans, on the other hand, offer less control and customization. Insurance carriers typically offer a set of pre-designed plans with limited flexibility. While some customization is available, it is often at an additional cost.

Predictability and Stability

One of the primary advantages of fully-insured plans is predictability and stability in costs. Insurance carriers assume the risk of large claims, providing employers with a fixed premium cost each month. This predictability allows companies to budget accordingly and avoid unexpected expenses.

Self-insured plans, on the other hand, are subject to fluctuations in claims and other costs. While stop-loss insurance can help mitigate risk, the potential for unexpected expenses remains. However, self-insured plans can also result in cost savings in years with low claims.

Overall, both self-insured and fully-insured plans have their own set of advantages and challenges. Employers must weigh the benefits and drawbacks of each option to determine the best fit for their organization. For more information on the differences between self-insured and fully-insured plans, visit this resource.

Choosing the Right Plan for Your Business

When it comes to selecting a healthcare plan for your business, there are two primary options to choose from: self-insured and fully insured. Both options come with their own set of advantages and disadvantages, and it’s important to assess your business needs and evaluate your employee needs to determine which plan is right for you.

Assessing Business Needs

Before making a decision, it’s important to consider your unique business needs. Self-insured plans can offer more flexibility and control over insurance coverage, which can be particularly beneficial for employers with group health plans. Small businesses, in particular, may find self-insured plans to be a cost-effective option.

Fully insured plans, on the other hand, may be a better fit for businesses that prefer a more predictable and stable premium cost. This can be especially important for companies with limited financial resources or those that are just starting out.

Evaluating Employee Needs

When evaluating employee needs, it’s important to consider the level of insurance coverage required. Self-insured plans can offer more comprehensive coverage options, but they may also come with higher out-of-pocket costs for employees. Fully insured plans may offer more limited coverage options, but they can be more affordable for employees in terms of out-of-pocket costs.

Ultimately, the decision between self-insured and fully insured plans will depend on a variety of factors, including your business size, financial resources, and employee needs. It’s important to carefully evaluate these factors and consult with a healthcare insurance professional to make an informed decision.

For more information on choosing the right healthcare plan for your business, check out this resource from the National Association of Health Underwriters.

Frequently Asked Questions

What are the advantages and disadvantages of self-insured versus fully insured plans?

Self-insured plans allow employers to have more control over their healthcare costs and tailor their plans to the specific needs of their employees. However, they also come with greater financial risk and administrative responsibilities. Fully insured plans provide more predictable costs and less administrative burden, but they often come with less flexibility and higher premiums.

How does health insurance differ when comparing self-insured and fully insured options?

Self-insured health insurance plans are exempt from state insurance regulations, which can lead to cost savings for employers. However, they also require employers to assume more financial risk and administrative responsibilities. Fully insured plans are subject to state insurance regulations and offer less flexibility, but they provide more predictable costs and less administrative burden.

In what ways do self-insured and fully insured workers’ compensation plans vary?

Self-insured workers’ compensation plans allow employers to assume the financial risk of workplace injuries and illnesses, which can lead to cost savings. However, they also require employers to have the financial resources to cover claims and assume administrative responsibilities. Fully insured workers’ compensation plans transfer the financial risk and administrative burden to an insurance company, but they often come with higher premiums.

What implications does being self-insured have for auto insurance compared to fully insured coverage?

Self-insured auto insurance plans are typically only available to large corporations or government entities. They allow employers to assume the financial risk of auto accidents involving their employees, which can lead to cost savings. However, they also require employers to have the financial resources to cover claims and assume administrative responsibilities. Fully insured auto insurance plans transfer the financial risk and administrative burden to an insurance company, but they often come with higher premiums.

How do Administrative Services Only (ASO) contracts relate to fully insured plans?

ASO contracts allow employers to outsource the administrative responsibilities of their self-insured plans to a third-party administrator. This can provide cost savings and reduce administrative burden for employers. However, ASO contracts are only available to self-insured plans and do not transfer the financial risk to an insurance company like fully insured plans do.

What are the characteristics of a fully-funded insurance plan?

Fully-funded insurance plans are a type of fully insured plan where the insurance company assumes the financial risk and administrative responsibilities. Premiums are paid to the insurance company, which then pays for claims and administrative costs. These plans are subject to state insurance regulations and offer less flexibility, but they provide more predictable costs and less administrative burden for employers.

For more information on self-insured versus fully insured plans, visit the U.S. Department of Labor website.