It is important for every nonprofit organization to find the right accounting solution to meet their needs.

Accounting software provides organizations with a variety of tools that they can use to record and manage their finances on a day-to-day basis.

The best nonprofit accounting software should provide basic accounting functions. Some of the most important accounting features include budget management, income and expense tracking, accounts payable, accounts receivable, and revenue management.

The right fund accounting software for nonprofits can help organizations save a tremendous amount of time and money while increasing financial transparency.

With nonprofits around the world innovating and digitizing to improve efficiency and reach new audiences, why are these software programs so important?

Why Is Nonprofit Accounting Software Important?

According to the Future Charity Report, 57% of charity employees think a lack of new technology is hindering the sector’s development.

Nonprofit accounting software is important because it can save the organization a lot of time.

The right accounting software for nonprofits should come with automation features that can reduce clerical work. That way, this software program can reduce the number of mistakes that are made.

Financial statements from the program can also increase transparency. For example, nonprofits can track donations, identify discrepancies in their financial records, and address issues before they spiral out of control.

Therefore, nonprofit bookkeeping software should be an essential tool for all nonprofit companies.

Characteristics of Accounting Software for Non-Profits

There are several characteristics of accounting software programs that managers should consider. Some of the most important accounting tasks include:

Compliance With Non-Profit Accounting Standards

Nonprofit companies are held to different accounting standards, and all organizations need to make sure they are in compliance with those standards.

Cloud based software could even come with donor management tools and inventory management features that make it easier for nonprofits to track their revenue and expenses on a daily basis.

Robust Reporting And Data Analysis Capabilities

Many accounting programs also include numerous reporting capabilities.

These capabilities make it easier for nonprofits to generate accounting reports, which can be used for data analytics. That way, nonprofit organizations can more rapidly respond to changes in the nonprofit landscape.

Integration With Fundraising And Donation Management Systems

The right nonprofit accounting software should also integrate with numerous donation management systems, which makes it easier to handle income and expense allocation.

Board members can also find accounting software for nonprofits that integrate with third party apps and bank accounts, streamlining enterprise resource planning.

Budgeting And Financial Forecasting Tools

Finally, accounting programs should also come with numerous budgeting and financial tools. These could even include nonprofit specific features that can help with expense management and fixed asset tracking.

With increased transparency, nonprofit organizations can make decisions and adjust their positioning to ensure they maximize the value of every dollar spent.

Top Accounting Software Options for Nonprofit Organizations

The best overall accounting tool for one nonprofit might not be the right solution for another nonprofit. If you are looking for an accounting platform, some of the top options include:

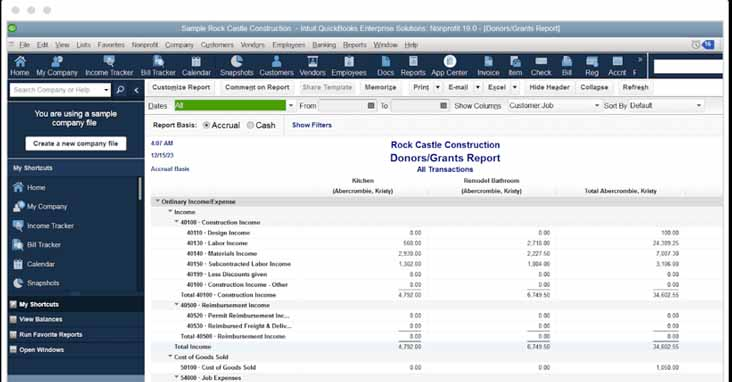

QuickBooks Non-Profit

Price From: $42.99 per month, 30-day free trails

Quickbooks Online also has a great program for nonprofits. The program is known for its ease of use, numerous integrations, and automated features. While this program has been popular among small and medium businesses for a long time, the features can be tweaked to match the needs of nonprofit organizations.

If you decide to use Quickbooks Online, you simply need to configure your account to treat customers as donors. You can find this feature in the settings area. Then, you will need to tweak the “income and revenue” area to reflect your revenue and expenditures.

With these easy switches, you can take advantage of the familiar interface of Quickbooks online to help you manage online donations.

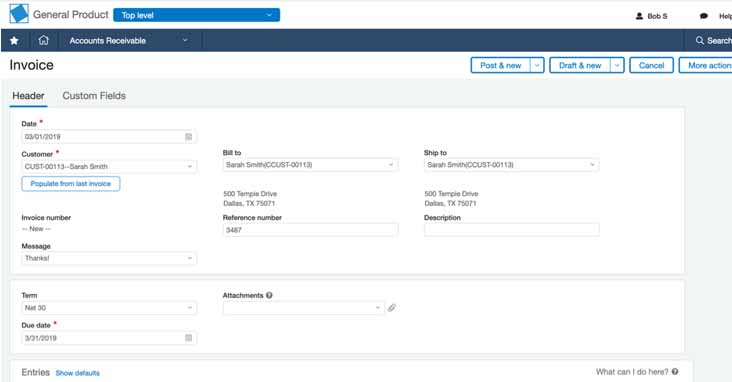

Sage Intacct

Custom Pricing Options

Next, you might want to think about Sage Intacct. This is a cloud-based financial management software program that can automate a lot of the accounting that you usually do by hand.

This program can help you manage your purchases, track your revenue, and balance your books. It is ideal for small and medium nonprofit organizations and is known for its versatility and scalability.

Sage Intacct can help you generate automatic financial reports to help you increase your financial transparency. This is also a great program in that it offers support for multiple currencies, allowing you to track international donations as well.

Sage can even provide budgeting and forecasting help, ensuring that you can plan for the future accordingly. It can even handle compliance issues related to FASB and GASB, allowing you to reduce your regulatory liability.

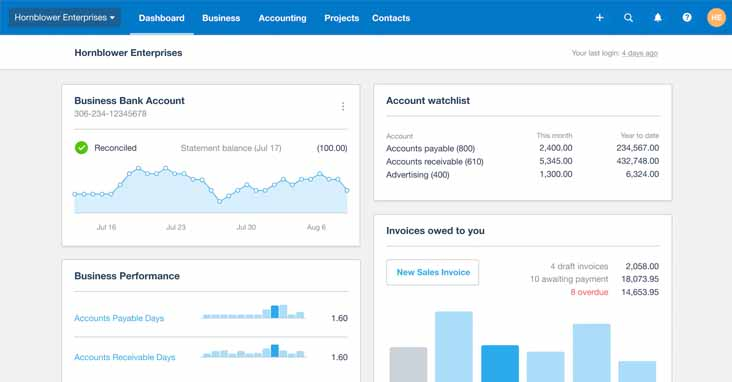

Xero

Pricing from: $25 per month, 30-day free trial

Some nonprofits could benefit from Xero because it comes with robust tools that can help you manage your nonprofit organization if it is growing quickly.

This versatile software program can help you track grants, manage expenses, and even handle recurring donations. This program can also help you be more transparent with your volunteers and board members, as you can generate reports related to your cash flow relatively quickly.

If you have stakeholders, Xero makes it easy for you to share accurate financial statements. With streamlined accounting features, you can spend less time auditing your books and more time focusing on your mission.

Do not forget that Xero is also a cloud computing program, meaning that you can access your most important accounting information even if you are not sitting behind your desk.

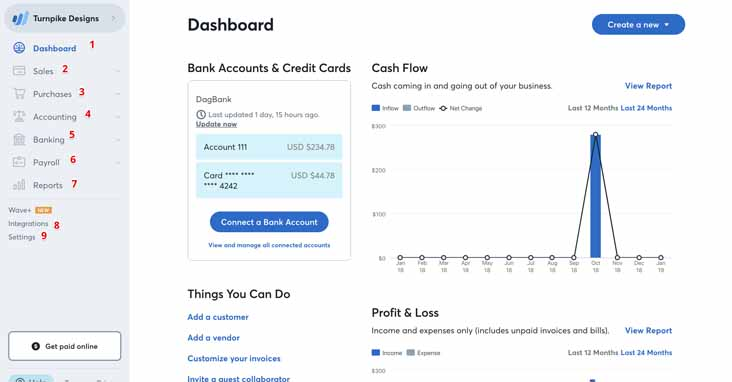

Wave

Pricing from: Free

You should also take a look at the features that come with Wave. If you are on a tight budget, Wave could be a great option because it is free! With this program, you can access customizable templates for just about all of your accounting needs.

This program also comes with automated tools that can help you reconcile your budget in the blink of an eye. You can divide your donors into different categories, allowing you to manage your revenue stream easily.

In addition, you can access granular permission for an unlimited number of users. That way, you control exactly what everyone has access to, which is important for cybersecurity. While the program does not come with any third-party integrations, Wave could be a great accounting software program for smaller nonprofits.

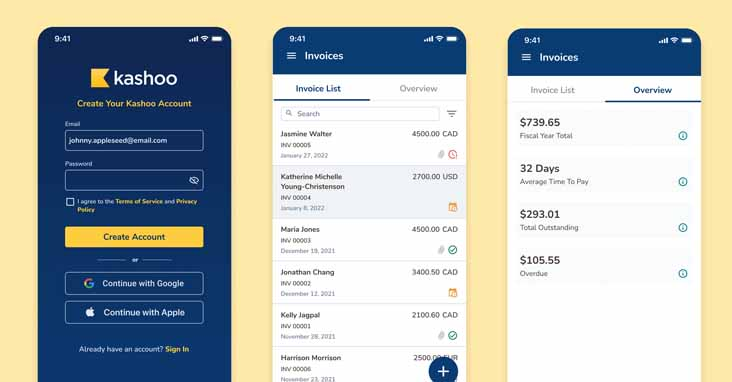

Kashoo

Pricing from: $1 for your first year

Kashoo has become a popular accounting program for nonprofits as well because of its simplicity and ease of use. If you need an accounting program that doesn’t come with a lot of bells and whistles, Kashoo could be for you.

This program provides you with permission-based sharing, meaning that you control what each of your board members, employees, and volunteers has access to. The security is further increased with automatic backups and mobile encryption.

In addition, Kashoo provides you with access to real-time reports that deliver information related to revenue, expenses, accounts payable, accounts receivable, and even integrated apps that allow you to see all of your information in one place. With access to a mobile app, you can access all the information you need even when on the go.

Key Features to Consider When Selecting Accounting Software for Non-Profits

As you are looking for an accounting program for small nonprofits or large nonprofits, there are several features you need to look for. They include:

User-Friendly Interface

The accounting suite should have a user-friendly interface. You should not have to struggle to find what you are looking for.

The menu should be conveniently laid out, you should be able to customize the features to meet your needs, and there should be a relatively short learning curve. You might even want a cloud based solution that will work well for you even while on the go.

Mobile Compatibility

Speaking of being on the go, you need to find an accounting program that is compatible with mobile devices. For example, there should be a convenient app that you can use to access all of the information that you would see even on a desktop computer.

This is particularly important if you have employees who work remotely a lot of the time. Find a nonprofit accounting software program that is compatible with mobile devices.

Automated Financial Reports And Statements

Manual data entry is now a thing of the past. Your accounting features should include automated tools that can help you generate reports, manage online donations, and access inventory tracking features that make it easier for you to manage your cash flow.

With automated tools that can help you with payroll services and donation tracking, you can streamline accounting while saving time and money.

Grant Management And Tracking Tools

As a nonprofit organization, you probably apply for a number of grants. You need to track your applications as they move through the evaluation process.

If you can see all of your grant applications in one place, you will have an easier time managing restricted funds and financial data. Find an accounting program that allows you to track your grant applications.

Multi-Currency Support

As your nonprofit organization grows, you may have donors from all over the world. While you certainly need to accept donations online, you also need to have support available for multiple currencies.

Nonprofit finances can be complicated, particularly for international nonprofits, so make sure you can accept multiple currencies.

Your accounting features should include bank reconciliation as well. This will make it easier for your organization to manage your financial reporting accordingly.

Cost Considerations for Accounting Software for Non-Profits

As you try to find the right nonprofit accounting tool to meet your needs, you need to think about the expenses that go along with the program. Some of the areas you need to consider include:

Upfront Costs

First, you need to think about the upfront costs that go along with the program. How much money will it cost to purchase the program? This could be a one-time fee, or you might have to pay an upfront fee before handling a recurring subscription.

Keep in mind that there might be some upfront costs outside of the software program itself. You might also have to hire someone to train your users on the program, depending on how complicated it is.

Ongoing Costs And Fees

You must also track expenses on a recurring basis which could include subscription billing. Is it going to cost you money to keep using the software year in and year out?

You might need to pay for a monthly subscription to the program, or you might opt for an annual subscription instead.

You need to think about which arrangement is right for you, so don’t forget to think about the subscription costs that go along with the software program. You need to budget accordingly.

Return On Investment

Finally, do not forget to think about the return on your investment. As part of board management, you should calculate the amount of money the program saves you.

For example, the program might come with automated nonprofit specific tools that allow you to reduce your manpower. Or, the program could help you identify deductions and credits as a part of your tax services that can help you reduce your tax burden.

The right nonprofit accounting software solution should help your nonprofit organization save time and money. What does this return look like, and is it worth it for your nonprofit organization to invest in an expensive accounting program?

Find the Best Accounting Software for Nonprofits

Ultimately, these are just a few of the most important points you need to keep in mind if you are looking for an accounting software program for nonprofit organizations.

Remember that the right software program for one organization is not necessarily the right program for another organization.

You need to think about the needs of your nonprofit, how those needs might change in the future, and which program can best meet those needs and scale with your nonprofit.

Keep in mind that nonprofit organizations are subject to different rules, regulations, and tax laws than regular corporations. You might want to take a closer look at the tax laws related to nonprofits on the IRS website. Then, find an accounting software program that can automate your tax reporting and help you reduce your tax burden.