Insurance agents, like most sales professionals, excel when given the opportunity to foster and grow customer relationships, which is why CRM for insurance agents is a key factor in their success.

In the modern age of business technology, software has made customer relationship management (CRM) tools more accessible and feature-rich than ever.

With all the uncertainties life can throw, insurance is a popular product for people looking for stability, even when spending on other areas and industries may drop.

The popularity of insurance products makes the space highly competitive though, and with competition so fierce, it’s critical to give your business all the advantages you can get to continue growth.

In this article, we’ll be looking at the best CRM for insurance agents on the market today as rated and reviewed by our Serchen community of real-world users.

Do Insurance Companies use CRM?

While it’s not strictly necessary for insurance companies to use CRM software, they’re putting themselves at an extreme disadvantage by not doing so.

CRM software helps organizations manage the business’s relationship with individual leads and customers, by providing clear oversight of communications with clients, and workflow streamlining features that both reduce downtime and increase uptime productivity.

Insurance agents spend their most important time making calls and negotiating deals with clients, and with the help of CRM software, those tasks can be prioritized, and with the help of automated workflows and third-party software integrations, many admin tasks can be completed without agents having to lift a finger.

What is a CRM for insurance agencies?

CRM software is an incredibly popular category, as most businesses stand to benefit from the features it provides, with the added bonus that it helps maximize sales potential, leading to growth and increased revenue.

And while there is a range of fantastic CRM solutions for businesses, such as Hubspot, Zoho CRM, and Salesforce, their purview is a more generic sales environment than insurance agencies face.

But the good news is that there is a range of excellent CRM software tools dedicated to helping insurance agencies make the most of their sales opportunities while also providing solutions to the common insurance workflows generic CRM tools aren’t built to accommodate.

The Benefits of CRM Software for Insurance Agents

CRM software has a range of functions that come together to streamline the sales process, so let’s take a look at some of the most important features CRM software provides for businesses in general, and how insurance CRM provides extra features for agencies.

Key CRM Benefits

Centralized Database

One of the most important features of cloud-based, CRM software is the flexibility of access it provides for your sales teams.

For businesses that operate with agents that often have to pick up conversations with clients already in the pipeline who they haven’t spoken to before, this can be a lifesaver, as they can quickly pull up customer and lead information on the CRM and see all the conversations and notes that previous agents have made.

A centralized database of information about your customers means agents don’t risk siloing vital information their team needs to close sales and progress deals down the sales pipeline, as information is easily available for reps who need it whenever they need it.

Customer relationship management

Keeping track of where all your leads and deals are can be a tricky process without a CRM, leading to ad-hoc solutions from spreadsheets and files that aren’t designed for that function.

It’s all too easy to lose files and forget to update your spreadsheets, leading to lost and out-of-date information that could scupper your deals and cost you revenue.

But with CRM software, the lead management sales pipeline gives your sales teams an accurate overview of your deals and customers in real time, with all your customer information and contact data linked to your deals.

Plus, with a record of all your sales team’s interactions with your leads, it’s simple to see how customers are progressing in the pipeline, and what further action needs to be taken.

Automation

An incredible feature of modern software technology is the capacity to automate basic tasks and workflows, freeing up time for agents and teams across the sales process.

A large part of agents’ time is taken up completing mundane, repetitive tasks, such as filling out forms and data entry.

But with CRMs, agents can simply create their automated workflows once, and let the software complete the repetitive action for them.

While this saves a huge amount of time for sales teams to focus on what they do best, nurturing relationships and selling, it also prevents human error from creeping into data entry tasks.

Reporting

It’s impossible to tell how well a sales process works without figures, results, and data to compare.

Without dedicated software, collecting all the variables, data sets, sales activities, and all the other key pieces of sales data is incredibly impractical and time-consuming, if not outright impossible.

But with CRM software collecting all your data for you, and making note of all your sales team’s activities, businesses now have everything they need for advanced analytics within their software.

CRM software gives businesses the chance to generate reports in order to better understand their sales process and see where it needs improving, provide sales forecasts to help management and other departments budget, and help in decision-making by providing the analytics needed to inform discussions.

Insurance CRM benefits

Aside from the general benefits CRM software provides, specialized CRM software for insurance agents has extra features designed specifically to aid with insurance agency sales.

Policy Management

Policies are the lifeblood of insurance agencies, so having insurance CRM software with dedicated policy management tools is critical for efficient operation.

Agents need software that allows them to link their policies to carriers, agents, commissions, and clients to provide complete oversight of each policy, and to manage payouts and payments for the policies customers hold.

Agents also need tools that allow them to update customers with any changes to policies, as well as automated notifications for renewals.

Quoting and Proposals

Agents need to be able to compare a range of policies from providers to find the best policy for their leads, and insurance CRM software provides agents with the tools to look up policies and providers.

Moreover, agents need to be able to provide quotes by submitting applications to exchanges and carriers, which insurance CRM software provides.

Commissions Management tools

Insurance CRM software can help streamline commission processing, by linking agents to policies and commissions, providing complete oversight of commission payments.

Some software even allows agents to import provider forms, identify and reconcile inaccurate payments, and calculate payments.

Built-in telephony system

For agents that operate predominately over phone calls, insurance CRM tools with built-in telephony systems allow agents to make phone calls from within their CRM, saving time and providing a range of useful features.

Features differ by CRM solution but can include intelligent call routing systems, click-to-call, call recording, call queue lists, group calls, auto dialing, and more.

The Best CRM for Insurance Agents

Now we’ve looked at what Insurance CRM can bring to insurance agencies, let’s take a look at the best insurance CRM software on the market today.

Looking for more options? Then check out all our CRM software reviews

Agencybloc

Price:

starts from $70 per month, customized to agency needs

Agencybloc is an agency management system designed to help life and health insurance agencies with a range of software tools.

We’ll be focusing on Agencybloc’s CRM primarily, but it also comes bundled with insurance automation features, sales management, commission processing, reporting, data analysis, and data management and security.

Agencybloc’s CRM covers all the standard CRM features you’d expect, including contract management, communication tracking, activity tracking and task assignment, file and document management, email marketing, and reporting.

But Agencybloc’s insurance CRM provides a range of extra features for agents and insurance agencies.

Firstly, with advanced activity management, managers can monitor the activity of their agents in order to see what tasks have been completed and what’s still ongoing. By recording all your activities, Agencybloc provides businesses with a digital paper trail for E&O issues and internal auditing.

The Agencybloc CRM also helps agents track policy status over the policy lifetime, including coverage, product details, enrollment and election information, the servicing agent, the communication tied to each policy, and the commission associated with it.

And with advanced account and client management features, agents can store more industry-specific data about clients within an intuitive database that makes searching for information a breeze to boost customer support.

Plus, with mass communication tools and email marketing automation features, agents can easily stay in touch with leads to create more personalized communications and create segmented lists to reach leads at the right time with the right message.

Key Features

Agency management platform

Not only does Agencybloc come with a great insurance CRM, but it also includes automation, sales management, commission processing, reporting and data analysis, and data management and security features.

Policy management

Easily keep on top of customers’ policies with all information linked in one place to provide maximum oversight, as well as staying on top of commission details.

Activity tracking

Keep an eye on all your agents’ tasks to see what’s been completed and what’s still in progress, with the extra benefit of activity recording for simplified E&O and internal auditing.

Client management

Attach all your important information about customers and leads to accounts and contacts within the Agencybloc CRM, and find the information you need in an instant with easy-to-use search features.

Radius

Price:

Agent plan @ $34 per month

CSR plan @ $68 per month

Broker plan @ $149 per month

Agency plan @ $292 per month

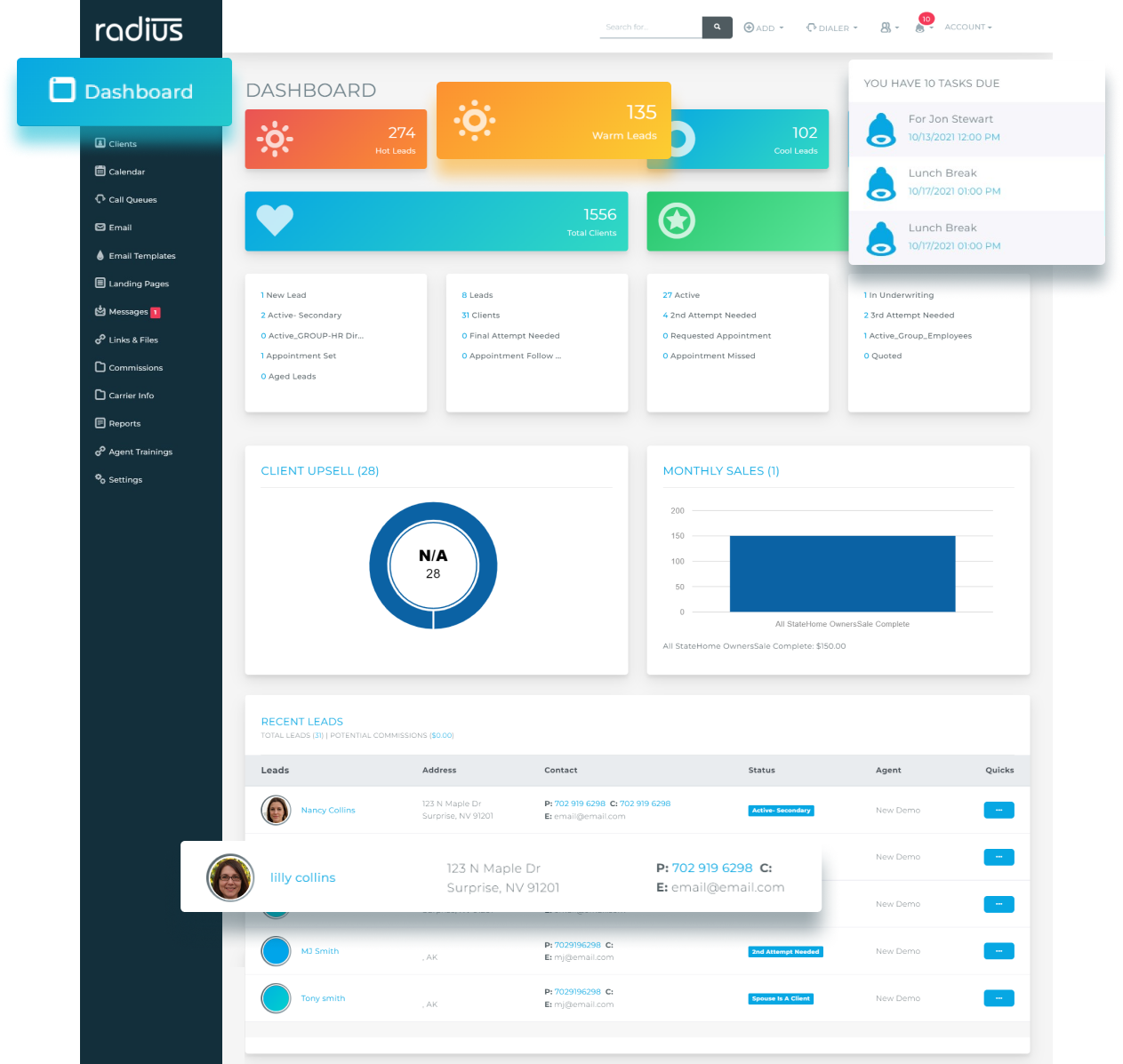

Radius is an agency management system built specifically for insurance agencies, with a focus on lead, client, and agent management.

Radius centralizes multiple systems insurance agencies use into one system, cutting down on the number of browser tabs and apps open, the cost of using multiple different systems, and possible distractions from moving between software.

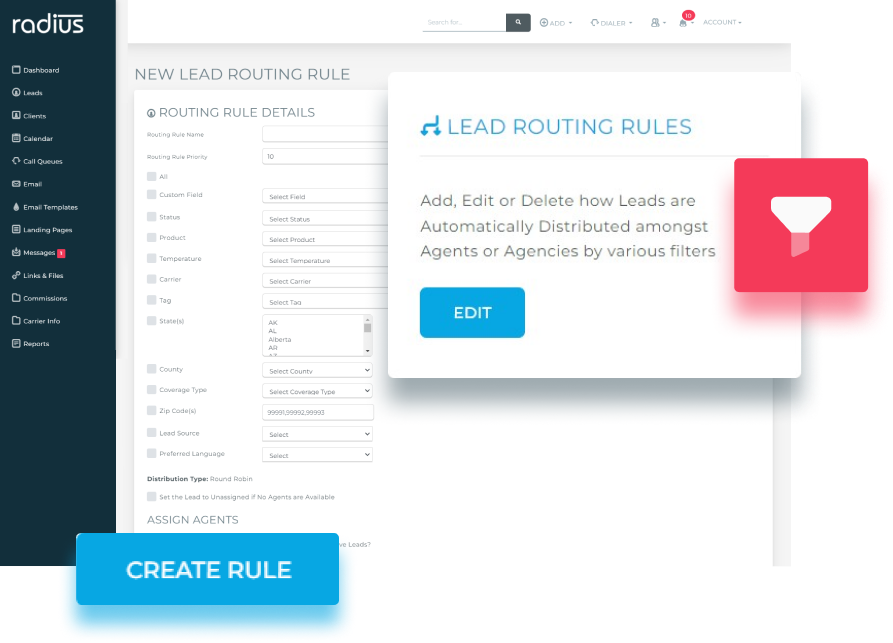

Radius’s sales automation suite offers agents the CRM features they need to keep track of lead progression through the pipeline, as well as customizable smart lead and task distribution between agents, automated workflows, quote engines, and text messaging features, which help free up agents’ time to focus on selling, rather than admin.

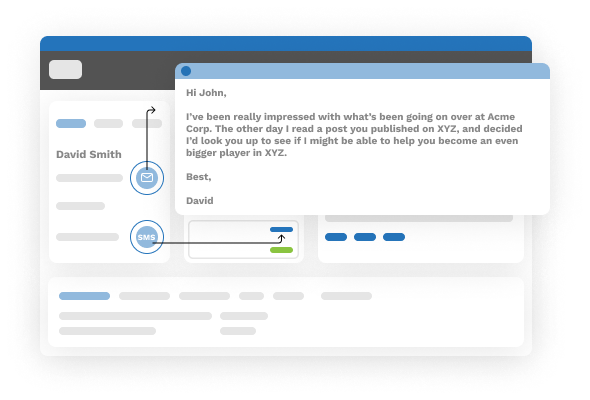

The marketing automation suite means that agents can set up email and text message messages and campaigns, so that as soon as new leads are added to the database, they can be automatically added to email drip campaigns and receive text messages, depending on the tags associated with the lead.

And for agencies that need a powerful telephony solution, Radius’s integrated VoIP system means they don’t need to spend on additional call center software. Operating directly from the Radius platform, agents have access to click-to-call features, an auto preview dialer, call recording, call queue lists, local and toll-free numbers, and IVR and call groups.

On top of these great features, Radius also provides a centralized calendar, automated reminders, and time-stamped notes, with a range of useful integrations with third-party applications to help bring your entire software stack into your CRM system.

Key Features

Extensive automation

Use Radius’s huge range of automations to save your agents time by automating their mundane, admin tasks, allowing them to focus on reaching out to leads and clients and progressing them toward a sale.

Integrated VoIP

A fully integrated telephony solution within your insurance agency management software, Radius brings a smart call center solution with useful functions to agencies that depend on their phone sales channel.

Marketing Suite

Create automated email drip campaigns and text messaging campaigns, autoresponders, monthly newsletters, and Direct mail, and have Radius automatically add new leads to your custom lists for automated marketing.

Integrations

Integrate Radius with a range of third-party tools, including internet lead vendors, screen sharing software, provider quoting systems, Direct Mail, website building software, as well as Office 365 and Google apps.

VanillaSoft

Price:

Starts from $80 per month

Demo available

VanillaSoft is a leading sales engagement platform for the insurance industry, designed to simplify the entire sales process so agents of all skill levels can cut through the noise and focus on what’s important: selling.

VanillaSoft knows that prioritizing your leads is the most effective way of progressing leads toward a deal. By scoring incoming leads against your custom segmentation strategy and ideal customer profile, VanillaSoft directs attention toward your highest-value leads and ensures that your agents reach out to new leads within minutes.

But even your low-priority leads get attention, as VanillaSoft ensures every lead remains active with automated drip campaigns to nurture your colder leads until they’re ready to buy.

VanillaSoft also lets agents import their leads in from wherever they source their leads, such as Facebook, web forms, chatbots, lead list services, and more, so your agencies can easily manage their leads from one platform.

And when it comes to engaging with leads, VanillaSoft centralizes email, video, SMS, and phone channels into one platform, making it easier for agents to reach leads on the channel they’re most likely to respond to.

With integration with Outlook and Google calendar, agents can quickly schedule calls and appointments and have them added to their calendars automatically.

And to save agents time, VanillaSoft’s extensive automation features mean they can spend more time using their selling skills and less time on admin and data entry. With automated lead lists, call scheduling, follow-up emails and texts, and more, agents no longer have to worry about mundane tasks.

Plus, with referral measurement features, agencies can quickly determine the ROI of leads over time, as well as the cost of each lead referral, to determine their most profitable lead referral sources.

Key Features

Lead priority

Use lead scoring to match your incoming leads against your ideal customer persona and segmentation strategy to determine your most valuable leads and follow up with them first, while engaging your colder leads with automated marketing campaigns until they’re ready to buy.

Centralized communications

Bring your email, video, SMS, and phone communication solution into one platform to reach leads on the channel they prefer.

Referral Measurement

Kept track of your referral sources’ ROI and each individual lead’s cost and return.

Automation features

Save agents time by letting them automate their repetitive, mundane tasks, as well as call scheduling and follow-ups, so leads are never left to go cold.

NextAgency

Price:

from $750 per year for NAHU members

From $937.50 per year for standard license fees

NextAgency brings businesses an insurance agency management system for life insurance and health insurance agents.

As well as one of the best insurance CRM tools, the NextAgency suite also includes agency management tools, marketing and communication features, commission tracking, and a large range of built-in integrations to connect to the rest of each business’s software stack.

The NextAgency CRM is built around sales pipelines to provide complete oversight to agents working on leads within the system. There are personalized to-do lists for each agent over days and weeks, which can be sorted through deadline, priority, who created the task, and who the task was assigned to, as well as noting taking and task tracking for detailed information and client-specific tasks.

It also centralizes your communications within the NextAgency database by synchronizing your Outlook, Gmail, IMAP/POP, and ProtonMail email accounts, meaning all emails are routed via your leads’ case records, whether they’re to your leads or just regarding them. Text messages are also integrated into the NextAgency platform, so agents can build text-based relationships from their CRM, reaching even more prospects.

NextAgency also helps track your customers’ current and past policies, with templates for the most common product types, and the ability to create new benefit templates in minutes or customize existing ones.

Plus, your customers’ policy information is kept with their other forms, files, and notes, so agents can instantly see the full picture of their leads and customers.

And when it comes to tracking quotes, proposals, and enrollment kits, NextAgency makes it simple by organizing your sales information for you, and with integrations with other popular sales tools, NextAgency lets you share your data for even better oversight.

Key Features:

Agency management CRM

Not only does NextAgency provide agents with a great CRM, but it also includes a range of other useful software including agency management tools, marketing and communications, commission tracking, and integrations.

Clear pipeline oversight

NextAgency makes it easy to see the status of each lead in your sales pipeline with its intuitive and clear dashboard.

With customization options, a range of filters, personalized to-do lists, noting taking, and task management, agents can provide a consistent, high-quality service to leads every time.

Communication integration

Bring your sales and marketing into the NextAgency platform with synchronized email and integrated SMS messaging, so agents can reach out to leads from within their CRM.

Policy Tracking

Ensure your agents always know your customers’ current and past policies by using the NextAgency policy templates, creating new templates or customizing existing ones for specialist products.

Quote Tracking

Let NextAgency keep track of your agency’s quotes, proposals, and enrollment kits in one place to make keeping track of your quotes a breeze.

Choosing the Best Insurance CRM

Businesses in the insurance industry should be using a CRM, as without one they’ll be giving ground to their competitors who are using one, and leaving money on the table when it comes to improving their sales conversions and revenue.

But an insurance agency has more specific needs than a generic business, and its CRM should reflect this.

By choosing a CRM built for the insurance industry, an insurance agency gives itself the best chance of converting leads into customers.

With the range of tools available to agents, they’re freed up from needless database searching, flipping through multiple apps, and performing repetitive admin work, allowing them to spend more time on customer support and building valuable relationships with clients.

When choosing an insurance CRM for your business, it’s key to focus on what matters most to your business. There’s no point splashing out on software with more features than your business needs.

Instead, focus on the features your agents need to get their job done more efficiently, and the oversight tools management needs to make important decisions and forecast for the future.

That way, you build upon your existing successes, streamline your processes, and give your business the tools it needs to maximize its selling power.