Are you tired of the time-consuming and labor-intensive task of debt collection? Do you wish there was a more efficient and effective way to manage your debt collection process? Look no further than debt collection software!

The team at Serchen has conducted extensive research to identify the top 5 debt collection software providers in the industry. Through our research, we have identified five providers that stand out for their comprehensive features, user-friendly interface, and outstanding customer support.

In this post, we’ll introduce you to each of these providers and highlight their best features, so you can choose the one that perfectly meets the needs of your business.

What is Debt Collection Software?

Debt collection software is a type of software that is designed to help businesses, organizations and collection agencies collect debts from customers or clients. The software can automate many of the tasks involved in debt collection, making the process more efficient and effective. Debt collection software is typically used by organizations such as banks, credit unions, and debt collection agencies.

Unique Debt Collection Software Features

Debt collection software includes a range of features that are specifically designed to help a collections team manage the debt collection process. Here are some of the unique features of this software:

Automated messaging:

Debt collection software can send automated messages to customers, reminding them of their outstanding debts and requesting payment. These messages can be sent via email, text message, or phone call.

Payment processing:

Many debt collection software options allow customers to make payments directly through the software, which can help accounting operations streamline the payment process. This feature can also provide customers with more payment options and increase the likelihood of successful debt collection.

Compliance management:

Debt collection software often includes tools to help businesses comply with legal and regulatory requirements related to debt collection. For example, the software may include a centralized database to help organizations stay compliant with the Fair Debt Collection Practices Act (FDCPA) or other relevant laws.

Customizable workflows:

Debt collection software can be customized to meet the specific needs of a business or organization, allowing them to tailor the debt collection process to their unique requirements. This can help organizations to automate the collection process and improve efficiency.

Client portal:

A client portal is a secure online platform that is typically included as a feature in debt collection software. The portal allows businesses to communicate and exchange information with their customers, providing a convenient and secure way for customers to view their account information, make payments, and communicate with the business.

Credit bureau reporting:

Credit bureau reporting is a valuable feature included in many debt collection software tools. This feature allows businesses to report customer debt to credit bureaus, which can impact the customer’s credit score and credit history.

Document Storage

The ability to store critical documents is a commonly found feature in debt collection software. This feature allows businesses to store and manage documents related to their debt collection process, such as invoices, payment receipts, settlement offers, and other related documents.

Contact Management

Contact management is an essential feature of debt collection software, allowing organizations to manage customer information more effectively. This feature enables organizations to centralize and store customer contact details, such as names, addresses, phone numbers, and email addresses, in one place.

Analytics

Debt collection software also offers advanced functionalities like segmentation and grouping, communication history tracking, and appointment scheduling. Combined these features can help predict debt recovery results more effectively.

Benefits of Using Debt Collection Software

There are several benefits to using debt collection software, including:

Increased efficiency:

By automating many of the tasks involved in debt collection, businesses can complete the process more quickly and efficiently. This can reduce the time and resources required for debt collection, freeing up staff to focus on other important tasks.

Improved accuracy:

Debt collection software can reduce errors and improve accuracy, leading to more successful debt collection outcomes. For example, the software can automatically update customer account information or send reminders to customers based on their payment history.

Better customer engagement:

Automated messaging and other features of debt collection software can help to improve customer engagement and build stronger relationships with customers. For example, the software can send personalized messages to customers based on their payment history or offer payment plans to help them pay off their debts.

Increased compliance:

By helping businesses stay compliant with legal and regulatory requirements related to debt collection, debt collection software can reduce the risk of legal or reputational issues. This can help businesses to maintain a positive relationship with their customers and protect their brand reputation.

Overall, debt collection software is a valuable tool for businesses and organizations that need to manage the debt collection process. By streamlining tasks, improving accuracy, and increasing compliance, this software can help businesses achieve more successful debt collection outcomes while also building stronger relationships with their customers.

How We Choose The Best Debt Collections Software

Choosing the right debt collection software can significantly impact the success of your debt collection process, as well as your overall business operations. With numerous options available in the market, it can be challenging to determine which one is the best fit for your business. To simplify the decision-making process, we’ve conducted extensive research and analysis to identify the top debt collection software options in the industry.

Our methodology for selecting the best debt collection software vendors is based on several key factors. First, we considered the functionality and features offered by each software, including automated messaging, payment processing, compliance management, customizable workflows, and predictive dialing. We also evaluated the level of security and data protection provided by each software to ensure the safety of customer information.

Second, we analyzed customer reviews and feedback on platforms such as Serchen, G2, and Capterra to gauge user satisfaction and the level of support provided by each vendor. We took into account the responsiveness of customer service and the availability of training and resources to help users make the most of the software.

Additionally, we considered the pricing and affordability of each solution, as well as the level of customer service and support offered. We also evaluated the ease of use and level of customization offered by each software to ensure that businesses of all sizes and levels of technical expertise can use it effectively.

In summary, our methodology for selecting the best debt collection software vendors includes evaluating the functionality and features, user satisfaction and support, pricing and affordability, security and data protection, and ease of use and customization. By considering these factors, we identified the top debt collection software options to help debt collectors streamline their debt collection strategies and achieve better outcomes.

The 5 Best Debt Collections Software Providers

Here is our final shortlist of debt collection software providers. 4 of the finalists are suited to most businesses, with only one of them (casetrackerlaw) specifically focussed on the legal industry. All these vendors met our criteria for recommendations. The final selection should come down to the specific needs of your own business and customers.

CasetrackerLaw

Best Feature: Customizable workflows

CasetrackerLaw is a web-based case management software solution designed specifically for law firms that handle debt collection and other legal services. The software offers a range of features that helps law firms manage their cases efficiently, including document management, automated workflows, calendar scheduling, and reporting tools. CasetrackerLaw also includes client portals, which enables lawyers and clients to view their case information and communicate with their attorneys online. The software is highly customizable, and can be tailored to meet the unique needs of each firm.

Debtmaster

Best Feature: Predictive Dialer

Debtmaster is a debt collection software platform that helps organizations manage their collection processes more efficiently. The software offers a range of features, including account management, payment processing, document management, and compliance management. Debtmaster also includes automated workflows, which can help organizations improve their collection rates and reduce manual tasks. If you’re looking to have faster collections debtmaster is really worthy of your consideration.

Quantrax

Best Feature: Payment Processing

Quantrax is a debt collection software platform that offers a range of features to help organizations manage their collection processes more efficiently. The software includes account management tools, payment processing, reporting and analytics, and document management. Quantrax also includes automated workflows and scripting capabilities, which can help organizations streamline their collection processes and reduce manual tasks. The software is highly customizable, and can be tailored to meet your business needs.

Collect!

Best Feature: Customizable workflows

Collect! for Credit and Collection is a debt collection software solution that offers a range of features to help organizations manage their collection processes more efficiently. The software includes account management tools, payment processing, document management, and reporting and analytics. Collect! also includes automated workflows and scripting capabilities, which can help organizations streamline their collection processes and reduce manual tasks. The software is highly customizable, and can be tailored to meet the unique needs of each organization.

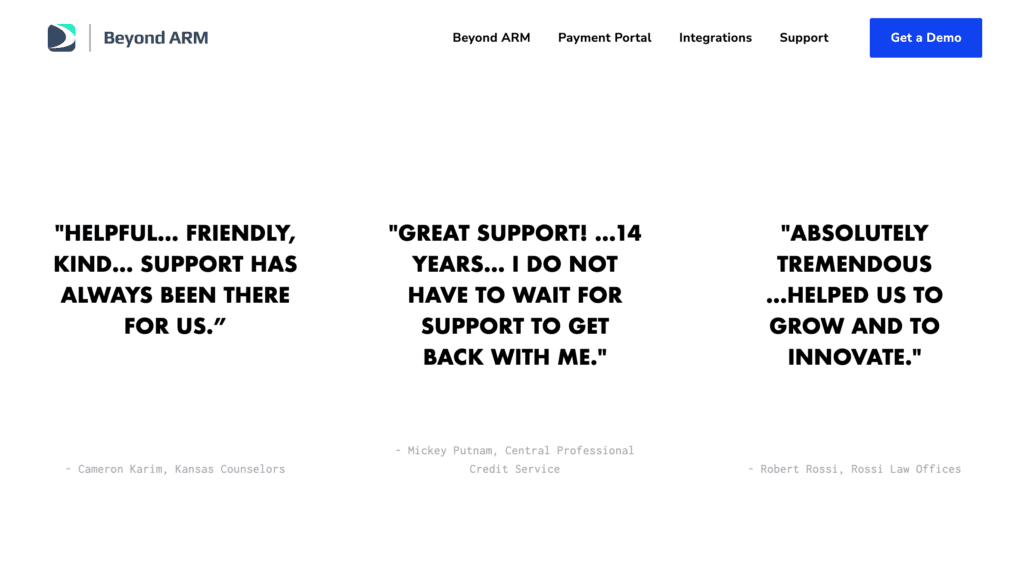

Beyond ARM

Best Feature: Customizable Workflows

Beyond ARM is a debt collection software platform that offers a range of features to help organizations manage their collection processes more efficiently. The software includes account management tools, payment processing, document management, and reporting and analytics. Beyond ARM also includes automated workflows and scripting capabilities, which can help organizations streamline their collection processes and reduce manual tasks. The software is highly customizable, and can be tailored to meet the unique needs of each organization. In addition, Beyond ARM offers a range of additional services, including training and consulting, to help organizations maximize the value of their investment in the software.

Debt Collection Software – FAQ

What is debt collection software?

Debt collection software is a tool that helps businesses and organizations automate and manage the debt collection process. The software typically includes features such as payment processing, automated messaging, reporting and analytics, and compliance management tools.

How does debt collection software work?

A debt collection software works by automating and streamlining many of the manual tasks involved in the debt collection process, featuring both inbound and outbound capabilities a support team needs.

What are the benefits of using debt collection software?

The benefits of using debt collection software enable faster collections, improved efficiency, increased accuracy, and better customer experience. With debt collection software, businesses can automate many of the manual tasks involved in debt collection, reducing the time and resources required for the process. Additionally, debt collection software can help businesses stay compliant with legal and regulatory requirements related to debt collection, reducing the risk of legal or reputational issues.

How do I choose the right debt collection software for my business?

To choose the right debt collection software for your business, consider your specific requirements and needs. Look for software that offers the features you need, such as payment processing, automated messaging, and reporting and analytics. Additionally, consider factors such as ease of use, affordability, and customer support when choosing a debt collection software provider.

Is debt collection software suitable for businesses of all sizes?

A: Yes, debt collection software is suitable for businesses of all sizes. There are debt collection software providers that offer solutions tailored to the needs of small businesses, as well as solutions designed for larger organizations with more complex requirements.

Is debt collections software suited to collection agencies?

Yes, debt collection software is commonly used by collection agencies to manage the debt collection process. A collection agency requires robust software that can handle a high volume of accounts, automate many of the manual tasks involved in debt collection, and provide reporting and analytics tools to help them track their performance. Debt collection software is specifically designed to meet these needs and is therefore a popular choice for collection agencies. Many debt collection software providers offer solutions that are specifically tailored to the needs of collection agencies, providing features such as automated messaging, skip tracing, and compliance management tools to help them improve the efficiency and effectiveness of their debt collections management.

What is a debt collection system?

A debt collection system is a software tool designed to help businesses and organizations manage their debt recovery. It typically includes a range of features to automate and streamline many of the manual tasks involved in debt collection, such as generating invoices and reminders, tracking the status of accounts, and managing compliance with legal and regulatory requirements related to debt collection.

Is Legal case management a debt collection software feature?

A legal case management solution isn’t a feature typically found in debt collection systems. Legal case management software is specifically designed to help law firms manage their cases and clients, while debt collection software is focused on automating and streamlining the debt collection process. While there may be some overlap in the features offered by these two types of software, they are generally distinct categories with different functionalities and use cases.

Does debt collection software integrate with accounting software?

Yes, debt collection software can integrate with accounting software, providing a seamless way for organizations to manage their debt collections and financial processes. Integration with accounting software enables debt collection organizations to sync their data between their debt collection software and accounting software, eliminating the need for manual data entry and ensuring that financial records are accurate and up-to-date.

Wrapping things up!

Debt collection software can be a game-changer for businesses looking to streamline their debt collection process and improve their financial performance. By automating many of the manual tasks involved in debt collection and providing valuable insights through reporting and analytics, debt collection software can help businesses improve their efficiency, accuracy, and effectiveness in collecting debts.

Our research has identified five top debt collection software providers that stand out for their comprehensive features, user-friendly interface, and outstanding customer support. Whether you are a small business owner or a large corporation, there is a debt collection software solution that can meet your specific needs and requirements. We hope this post has been informative and helpful in your search for the best debt collection software provider for your business.

Find more than 70 more Debt Collection Software Vendors in our Software Marketplace