Self-employed individuals are people who work for themselves, instead of being employed by an employer. They typically earn their income through freelancing, sole proprietorships, and other forms of self-employment.

Self-employed individuals need accounting software to keep track of their finances and business operations. Accounting software can help them stay organized, manage their expenses, handle invoicing and payments, as well as generate financial statements like profit and loss statements and balance sheets.

Accounting software also provides helpful insights into trends in the business which helps create strategies for maintaining profitability. Accounting software can also help with taxes, allowing self-employed individuals to stay on top of their tax obligations.

What to Look For In Self Employed Accounting Software

Essential Features

When selecting accounting software for self-employed individuals, it is important to consider essential features such as invoicing and payment processing, budgeting tools, reporting capabilities, project tracking and profitability analysis along with more advanced accounting features. The software should also be easy to use with intuitive navigation.

Most accounting software providers offer free trials, so you can try out the software before you commit to it.

Look for accounting software that has essential features such as invoicing, expenses tracking, and financial reporting. A receipt capture feature, so you can ditch the paper receipts. Also look for software with helpful extras like budgeting tools and automatic tax calculations.

Automation can be a major time-saver when it comes to managing your finances. Look for accounting software that allows you to set up automatic payments and invoices, as well as automatic tax calculations. Advanced features such as bank reconciliation features also save lots of valuable time.

Accounting software should be easy to use and understand. Look for accounting software with a user-friendly interface and helpful tutorials or support services so you can quickly get up-and-running.

Security is a must for any accounting software used by the self-employed. Look for software that uses encrypted connections, data encryption, two-factor authentication, and other security measures to keep your data safe.

Cost And Payment Options

When selecting freelance accounting software for self-employed individuals, it is important to consider the cost and payment options. Self-employed individuals often have limited budgets, so they should look for a cost-effective solution that is within their budget. In addition, look for accounting software with flexible payment plans such as monthly or annual subscription models. Analytics capabilities are also important as they allow self-employed individuals to gain insights into their financial data.

Cost and payment options should also be taken into consideration when selecting accounting software. Look for software that offers a variety of pricing plans, including monthly or annual subscription options. Additionally, look for software that offers discounts and special offers throughout the year. Some providers also offer free trials which can be ideal if you’re not sure what features you need.

It is also important to consider payment options when selecting accounting software. Look for software that offers payment methods such as credit cards, PayPal, bank transfers or other online payment systems. This will allow you to easily and securely pay for the software without having to worry about entering your financial information into a system you’re unfamiliar with.

User-Friendliness

Finally, user-friendliness should be a top priority when selecting small business accounting software. Look for software that is designed with the self-employed in mind and is easy to navigate. Tutorials or customer support services can also be helpful in getting you up and running quickly. Additionally, look for software that automatically synchronizes with your other business apps—such as your CRM or eCommerce platform—so that you can easily keep track of all your financial data.

The accounting software should be user-friendly with intuitive navigation, making it easy for self-employed individuals to access and understand their financial data. Additionally, look for features that make the process of income and expense tracking, invoicing clients and managing payments easier. Finally, ensure the software offers customer support in case you encounter any difficulties while using the software.

By considering key features such as invoicing, automation, user-friendliness, cost and payment options, and security; self-employed individuals can find the best accounting software to fit their needs. With the right software, you can easily manage your finances without spending hours on manual data entry.

The right accounting software programs can make a huge difference in the success of any self-employed individual. With the right features, accounting software cost and payment options, user-friendliness and security features; the perfect accounting software for your business is just around the corner.

Top Accounting Software for Self-Employed

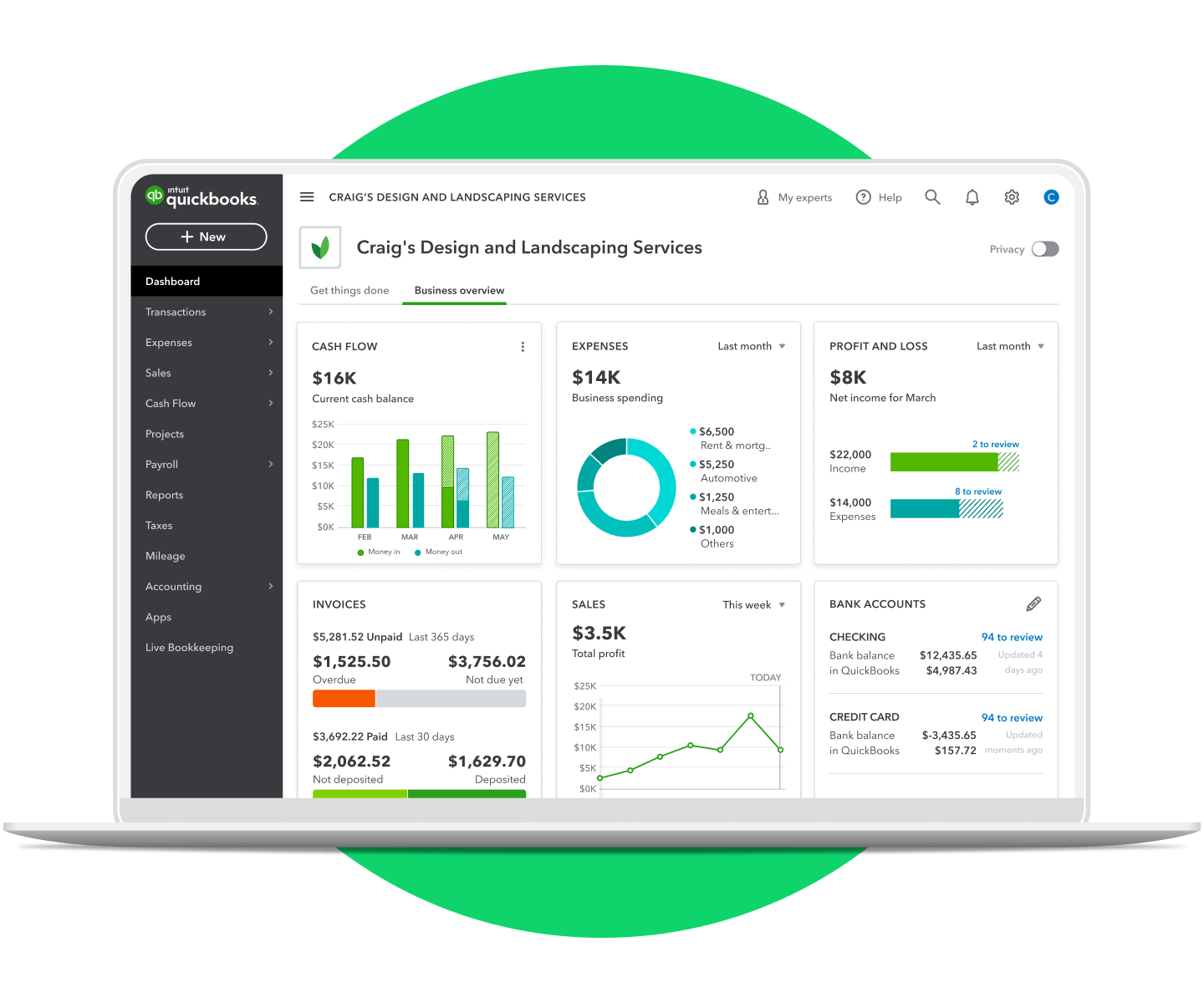

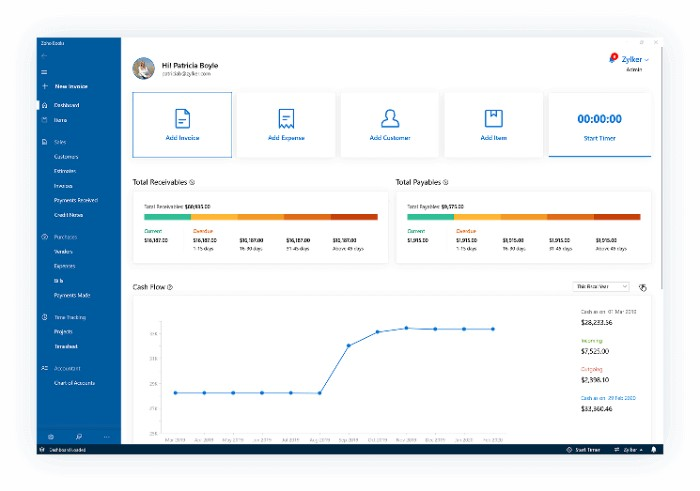

Quickbooks

QuickBooks online Self-Employed is the perfect accounting solution for self-employed individuals and small business owners. With features such as invoicing, payments processing, expense tracking and categorization, mileage tracking, sales tax calculations, sales tax tracking, tax deductions management and more; this software will save you time while giving you all of the tools that you need to run your business with ease. The availability of features in QuickBooks Online is dependent on the version you subscribed to, although basic features such as bank connectivity, track income and expenses, and cash flow management are included in all plans. Plus they also offer customer support so that every user can get the most out of their experience!

Pros of using Quickbooks Self-Employed

Easy to Set Up: QuickBooks Self-Employed is easy to set up and use. It’s designed to be user friendly and intuitive, so you can quickly set up your accounts and start tracking your income and business expenses.

Automated Tax Calculations: QuickBooks Self-Employed automatically calculates your quarterly tax estimates based on your income and expenses. This makes filing your taxes much easier and more accurate.

Track Mileage: QuickBooks Self-Employed allows you to easily track your business mileage. This can be a great way to save money on taxes by deducting your business miles.

Bank Sync: QuickBooks Self-Employed allows you to connect your bank accounts and credit cards, so you can automatically track your expenses and income and reconcile bank transactions.

Cons of using Quickbooks Self-Employed

Limited Features: QuickBooks Self-Employed is a basic accounting software, so it doesn’t have as many features as some of the more comprehensive accounting solutions.

No Invoicing: QuickBooks Self-Employed does not offer invoicing or bill payment features.

Limited Reports: QuickBooks Self-Employed offers limited reporting capabilities, so you may need to use other software for more detailed reports.

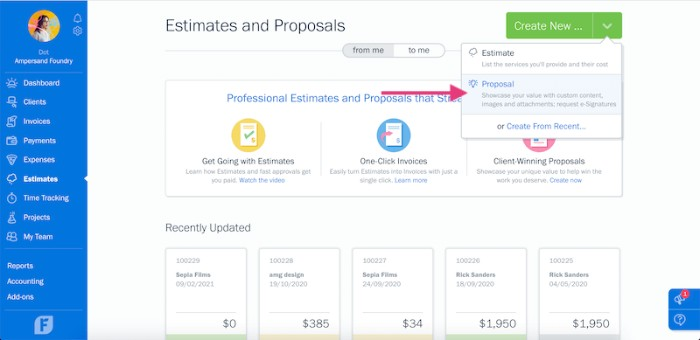

FreshBooks

FreshBooks is an accounting software designed for small businesses, including self-employed individuals. It offers features such as invoicing and payment processing, time tracking, project management, financial reporting, and more. FreshBooks also includes customer support to ensure users have a smooth experience while using the software.

Freshbooks is a popular accounting software platform for the self-employed. It’s an easy way to stay organized and understand where you are financially. While FreshBooks has many advantages, it’s important to consider some potential drawbacks too. Here are some of the pros and cons of using Freshbooks as a self-employed individual.

Pros of using Freshbooks for Self-Employed

Easy to Set Up: FreshBooks has a simple and straightforward setup process. You can quickly create invoices, track time, and business and personal expenses.

Automated Tax Calculations: FreshBooks automatically calculates your estimated taxes and creates reports to help you stay organized and on top of your tax filing obligations.

Expense Tracking: FreshBooks makes it easy to track your expenses and categorize them for tax deductions.

Online Payments: FreshBooks allows you to accept payments online, which can be a great way to save time and streamline your invoicing processes.

Cons of using Freshbooks for Self-Employed

Limited Integrations: FreshBooks doesn’t offer as many integrations as other accounting software solutions.

Limited Reports: FreshBooks only offers basic reporting, so you may need to use a third-party solution for more in-depth reporting and analysis.

No Mileage Tracking: FreshBooks does not offer a way to track your business miles.

Zoho Books

Zoho Books is an accounting software designed for small businesses and self employed business owners, including self-employed individuals. It offers features such as invoicing and payment processing, automated recurring invoices, time tracking, budgeting tools, financial reporting, and more. Zoho Books helps automate some of the most tedious accounting tasks, including invoicing and expense categorization. Zoho Books also includes customer support to ensure users have a smooth experience while using the software.

Pros of using Zoho Books for Self-Employed

Easy to use: Zoho Books is designed with an intuitive user-interface to make it easy for self-employed people to manage their finances. It has a variety of features and functions that allow users to quickly and easily organize their accounts, track expenses, and generate financial reports.

Automated features: Zoho Books offers automated features that can help self-employed people save time and money. These features include the ability to automatically reconcile transactions, generate invoices, and remind customers of payments due.

Affordable pricing: Zoho Books is an affordable accounting solution for self-employed individuals. It offers a variety of pricing plans that can be tailored to fit different budgets.

Cons of using Zoho Books for Self-Employed

Lack of customization: Zoho Books does not offer much customization when it comes to creating financial reports. As a result, self-employed individuals may have difficulty creating reports that are tailored to their specific needs.

Limited integrations: While Zoho Books can integrate with some third-party services, the list of compatible applications is limited. This may be a problem for self-employed people who use multiple applications to manage their finances.

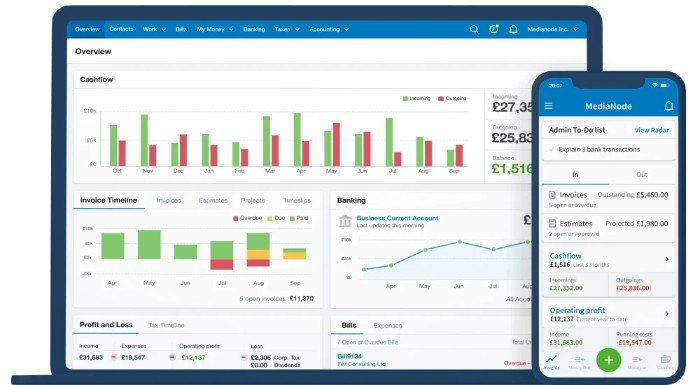

FreeAgent

FreeAgent is an accounting software designed for small businesses, including self-employed individuals. It offers features such as invoicing and payment processing, time tracking, project management, financial reporting and more. FreeAgent also includes customer support to ensure users have a smooth experience while using the software. Additionally, it has a free trial version so users can try it out before making a purchase.

Pros of using FreeAgent for Self-Employed

Easy to use: FreeAgent is designed to be user-friendly and makes it easy for self-employed individuals to manage their finances and get an overview of their business performance.

Automated invoicing: FreeAgent makes it easy to create and send invoices to customers, and it can also be used to track payments and send reminders for overdue invoices.

In-depth reporting: FreeAgent provides detailed reports with insights into where your money is going, helping you to make better business decisions.

Tax estimator: FreeAgent’s tax estimator tool helps self-employed individuals to understand how much tax they need to pay and when they need to pay it.

Free trial: FreeAgent offers a free 30-day trial, so you can try it out before committing to a paid plan.

Cons of using FreeAgent for Self-Employed

Limited features: FreeAgent has fewer features than some of its competitors, so it may not be suitable for more complex businesses.

Expensive plans: FreeAgent’s pricing plans can be costly, especially for larger businesses.

Wave Accounting

Wave Accounting is an accounting software designed for small businesses, including self-employed individuals. It offers features such as invoicing and payment processing, time tracking, budgeting tools, financial reporting and receipt scanning. Wave Accounting also includes customer support to ensure users have a smooth experience while using the software. Additionally, it has a free version so users can use the software without having to pay a subscription fee.

Pros of using Wave Accounting for Self-Employed

Easy to use: Wave Accounting is easy to use and navigate, with a simple user interface. This makes it ideal for self-employed individuals who may not be familiar with accounting software.

Automation: Wave Accounting allows you to automate many of the tasks associated with accounting, such as invoicing, payments, and reconciliations. This can save time and reduce the burden of managing your finances.

Low cost: Wave Accounting is free for individuals with fewer than nine employees. There are also affordable subscription plans available for larger businesses.

Flexibility: Wave Accounting is flexible and can be customized to fit your individual needs.

Cons of using Wave Accounting for Self-Employed

Limited features: Wave Accounting is a basic accounting software and does not offer all the features such as inventory tracking or payroll processing.

Limited integrations: Wave Accounting does not offer as many integrations as other accounting software. This can limit its usefulness for some businesses.

Conclusion of Best Accounting Software For Self Employed

When it comes to finding the best accounting software for self-employed individuals, there are lots of great accounting software options available. From cloud-based solutions to desktop software, you have plenty of choices to fit your needs and budget. To make sure you get the right solution for your business, be sure to compare accounting features and pricing before settling on a platform.

Each accounting software has its own unique set of features, so it is important to consider all factors before making a decision. With the right accounting software in place, self-employed individuals can keep their finances organized easily manage their finances and ensure that your business runs smoothly.

Whether you’re a freelancer, sole proprietor, or any other type of self-employed individual, accounting software can be an invaluable tool for managing your business operations. With the right features and payment options, you can easily find the best accounting software to fit your needs.

Find: The Best Account Software in the Serchen Marketplace