Are you a freelancer in need of accounting software? With so many accounting software tools available, it can be hard to decide which one best suits your needs. To make the process easier, we’ve done the research and created this guide to help you find the best bookkeeping software for freelancers.

After reading our guide, you should feel confident that you’ll find the best accounting software for your business! Let’s get started!

What Freelancers Need in Their Accounting Software

A freelance business needs their accounting software to include some key features which arent always standard in a typical accounts package. Mileage tracking, recurring invoices, automatic bank account integration and quarterly taxes preperation are just a handful of features that should be included in the best accounting systems. Must have features include:

Invoicing

Time tracking

Expense tracking

Income tracking

Budgeting and forecasting

Payroll management

Tax filing services

Financial data analysis capabilities

Lets take a deeper dive into each of the key areas and why theyre so important for your business

Invoicing

Accounting software can help freelancers with invoicing in several ways:

Customizable Invoices: Accounting software typically provides templates for invoices, allowing you to create professional-looking invoices that you can customize with your brand logo and information.

Automated Invoicing: The software can automate the invoicing process by generating invoices based on time and expenses tracked in the system. This saves time and reduces the risk of errors associated with manual invoicing.

Online Payments: Many accounting software solutions offer the option to accept online payments, making it easier for clients to pay invoices. This can reduce the time and effort it takes to chase payments, as well as streamline the payment process.

Invoice History and Tracking: The software provides a centralized platform for managing invoices, allowing you to track the status of invoices, view payment history, and send reminders for past-due invoices.

Tax Management: Accounting software can help freelancers stay compliant with tax laws by automatically calculating taxes on invoices and providing accurate tax records.

Overall, using accounting software for invoicing can save freelancers time, reduce the risk of errors, and help streamline their invoicing and payment process, providing a more professional and efficient solution for managing their finances.

Time Tracking

Accounting software can help freelancers with time tracking in several ways:

Automated time tracking: Many accounting software applications have built-in time tracking features that allow freelancers to automatically track the time they spend on different projects and tasks. This eliminates the need for manual timekeeping and ensures that all time spent is accurately recorded.

Improved accuracy: With automated time tracking, freelancers can avoid common mistakes that can occur with manual timekeeping, such as missed entries or incorrect information. The software provides a more accurate and reliable record of time spent, which can be valuable in invoicing and reporting.

Simplified invoicing: Accounting software that includes time tracking features can also simplify invoicing by automatically generating invoices based on the time tracked. This saves time and reduces the risk of errors compared to manually creating invoices.

Better client billing: Freelancers can use the time tracking data in their accounting software to provide more accurate and detailed billing information to clients. This can help to build trust and transparency in client relationships.

Better budgeting and planning: Time tracking data can also help freelancers better understand their work patterns, project times, and costs. This information can be used to make informed decisions about future projects, pricing, and resource allocation.

Accounting software with time tracking features can help freelancers streamline their work, improve accuracy, and make better business decisions.

Expense Tracking

Accounting software can help with business and personal expenses tracking in several ways:

Automated Data Entry: With accounting software, you can easily and quickly input expenses by connecting bank accounts, credit cards, and other payment methods. The software automatically categorizes expenses, reducing manual data entry and the risk of errors.

Expense Tracking: The software provides a centralized platform for tracking expenses, enabling you to monitor expenses in real-time and get a clear picture of your spending. You can also set up custom reports to track expenses by category, like vendor, date, or any other criteria you choose.

Receipt Management: You can store digital receipts in the software, eliminating the need for physical receipt storage. The software also enables you to attach receipts to expenses, making it easier to reconcile expenses with vendor statements and bank transactions.

Budgeting and Forecasting: Accounting software can help you set budgets and forecast expenses, allowing you to plan for future spending and make informed decisions.

Audit Trail: The software provides an audit trail of all expense transactions, making it easy to review expenses and resolve any discrepancies. This can be especially useful in the event of an audit or tax review.

Using accounting software for expense tracking can improve the accuracy and efficiency of your expense tracking process, giving you greater control over your finances.

Income Tracking

Accounting software can help freelancers with income tracking in several ways:

Automated Data Entry: By connecting bank accounts and other payment methods, accounting software can automatically import income transactions and categorize them, reducing manual data entry and the risk of errors.

Income Tracking: The software provides a centralized platform for tracking income, allowing you to monitor income in real-time and get a clear picture of your earnings. You can also set up custom reports to track income by project, client, or any other criteria you choose.

Invoice Management: The software can be used to manage invoices, providing a clear record of the amounts you have billed and the amounts that have been paid. This information can be used to track income and ensure that you are paid on time.

Budgeting and Forecasting: Accounting software can help you set budgets and forecast income, allowing you to plan for future earnings and make informed decisions.

Tax Management: The software can assist with tax compliance by providing accurate records of your income and expenses, which can be used to prepare tax returns and ensure that you are paying the correct amount of tax.

Overall, using accounting software for income tracking can provide freelancers with a comprehensive and accurate view of their income, enabling them to make informed decisions and better manage their finances.

Budgeting and Forecasting

Here are some ways in which accounting software can assist freelancers with budgeting and forecasting:

Tracking expenses: Accounting software allows freelancers to track their expenses and categorize them according to their type (e.g., business expenses, personal expenses). This information can be used to create a budget and ensure that the freelancer stays within their financial constraints.

Creating a budget: Many accounting software applications have built-in budgeting tools that allow freelancers to create a budget based on their income and expenses. This budget can be updated regularly to reflect changes in the freelancer’s financial situation.

Forecasting future expenses: Accounting software can also help freelancers predict future expenses based on past transactions and current financial trends. This information can be used to create a more accurate budget and plan for future financial needs.

Managing invoices and payments: Freelancers often work with multiple clients and need to keep track of invoices and payments. Accounting software can help with this by automatically generating invoices, tracking payment status, and recording payments when they are received.

Financial reporting: Accounting software can generate a variety of financial reports that can be used to evaluate the freelancer’s financial health, including balance sheets, profit and loss statements, and cash flow statements. This information can be used to make informed decisions about budgeting and forecasting.

Accounting software can make budgeting and forecasting easier for small business owners and freelancers.

Tax Filing Services

Accounting software can help freelancers with tax filing services in several ways:

Automated Bookkeeping: Accounting software can automate the process of bookkeeping, making it easier to keep track of income and expenses. This can save time and reduce the risk of errors.

Tax Preparation: Many accounting software programs offer tax preparation services that can help you to calculate your taxes and generate the necessary forms and documents for filing.

Integration with Tax Filing Services: Some accounting software programs are integrated with tax filing services, allowing you to file your taxes directly from the software. This can save time and reduce the chance of errors compared to manual tax preparation.

Tax Planning: Accounting software can also provide valuable insights into your financial situation, making it easier to plan for taxes and to ensure that you are taking advantage of all available tax deductions and credits.

Accurate Record Keeping: Accounting software ensures that your financial records are accurate, organized and up-to-date. This can make it easier for you to comply with sales tax tracking laws and to respond to any questions or audits from the tax authorities.

Accounting software can help freelancers with tax filing services by streamlining the bookkeeping process, automating tax preparation, integrating with tax filing services, providing tax planning insights, and ensuring accurate record keeping.

Financial Data Analysis

Accounting software can help freelancers in several ways with financial data analysis capabilities:

Automated Bookkeeping: Accounting software can automate the bookkeeping process, which saves time and reduces the chances of human error. Freelancers can input financial transactions, categorize them, and generate financial reports.

Real-time Financial Data: Accounting software provides real-time financial data, which helps freelancers monitor their financial health and make informed decisions.

Financial Reports: Accounting software can generate various financial reports, such as profit and loss statements, balance sheets, and cash flow statements, which help freelancers understand their financial performance and identify areas for improvement.

Budgeting and Forecasting: Accounting software can help freelancers create budgets and perform forecasting, which helps them plan for the future and make informed decisions about their finances.

Invoicing and Billing: Many accounting software solutions offer invoicing and billing features, which helps freelancers streamline their billing process, save time, and get paid faster.

Tax Preparation: Accounting software can also help freelancers prepare their taxes by generating reports that provide the information needed to complete tax returns.

In summary, accounting software can help freelancers with financial data analysis capabilities by providing real-time financial data, generating financial reports, automating bookkeeping, and streamlining billing and tax preparation processes.

Best Accounting Software for freelancers

Now we know what features to look for, lets jump into our shortlist of accounting software we believe are best suited to freelance / self employed people.

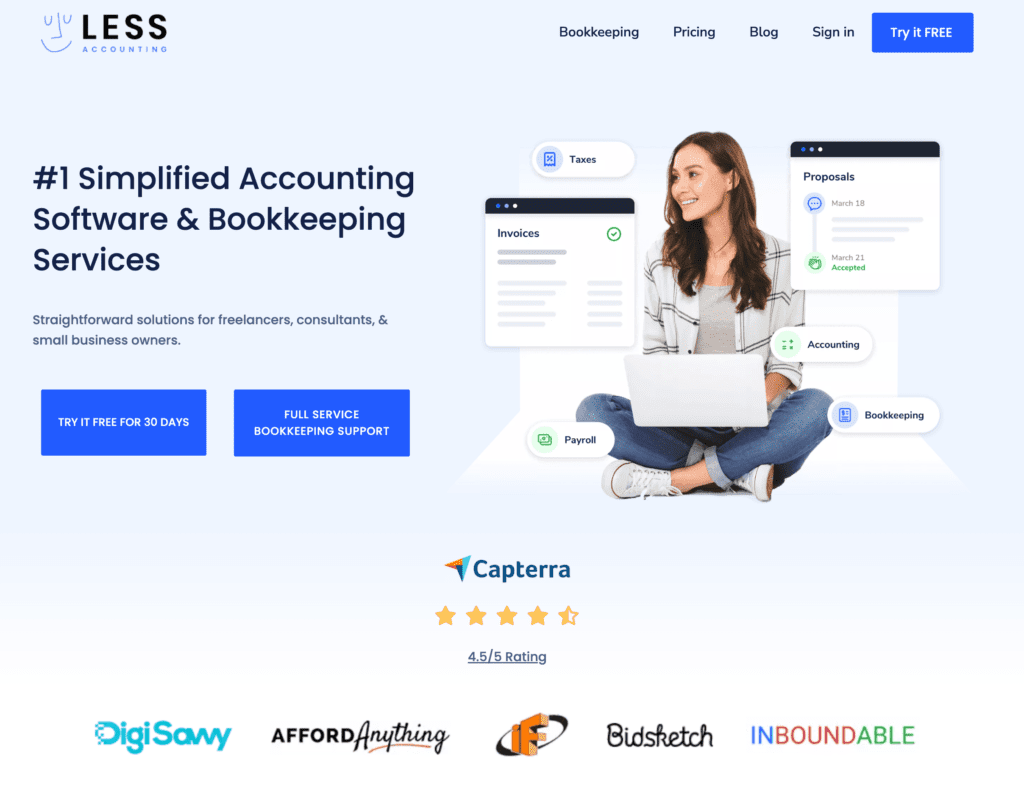

Less Accounting

LessAccounting is a web-based accounting software designed for small businesses and freelancers. It offers a range of features, including invoicing, expenses tracking, time tracking, and reporting. The software integrates with a number of popular payment gateways, making it easy to get paid and manage your cash flow.

One of the key benefits of LessAccounting is its ease of use. The software has a simple and intuitive interface that allows you to quickly get up and running, even if you have limited accounting experience. Additionally, the software offers a number of helpful resources, including video tutorials and a knowledge base, to help you get the most out of the software.

LessAccounting also offers a number of pricing plans to fit the needs of different businesses and freelancers. You can start with the free plan and upgrade as your needs change. The software also offers a 30-day free trial, so you can try it out before committing to a paid plan.

Overall, LessAccounting is a solid option for freelancers and small businesses looking for an affordable and easy-to-use accounting solution.

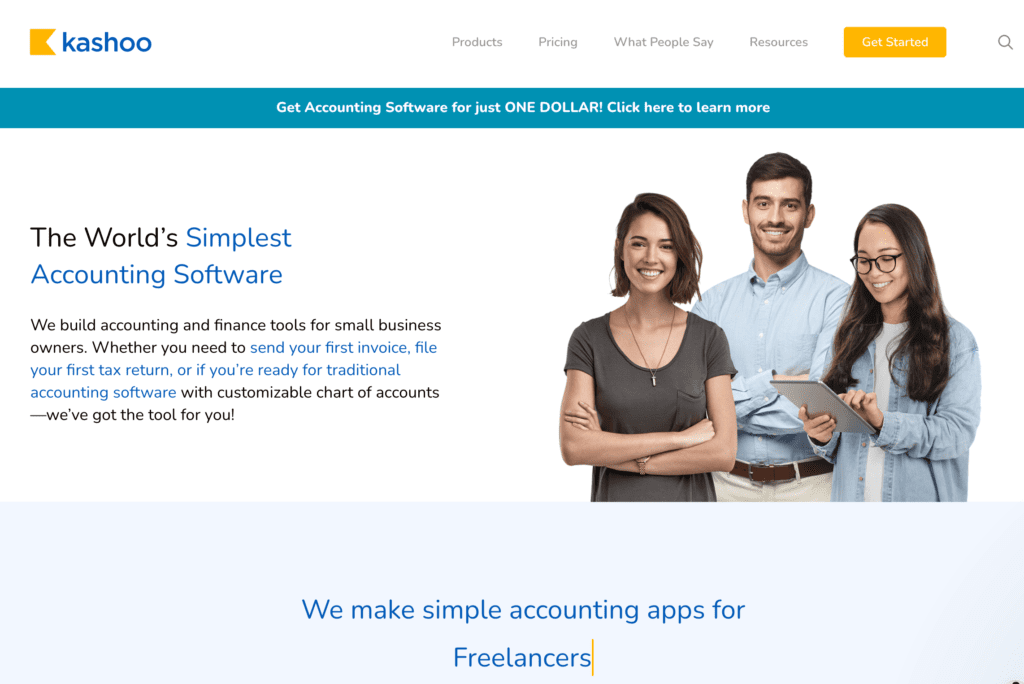

Kashoo

Kashoo is a cloud-based accounting software designed for small businesses and freelancers. It offers a range of features, including invoicing, expenses tracking, and reporting. The software is known for its ease of use, making it a good option for those who are new to accounting and want a simple solution.

Kashoo offers a number of features to help you manage your finances, including the ability to generate invoices, track expenses, and view real-time reports on your financial performance. You can also connect your bank accounts to Kashoo to automatically import transactions, saving you time and reducing the chance of manual errors.

One of the key benefits of Kashoo is its mobile app, which allows you to manage your finances on the go. You can create and send invoices, track expenses, and view reports from your smartphone or tablet.

Kashoo offers a free trial, so you can test the software and see if it meets your needs before committing to a paid plan. The software also offers a number of pricing plans, including a free plan and several paid plans that offer more advanced features.

Overall, Kashoo is a good option for small businesses and freelancers looking for an easy-to-use, affordable accounting solution that offers a range of features to help you manage your finances.

Wave

Wave accounting is a free, cloud-based accounting software designed for small businesses and freelancers. It offers a range of features, including invoicing, receipt scanning, and expense tracking, making it a good option for those who are new to accounting and need a simple solution.

One of the key benefits of Wave is its ease of use. The software has a simple and intuitive interface that makes it easy to get started, even if you have limited accounting experience. You can also use Wave’s mobile app to manage your finances on the go.

Wave also offers a number of features to help you manage your finances, including the ability to create and send invoices, scan receipts to track expenses, and view real-time reports on your financial performance. The software also integrates with a number of payment gateways, making it easy to get paid and manage your cash flow.

Another benefit of Wave is that it’s completely free to use. There are no hidden fees or charges, and you can use the software as much as you need without incurring any additional costs.

Overall, Wave is a good option for small businesses and freelancers looking for a free, easy-to-use accounting solution that offers a range of features to help you manage your finances.

Freshbooks

FreshBooks accounting software is a cloud-based package designed for small businesses and freelancers. It offers a range of features, including invoicing, expenses tracking, time tracking, and reporting. The software is known for its ease of use, making it a good option for those who are new to accounting and want a simple solution.

FreshBooks offers a number of features to help you manage your finances, including the ability to generate professional invoices, track expenses, and view real-time reports on your financial performance. You can also use FreshBooks to manage your project tasks and team members, making it a good option for those who need to manage multiple projects.

One of the key benefits of FreshBooks is its mobile app, which allows you to manage your finances on the go. You can create and send invoices, track expenses, and view reports from your smartphone or tablet.

FreshBooks offers a number of pricing plans to fit the needs of different businesses and freelancers. You can start with a free trial and upgrade as your needs change. The software also offers a number of integrations with other tools and platforms, making it easy to connect with the other tools you use to run your business.

Overall, FreshBooks is a good option for small businesses and freelancers looking for an easy-to-use, affordable accounting solution that offers a range of features to help you manage your finances.

Quickbooks

QuickBooks Online is a cloud-based accounting software designed for small businesses and freelancers. It offers a range of features, including invoicing, expenses tracking, payroll, and reporting. QuickBooks is known for its comprehensive and robust feature set, making it a good option for businesses that need more advanced accounting features.

QuickBooks Online offers a number of features to help you manage your finances, including the ability to generate invoices, track expenses, and view real-time reports on your financial performance. You can also use QuickBooks to manage your payroll, run tax reports, and handle other financial tasks.

One of the key benefits of QuickBooks Online is its integration with a number of other tools and platforms. For example, you can connect your bank accounts to automatically import transactions, or integrate with a payment gateway to process payments.

QuickBooks Online offers a number of pricing plans to fit the needs of different businesses and freelancers. You can start with a free trial and upgrade as your needs change. The software also offers a number of integrations with other tools and platforms, making it easy to connect with the other tools you use to run your business.

Overall, QuickBooks Online is a good option for small businesses and freelancers looking for a comprehensive, cloud-based accounting solution that offers a range of features to help you manage your finances.

Xero

Xero accounting is a cloud-based accounting software designed for small businesses and freelancers. It offers a range of features, including invoicing, expenses tracking, payroll, and reporting. Xero is known for its ease of use and user-friendly interface, making it a good option for businesses that need an accounting solution that is both powerful and easy to use.

Xero offers a number of features to help you manage your finances, including the ability to generate invoices, track expenses, and view real-time reports on your financial performance. You can also use Xero to manage your payroll, run tax reports, and handle other financial tasks.

One of the key benefits of Xero is its integration with a number of other tools and platforms. For example, you can connect your bank accounts to automatically import transactions, or integrate with a payment gateway to process payments. Xero also offers a mobile app, which allows you to manage your finances on the go.

Xero offers a number of pricing plans to fit the needs of different businesses and freelancers. You can start with a free trial and upgrade as your needs change. The software also offers a number of integrations with other tools and platforms, making it easy to connect with the other tools you use to run your business.

Overall, Xero is a good option for small businesses and freelancers looking for a comprehensive, cloud-based accounting solution that is easy to use and offers a range of features to help you manage your finances.

Accounts Portal

AccountsPortal is a cloud-based accounting software designed for small businesses and freelancers. It offers a range of features, including invoicing, expenses tracking, and reporting. The software is known for its simplicity and ease of use, making it a good option for businesses that are new to accounting and need a straightforward solution.

AccountsPortal offers a number of features to help you manage your finances, including the ability to generate invoices, track expenses, and view real-time reports on your financial performance. The software also includes a number of financial reports that can help you keep track of your business performance.One of the key benefits of AccountsPortal is its mobile app, which allows you to manage your finances on the go. You can create and send invoices, track expenses, and view reports from your smartphone or tablet.AccountsPortal offers a number of pricing plans to fit the needs of different businesses and freelancers. You can start with a free trial and upgrade as your needs change. The software also offers a number of integrations with other tools and platforms, making it easy to connect with the other tools you use to run your business.Overall, AccountsPortal is a good option for small businesses and freelancers looking for a simple, affordable accounting solution that offers a range of features to help you manage your finances.

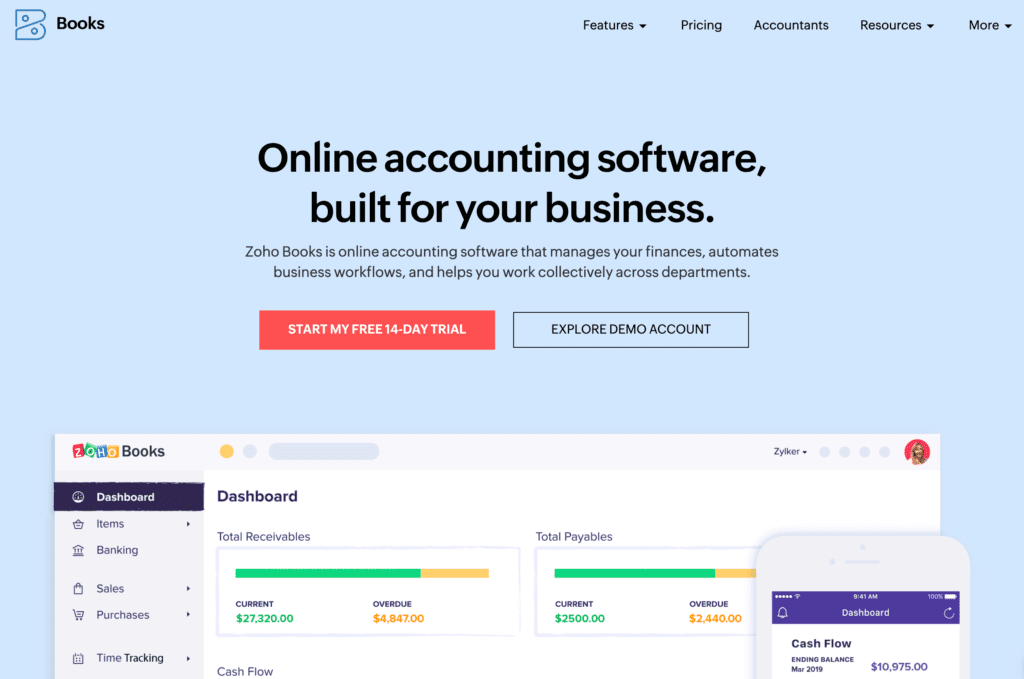

Zoho Books

Zoho Books is a cloud-based accounting software designed for small businesses and freelancers. It offers a range of features, including invoicing, expenses tracking, and reporting. The software is known for its comprehensive feature set and ease of use, making it a good option for businesses that need a robust accounting solution that is still easy to use.

Zoho Books offers a number of features to help you manage your finances, including the ability to generate invoices, track expenses, and view real-time reports on your financial performance. The software also includes a number of financial reports that can help you keep track of your business performance.

One of the key benefits of Zoho Books is its integration with the Zoho ecosystem of business applications. You can easily connect Zoho Books with other Zoho applications, such as Zoho CRM, to streamline your business processes and manage all of your business data from one place.

Zoho Books offers a number of pricing plans to fit the needs of different businesses and freelancers. You can start with a free trial and upgrade as your needs change. The software also offers a number of integrations with other tools and platforms, making it easy to connect with the other tools you use to run your business.

Overall, Zoho Books is a good option for small businesses and freelancers looking for a comprehensive, cloud-based accounting solution that offers a range of features to help you manage your finances, while also providing integration with other Zoho applications.

Freelance Accounting Software – Frequently Asked Questions

Understandably freelancers have plenty of questions when it comes to choosing accounting software. To save you time, we pulled together the most common questions and answered them below.

Do freelancers need to use accounting software?

As a freelancer, using accounting software can be highly beneficial in managing your finances by automating record keeping, improving organization, simplifying invoicing and billing, and facilitating tax preparation. However, it is not a requirement and some freelancers may prefer to use manual methods like a spreadsheet or ledger.

Do freelancers need an accountant?

As a freelance worker, you are considered self-employed and are responsible for managing your own finances, including taxes. In this case, it can be helpful to have the services of an accountant to assist with bookkeeping and tax compliance.

Is freelancer accounting software expensive?

The cost of freelancer accounting software can vary widely depending on the features offered and the company providing the software. Some software options are free or have limited free versions, while others can cost hundreds of dollars per year.

Can you use free accounting software?

Yes, you can use free accounting software. There are many free accounting software options available that are designed specifically for freelancers and small businesses. Some popular free options include: Wave & Zipbooks

Conclusion

With so many options available in the market, it’s important to consider your specific needs and budget before making a decision. Whether you’re looking for an easy-to-use platform or a more robust solution with advanced features, there’s an accounting software out there for you. By carefully evaluating your options and researching the pros and cons of each one, you can find the perfect accounting software that fits your business and helps you manage your finances with ease.